Region:Asia

Author(s):Geetanshi

Product Code:KRAB1593

Pages:90

Published On:October 2025

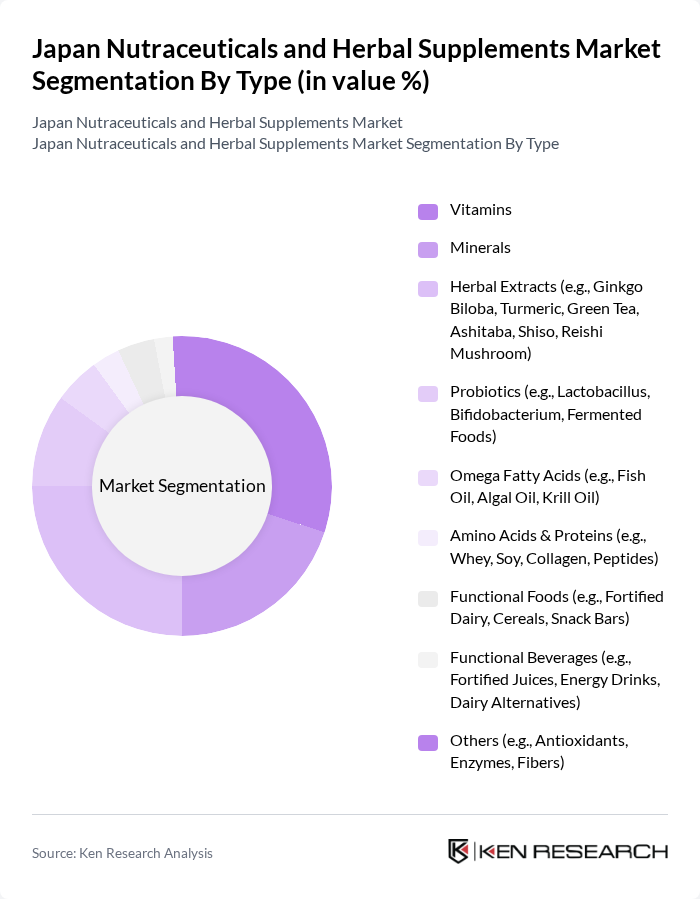

By Type:The market is segmented into vitamins, minerals, herbal supplements (including traditional Japanese botanicals), probiotics, amino acids/protein supplements, functional foods, functional beverages, omega fatty acids, and others. Vitamins and herbal supplements remain particularly popular, reflecting both traditional Japanese health practices and contemporary wellness trends. The shift toward preventive healthcare and immunity-boosting products is driving increased consumption of these categories. Functional foods and beverages, such as fortified dairy, soy products, and energy drinks, are also experiencing strong growth due to consumer demand for convenient nutrition .

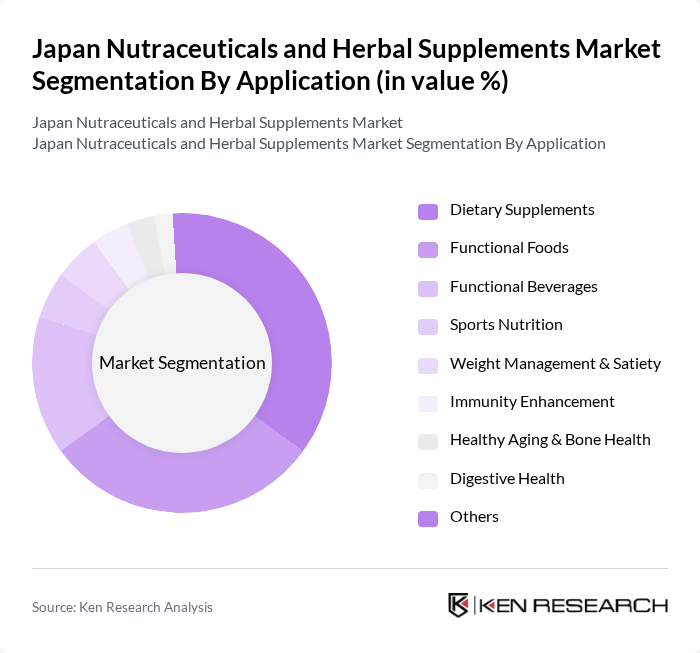

By Application:Applications include weight management, immunity enhancement, bone and joint health, heart and metabolic health, digestive health, general wellness, and others. The market has seen a notable shift towards immunity enhancement and weight management, driven by increased health awareness and the impact of the global pandemic. Products supporting digestive health, bone and joint care, and overall wellness are also in high demand, reflecting the aging population and lifestyle changes .

The Japan Nutraceuticals and Herbal Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Takeda Pharmaceutical Company Limited, Otsuka Pharmaceutical Co., Ltd., Fancl Corporation, DHC Corporation, Asahi Group Holdings, Ltd., Suntory Holdings Limited, Meiji Holdings Co., Ltd., Kikkoman Corporation, Yakult Honsha Co., Ltd., Shiseido Company, Limited, Maruha Nichiro Corporation, Ajinomoto Co., Inc., Kirin Holdings Company, Limited, Morinaga Milk Industry Co., Ltd., Nissin Foods Holdings Co., Ltd., Amway Japan G.K., Herbalife Japan K.K., Kobayashi Pharmaceutical Co., Ltd., Orihiro Co., Ltd., House Wellness Foods Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan nutraceuticals and herbal supplements market appears promising, driven by ongoing trends in health consciousness and technological integration. As consumers increasingly seek personalized health solutions, companies are likely to invest in tailored product offerings. Additionally, advancements in digital health technologies will facilitate better health monitoring, enhancing consumer engagement. The market is expected to adapt to these trends, fostering innovation and expanding product lines to meet evolving consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements (including traditional Japanese botanicals) Probiotics Amino Acids/Protein Supplements Functional Foods (bakery & cereals, dairy, soy products, etc.) Functional Beverages (energy drinks, fortified juices, dairy alternatives) Omega Fatty Acids Others (e.g., antioxidants, fibers, specialty ingredients) |

| By Application | Weight Management & Satiety Immunity Enhancement Bone & Joint Health Heart & Metabolic Health Digestive Health General Wellness Others (e.g., beauty, cognitive health) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Drug Stores & Pharmacies Specialty Health Food Stores Online Retail Stores Direct Selling Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) Health Consciousness (High, Medium, Low) |

| By Formulation | Tablets Capsules Powders Liquids Gummies Softgels Others |

| By Price Range | Premium Mid-Range Budget |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers New Entrants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutraceuticals Sales | 100 | Store Managers, Product Buyers |

| Herbal Supplement Usage | 60 | Health-Conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 50 | Doctors, Nutritionists, Pharmacists |

| Market Trends in Functional Foods | 40 | Food Scientists, Product Developers |

| Consumer Attitudes Towards Herbal Products | 50 | General Consumers, Wellness Advocates |

The Japan Nutraceuticals and Herbal Supplements Market is valued at approximately USD 28 billion, reflecting a robust growth driven by health-conscious consumers and innovations in product formats.