Region:Europe

Author(s):Geetanshi

Product Code:KRAB5731

Pages:86

Published On:October 2025

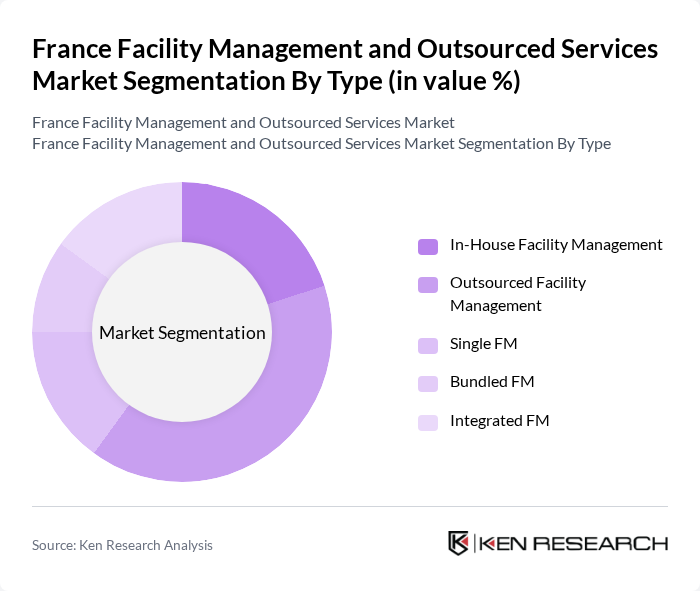

By Type:The market is segmented into various types, including In-House Facility Management, Outsourced Facility Management, Single FM, Bundled FM, and Integrated FM. Among these, Outsourced Facility Management is gaining traction as businesses increasingly prefer to focus on their core competencies while outsourcing facility management tasks to specialized service providers. This trend is driven by the need for cost efficiency, access to expert services, and the growing complexity of compliance and sustainability requirements .

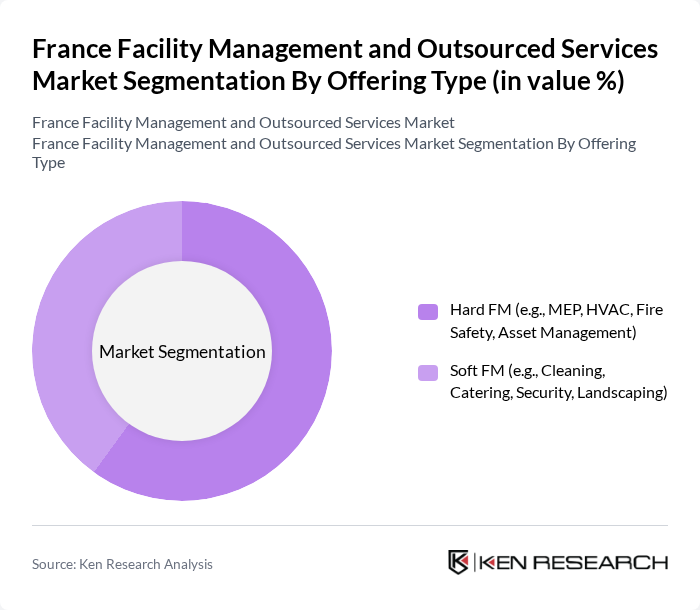

By Offering Type:The market is further divided into Hard FM and Soft FM. Hard FM includes services such as Mechanical, Electrical, and Plumbing (MEP), HVAC, Fire Safety, and Asset Management, while Soft FM encompasses Cleaning, Catering, Security, and Landscaping services. Hard FM remains the dominant segment due to the essential nature of these services in maintaining operational efficiency, regulatory compliance, and safety standards in facilities. The integration of IoT and automation in Hard FM is further strengthening its market position .

The France Facility Management and Outsourced Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sodexo, ISS France, CBRE Group, Inc., JLL (Jones Lang LaSalle), Bouygues Energies & Services, Atalian Global Services, Vinci Facilities, ENGIE Solutions, Elior Group, Samsic Facility, Derichebourg Multiservices, Armonia, Seris Security, Dalkia (EDF Group), GSF Groupe contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in France appears promising, driven by ongoing digital transformation and a heightened focus on health and safety standards. As businesses increasingly adopt integrated facility management solutions, the demand for remote monitoring services is expected to rise significantly. Additionally, the integration of smart technologies will enhance operational efficiency and service delivery. These trends indicate a robust growth trajectory, positioning the market for substantial advancements in service quality and customer satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | In-House Facility Management Outsourced Facility Management Single FM Bundled FM Integrated FM |

| By Offering Type | Hard FM (e.g., MEP, HVAC, Fire Safety, Asset Management) Soft FM (e.g., Cleaning, Catering, Security, Landscaping) |

| By End-User | Commercial Institutional Public/Infrastructure Industrial Residential Healthcare Education Others |

| By Service Model | Outsourced Services In-House Services Hybrid Model |

| By Contract Type | Fixed-Term Contracts Service Level Agreements (SLAs) Time and Material Contracts |

| By Geographic Coverage | Île-de-France (Paris Region) Other Urban Areas Suburban Areas Rural Areas |

| By Service Frequency | Daily Services Weekly Services Monthly Services On-Demand Services |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Outsourced Cleaning Services | 60 | Procurement Managers, Quality Assurance Officers |

| Security Services in Commercial Spaces | 50 | Security Managers, Risk Assessment Officers |

| Maintenance Services for Industrial Facilities | 40 | Maintenance Supervisors, Engineering Managers |

| Integrated Facility Management Solutions | 50 | Business Development Managers, Strategic Planners |

The France Facility Management and Outsourced Services Market is valued at approximately USD 73 billion, reflecting a significant growth trend driven by the demand for efficient facility management and the outsourcing of non-core services by businesses.