Egypt Nutritional & Health Supplements Market Overview

- The Egypt Nutritional & Health Supplements Market is valued at USD 1.1 billion, based on a five-year historical analysis. Growth is primarily driven by increasing health awareness among consumers, a rise in lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions, and a growing trend towards preventive healthcare. The market has seen a significant uptick in demand for various supplements, including vitamins and herbal products, as Egyptians seek to enhance their overall well-being. The influence of global trends such as plant-based nutrition, personalized wellness solutions, and advancements in supplement formulations has further encouraged consumers to explore a wider variety of products. Additionally, improving financial conditions and rising disposable income among middle-class consumers have increased willingness to invest in premium nutrition and wellness products, while healthcare professionals and influencers promote supplementation benefits through digital platforms, contributing to market expansion .

- Cairo and Alexandria remain the dominant cities in the Egypt Nutritional & Health Supplements Market due to their large populations and urbanization trends. These cities have a higher concentration of health-conscious consumers and a growing number of retail outlets, making them key hubs for the distribution of nutritional and health supplements. The presence of numerous pharmacies, health food stores, and supermarket chains such as El Ezaby, Seif, and Roshdy further supports market growth in these regions. Urban consumers increasingly turn to multivitamin tonics, protein-enriched beverages, and immunity-boosting syrups to maintain daily wellness and energy levels .

- The Egyptian government has implemented binding regulations to ensure the safety and efficacy of nutritional supplements. The Egyptian Drug Authority (EDA), under the Ministry of Health and Population, enforces the registration and approval of all health supplements before they can be marketed, as stipulated in the Egyptian Drug Authority Law No. 151 of 2019. This regulation requires manufacturers and importers to submit product dossiers, comply with labeling standards, and meet safety and quality thresholds. The law aims to protect consumers from substandard products and promote transparency in the health supplement industry .

Egypt Nutritional & Health Supplements Market Segmentation

By Type:The market is segmented into vitamins, minerals, herbal supplements, protein and amino acid supplements, omega fatty acids, probiotics and prebiotics, functional foods and beverages, and others such as antioxidants and fiber. Vitamins and herbal supplements are particularly popular due to their perceived health benefits and natural origins. The increasing trend of self-medication and preventive health measures has led to a surge in demand for these products, making them the leading subsegments in the market. Urban consumers, especially working-age adults, favor multivitamin and protein-enriched products, while parents increasingly seek vitamin D drops and iron tonics for children and infants .

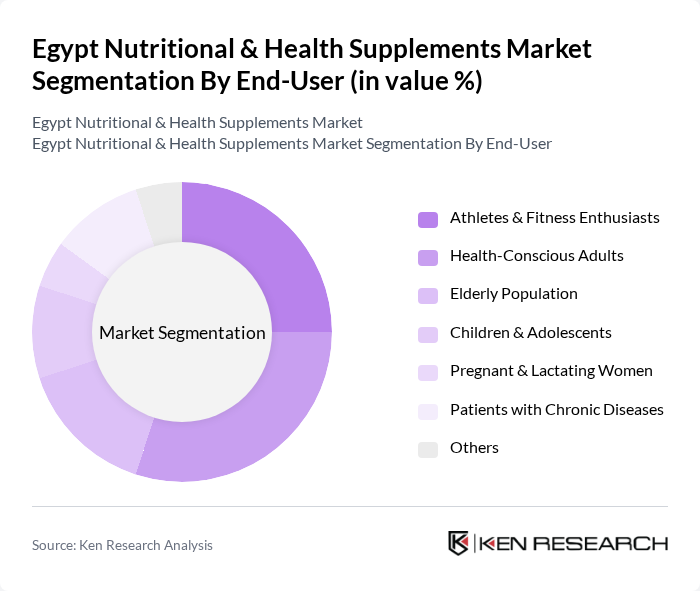

By End-User:End-user segmentation includes athletes and fitness enthusiasts, health-conscious adults, the elderly population, children and adolescents, pregnant and lactating women, patients with chronic diseases, and others. Athletes and fitness enthusiasts represent a significant portion of the market, driven by their need for performance-enhancing supplements. The growing awareness of health and wellness among the general population has led to increased consumption of supplements across various demographics. Adults lead the end use of supplements, supported by the rising focus on preventive healthcare, stress management, and nutritional supplementation among Egypt’s working-age population. The infant and child segment is also witnessing rapid growth due to increased parental awareness and pediatric recommendations .

Egypt Nutritional & Health Supplements Market Competitive Landscape

The Egypt Nutritional & Health Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amway Egypt, Herbalife Nutrition Egypt, Nestlé Health Science Egypt, Abbott Laboratories Egypt, GNC (General Nutrition Centers) Egypt, DSM Nutritional Products Egypt, Unilever Egypt, Nature's Way Egypt, Solgar Egypt, Blackmores Egypt, Swisse Wellness Egypt, NOW Foods Egypt, Garden of Life Egypt, Nutrilite Egypt, EVA Pharma, Pharco Pharmaceuticals, Nutrascia, Dawah-HoldiPharma contribute to innovation, geographic expansion, and service delivery in this space.

Egypt Nutritional & Health Supplements Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Egyptian population is becoming increasingly health-conscious, with 60% of adults actively seeking nutritional supplements to enhance their well-being. This trend is supported by a rise in health-related media coverage, with health publications increasing by 25% in the last year. Additionally, the World Health Organization reported that 40% of Egyptians are now prioritizing preventive healthcare, driving demand for supplements that support overall health and wellness.

- Rising Disposable Incomes:Egypt's GDP per capita is estimated at approximately $4,200 in future, reflecting moderate growth in recent periods. This economic growth is leading to higher disposable incomes, allowing consumers to allocate more funds towards health and wellness products. As a result, the nutritional supplements market is experiencing a surge, with sales expected to increase by 15% as consumers invest in their health and seek premium products.

- Expansion of E-commerce Platforms:The e-commerce sector in Egypt is expected to grow by 30% in future, driven by increased internet penetration, which reached approximately 72% of the population. This growth is facilitating easier access to nutritional supplements, with online sales projected to account for 20% of total sales. The convenience of online shopping is attracting a younger demographic, further boosting the market as consumers seek diverse product offerings and competitive pricing.

Market Challenges

- Regulatory Compliance Issues:The Egyptian health supplement market faces significant regulatory hurdles, with over 50% of companies reporting difficulties in meeting local compliance standards. The Ministry of Health has implemented stricter regulations, including mandatory testing and certification, which can delay product launches by up to six months. This regulatory environment poses challenges for both local and international brands, impacting their ability to compete effectively in the market.

- Consumer Skepticism towards Supplements:Despite the growing market, approximately 45% of Egyptian consumers express skepticism about the efficacy of nutritional supplements. This skepticism is fueled by a lack of awareness and misinformation regarding product benefits. As a result, brands must invest in educational marketing strategies to build trust and credibility, which can be resource-intensive and may slow down market penetration efforts.

Egypt Nutritional & Health Supplements Market Future Outlook

The future of the Egyptian nutritional and health supplements market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As consumers become more informed about health benefits, the demand for personalized and plant-based supplements is expected to rise. Additionally, the integration of technology in health monitoring will likely enhance consumer engagement, leading to innovative product offerings that cater to specific health needs and preferences, further expanding market potential.

Market Opportunities

- Growth in Online Sales Channels:With e-commerce projected to capture 20% of the market share, brands have a significant opportunity to enhance their online presence. Investing in digital marketing and user-friendly platforms can attract tech-savvy consumers, driving sales and brand loyalty in a competitive landscape.

- Increasing Demand for Organic Products:The organic supplement segment is gaining traction, with a 25% increase in consumer interest. Brands that focus on organic certifications and sustainable sourcing can tap into this growing market, appealing to health-conscious consumers who prioritize natural ingredients and environmentally friendly practices.