Region:Africa

Author(s):Geetanshi

Product Code:KRAB1526

Pages:82

Published On:October 2025

By Type:The market is segmented into various types, including Dietary Supplements, Functional Foods, Functional Beverages, Proteins & Peptides, Vitamins & Minerals, Herbals, Probiotics, Omega Fatty Acids, and Others. Among these,Dietary SupplementsandFunctional Foodsare the most prominent segments, driven by consumer demand for health-enhancing products. Dietary Supplements, in particular, have gained traction due to their convenience and targeted health benefits, appealing to a wide range of consumers seeking solutions for immunity, energy, and chronic disease prevention .

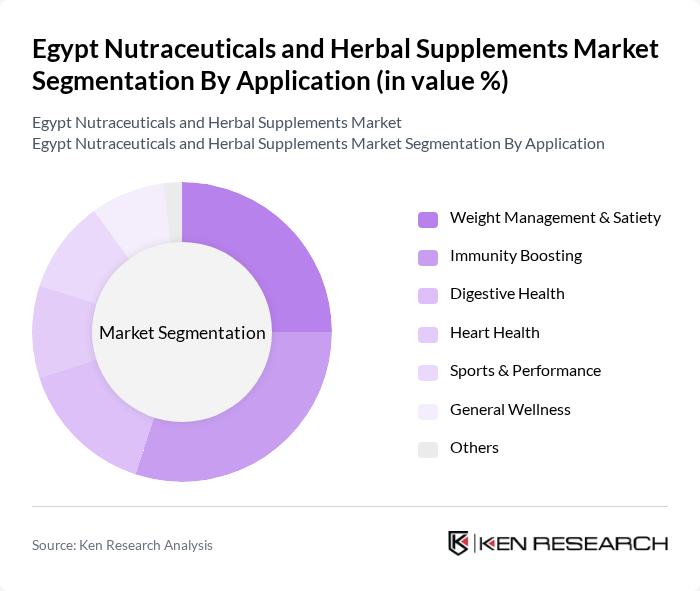

By Application:The applications of nutraceuticals and herbal supplements include Weight Management & Satiety, Immunity Boosting, Digestive Health, Heart Health, Sports & Performance, General Wellness, and Others. TheImmunity Boostingsegment has seen significant growth, particularly in light of recent global health challenges, as consumers increasingly seek products that enhance their immune systems.Weight Management & Satietyalso remains a strong focus, driven by rising obesity rates and health awareness, with Egyptians adopting supplements to support weight control and metabolic health .

The Egypt Nutraceuticals and Herbal Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as EVA Pharma, Amoun Pharmaceutical Co., HOLDIPHARMA, Pharco Pharmaceuticals, Arab Company for Pharmaceuticals and Medicinal Plants (Mepaco), Bioextract, Danone Egypt, Nestlé Egypt S.A.E., Jamjoom Pharma Egypt, Nutricia Egypt, Nature’s Way Products, LLC, GNC Holdings, Inc., Herbalife Nutrition Ltd., DSM Nutritional Products, NOW Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egyptian nutraceuticals and herbal supplements market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As consumers continue to prioritize natural products, companies are likely to innovate and diversify their offerings. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, enabling brands to reach a wider audience. Overall, the market is poised for significant growth, reflecting broader global trends in health and wellness.

| Segment | Sub-Segments |

|---|---|

| By Type | Dietary Supplements Functional Foods Functional Beverages Proteins & Peptides Vitamins & Minerals Herbals (Plant Extracts, Algal Extracts, Phytochemicals) Probiotics Omega Fatty Acids Others (e.g., Branded Ionized Salt, Branded Wheat Flour) |

| By Application | Weight Management & Satiety Immunity Boosting Digestive Health Heart Health Sports & Performance General Wellness Others |

| By Distribution Channel | Pharmacies Health Stores Supermarkets/Hypermarkets Online Retail Others (Wellness Centers, Direct Sales) |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) |

| By Price Range | Budget Mid-Range Premium |

| By Packaging Type | Bottles Sachets Blister Packs |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers First-Time Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Herbal Supplements | 100 | Store Managers, Product Buyers |

| Healthcare Professionals' Insights | 80 | Nutritionists, Dietitians |

| Consumer Preferences in Nutraceuticals | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Manufacturers of Herbal Products | 60 | Production Managers, Quality Control Officers |

| Distributors and Wholesalers | 40 | Supply Chain Managers, Sales Directors |

The Egypt Nutraceuticals and Herbal Supplements Market is valued at approximately USD 1.8 billion, reflecting a significant growth trend driven by increasing health consciousness and a preference for preventive healthcare solutions among consumers.