Singapore Nutritional & Health Supplements Market Overview

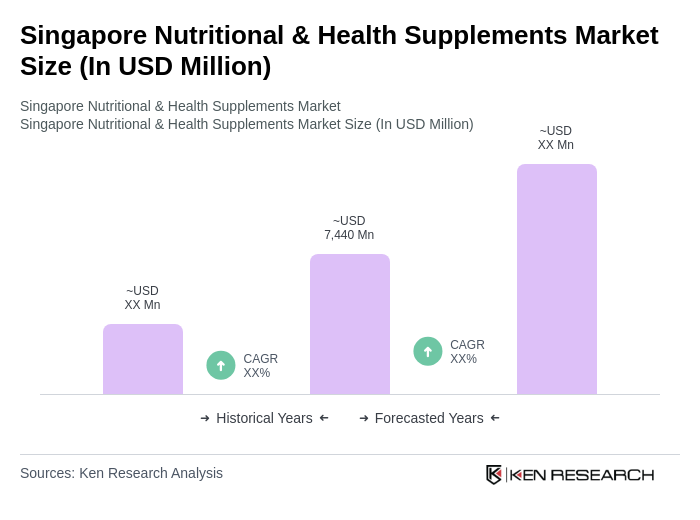

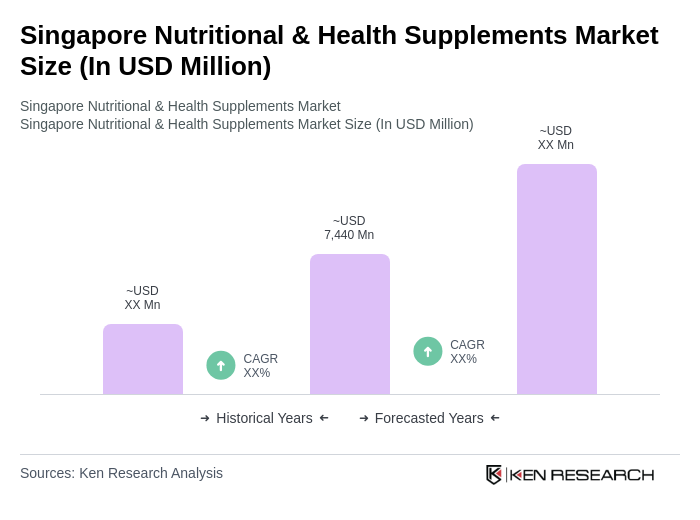

- The Singapore Nutritional & Health Supplements Market is valued at USD 7,440 million, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rise in preventive healthcare measures, and the growing trend of self-medication. The market has seen a significant uptick in demand for various supplements, particularly in the wake of the COVID-19 pandemic, as individuals seek to boost their immune systems and overall health. The aging population and urban lifestyles have further accelerated the adoption of supplements for immunity, digestive health, and mental wellness .

- Singapore, being a hub for health and wellness, dominates the market due to its advanced healthcare infrastructure, high disposable income, and a well-educated population that is increasingly aware of nutritional benefits. The city-state's strategic location also facilitates the import of a wide range of health supplements, making it a key player in the Southeast Asian market. The market is further supported by strong retail and e-commerce channels, enabling easy access to premium and specialized products .

- In 2023, the Singapore government implemented the Health Products Act (Chapter 122D), issued by the Ministry of Health, which regulates the sale and distribution of health supplements. This legislation aims to ensure that all nutritional products meet safety and efficacy standards, thereby protecting consumers from substandard products. The act mandates that all health supplements must be registered with the Health Sciences Authority (HSA) before they can be marketed, with compliance requirements covering product labeling, ingredient safety, and post-market surveillance .

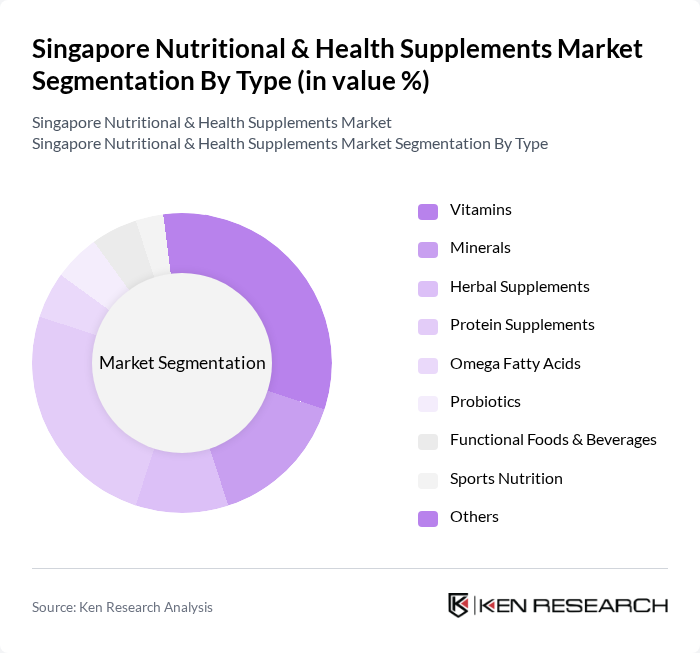

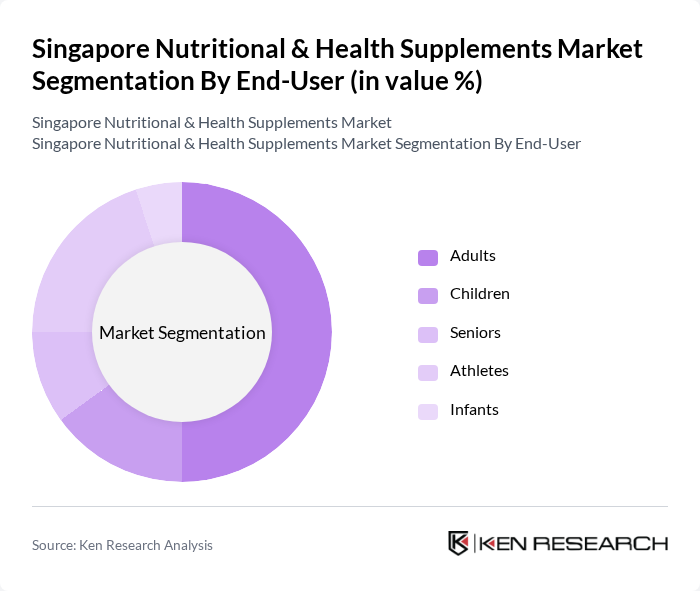

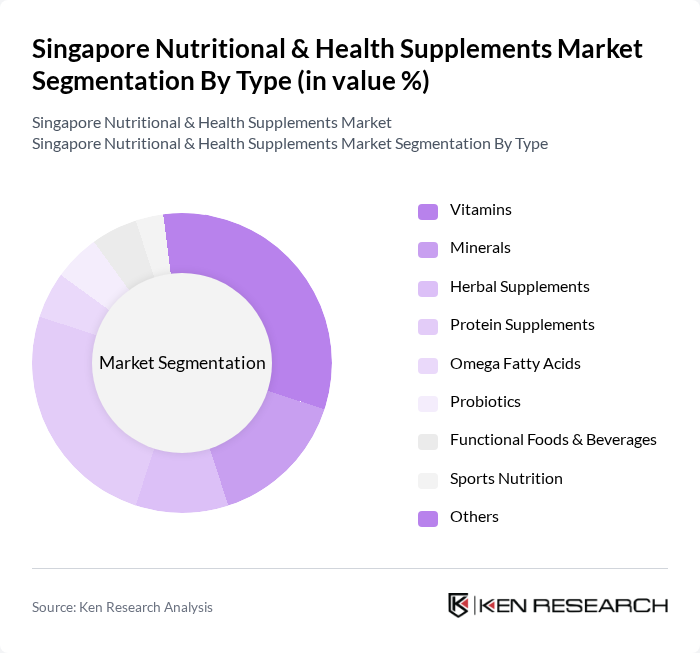

Singapore Nutritional & Health Supplements Market Segmentation

By Type:The market is segmented into various types of nutritional and health supplements, including Vitamins, Minerals, Herbal Supplements, Protein Supplements, Omega Fatty Acids, Probiotics, Functional Foods & Beverages, Sports Nutrition, and Others. Among these, Vitamins and Protein Supplements are particularly dominant due to their widespread use and consumer preference for products that support overall health and fitness. Functional Foods & Beverages also represent a major segment, reflecting the popularity of fortified products and convenience-based nutrition .

By End-User:The end-user segmentation includes Adults, Children, Seniors, Athletes, and Infants. Adults represent the largest segment, driven by a growing focus on health and wellness, while Athletes are increasingly turning to specialized supplements to enhance performance and recovery. Seniors are a rapidly growing segment due to the aging population and increased demand for products supporting bone, joint, and cognitive health .

Singapore Nutritional & Health Supplements Market Competitive Landscape

The Singapore Nutritional & Health Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blackmores Ltd., Amway (Singapore) Pte Ltd., Herbalife Nutrition Ltd., GNC Holdings, Inc., Swisse Wellness Pty Ltd., Nature's Farm Pte Ltd., Eu Yan Sang International Ltd., Nestlé Health Science, DSM Nutritional Products, USANA Health Sciences, Inc., Abbott Laboratories (Singapore), Bayer (Singapore) Pte Ltd., NOW Foods, Suntory Wellness Singapore Pte Ltd., Pharmaton (Boehringer Ingelheim) contribute to innovation, geographic expansion, and service delivery in this space.

Singapore Nutritional & Health Supplements Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Singaporean population is increasingly prioritizing health, with 70% of adults actively seeking nutritional supplements to enhance their well-being. This trend is supported by a report from the Ministry of Health, indicating that 60% of Singaporeans are aware of the benefits of dietary supplements. The rise in health awareness is further fueled by government initiatives promoting healthy lifestyles, contributing to a robust demand for nutritional products in the market.

- Rising Aging Population:Singapore's demographic shift towards an aging population is a significant growth driver for the nutritional supplements market. By the future, approximately 19% of the population will be aged 65 and above, according to the Department of Statistics. This demographic is increasingly focused on preventive healthcare, leading to a surge in demand for supplements that support health maintenance and chronic disease management, thereby driving market growth.

- Growth in E-commerce:The e-commerce sector in Singapore is projected to reach SGD 8.5 billion in future, according to the Infocomm Media Development Authority (IMDA). This growth is transforming how consumers purchase nutritional supplements, with online sales channels becoming increasingly popular. The convenience of online shopping, coupled with targeted digital marketing strategies, is driving higher sales volumes in the nutritional supplements market, making it a critical growth driver in the industry.

Market Challenges

- Regulatory Compliance Issues:The nutritional supplements market in Singapore faces stringent regulatory compliance challenges. The Health Sciences Authority (HSA) enforces strict guidelines on product safety and efficacy, which can hinder market entry for new products. In the future, companies must navigate complex regulations, including health claims and labeling requirements, which can lead to increased operational costs and potential market delays.

- Consumer Misinformation:Misinformation regarding nutritional supplements poses a significant challenge in Singapore. A survey by the Consumers Association of Singapore revealed that 40% of consumers are confused about supplement benefits due to misleading information. This confusion can lead to skepticism and reduced trust in products, ultimately affecting sales and market growth as consumers become more cautious in their purchasing decisions.

Singapore Nutritional & Health Supplements Market Future Outlook

The Singapore Nutritional & Health Supplements Market is poised for continued growth, driven by increasing health awareness and a focus on preventive healthcare. As the aging population expands, demand for tailored supplements will rise, particularly those addressing chronic health issues. Additionally, advancements in technology will facilitate personalized nutrition solutions, enhancing consumer engagement. Companies that adapt to these trends and invest in innovative product development will likely capture significant market share in the coming years.

Market Opportunities

- Expansion of Product Lines:Companies have the opportunity to diversify their product offerings by introducing specialized supplements targeting specific health concerns, such as immunity and mental health. This strategy can attract a broader consumer base and meet the growing demand for personalized health solutions, potentially increasing market penetration and revenue.

- Collaborations with Health Professionals:Partnering with healthcare providers can enhance credibility and consumer trust in nutritional supplements. By collaborating with dietitians and physicians, companies can develop evidence-based products and educational campaigns, fostering a stronger connection with health-conscious consumers and driving sales growth in the market.