Region:Africa

Author(s):Shubham

Product Code:KRAB5640

Pages:80

Published On:October 2025

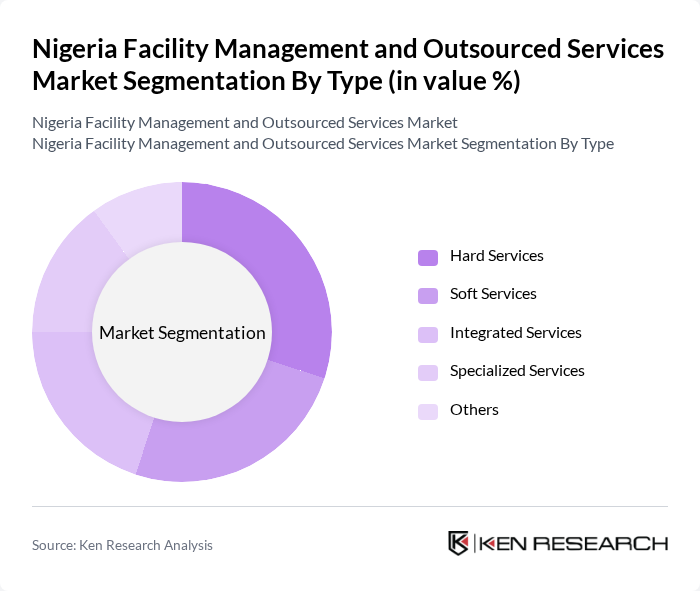

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services include cleaning and security. Integrated Services combine both hard and soft services for comprehensive management. Specialized Services cater to niche requirements, and Others cover additional offerings.

The Hard Services segment is currently dominating the market due to the essential nature of maintenance and repair tasks required by various facilities. As businesses and residential complexes prioritize safety and functionality, the demand for hard services has surged. This trend is further supported by the increasing investment in infrastructure and the need for compliance with safety regulations, making hard services a critical component of facility management.

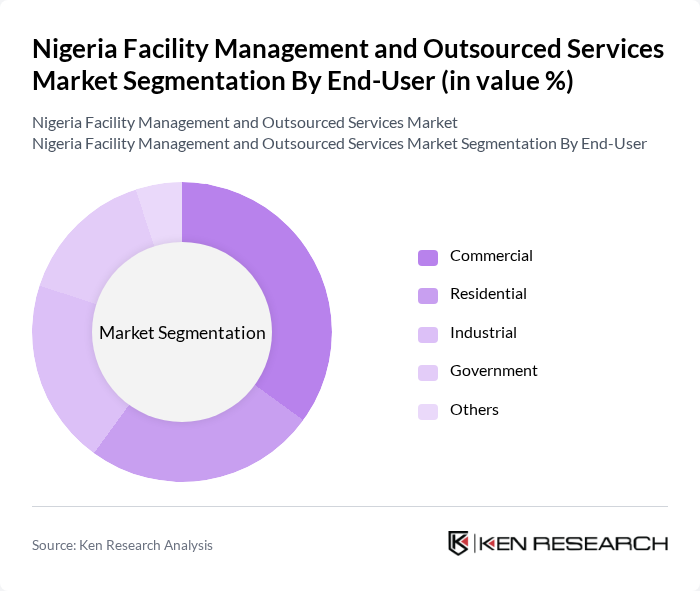

By End-User:The market is segmented by end-users into Commercial, Residential, Industrial, Government, and Others. Commercial end-users include businesses and offices, while Residential covers housing complexes. Industrial pertains to factories and manufacturing units, Government includes public sector facilities, and Others encompass various miscellaneous users.

The Commercial segment leads the market, driven by the increasing number of businesses and office spaces requiring professional facility management services. As companies focus on core operations, outsourcing facility management has become a strategic choice, enhancing efficiency and reducing operational costs. The growth of the commercial sector, particularly in urban areas, continues to bolster the demand for facility management services.

The Nigeria Facility Management and Outsourced Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Facility Management Services Ltd., Total Facilities Management Nigeria, JLL Nigeria, CBRE Nigeria, ISS Facility Services Nigeria, G4S Nigeria, Servest Nigeria, Axxon Facilities Management, Mace Group Nigeria, Knight Frank Nigeria, SODEXO Nigeria, Candover Green, Prologis Nigeria, Ecolab Nigeria, Aegis Facilities Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management and outsourced services market in Nigeria appears promising, driven by urbanization and technological advancements. As businesses increasingly adopt integrated facility management solutions, the demand for smart technologies and IoT applications will rise. Additionally, the focus on sustainability and green building practices will shape service offerings, encouraging companies to innovate and adapt to changing market dynamics. This evolving landscape presents opportunities for growth and enhanced service delivery in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Commercial Residential Industrial Government Others |

| By Service Model | Outsourced In-House Hybrid |

| By Sector | Healthcare Education Retail Hospitality Others |

| By Geographic Distribution | Northern Nigeria Southern Nigeria Eastern Nigeria Western Nigeria |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Duration | Short-Term Contracts Long-Term Contracts Project-Based Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Outsourced Cleaning Services | 80 | Procurement Managers, Facility Coordinators |

| Security Services in Commercial Buildings | 70 | Security Managers, Risk Assessment Officers |

| Maintenance Services for Industrial Facilities | 60 | Maintenance Supervisors, Engineering Managers |

| Integrated Facility Management Solutions | 90 | Business Development Managers, Service Delivery Heads |

The Nigeria Facility Management and Outsourced Services Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by urbanization, infrastructure development, and the increasing demand for efficient management across various sectors.