Region:Middle East

Author(s):Shubham

Product Code:KRAB6554

Pages:91

Published On:October 2025

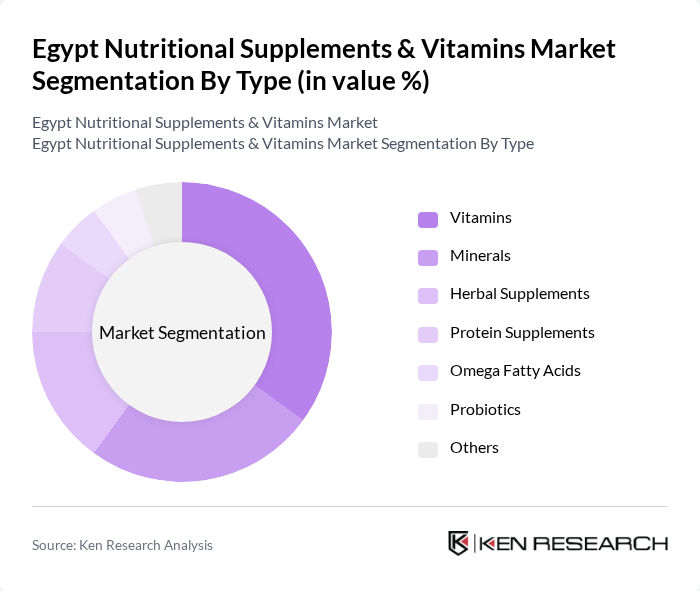

By Type:The market is segmented into various types of nutritional supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Among these, vitamins and minerals are the most sought-after due to their essential roles in maintaining health and preventing deficiencies. The increasing awareness of the importance of micronutrients in daily diets has led to a surge in demand for these products.

By End-User:The end-user segmentation includes athletes, health-conscious individuals, the elderly population, pregnant women, children, and others. Athletes and health-conscious individuals dominate the market as they actively seek supplements to enhance performance and overall health. The growing trend of fitness and wellness among the general population has also contributed to the increased consumption of nutritional supplements.

The Egypt Nutritional Supplements & Vitamins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amway Egypt, Herbalife Egypt, DSM Nutritional Products, GNC Egypt, Nature's Way, Solgar, Swisse Wellness, Blackmores, Nutraceutical International Corporation, Al Haramain Herbal Products, Omega Pharma, Herbalife Nutrition Ltd., NutraBlast, BioCare Copenhagen, Nature's Bounty contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nutritional supplements market in Egypt appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As e-commerce continues to expand, companies will likely leverage digital platforms to reach a broader audience. Additionally, the growing trend of personalized nutrition is expected to influence product development, with brands focusing on tailored solutions to meet individual health needs. This evolving landscape presents significant opportunities for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By End-User | Athletes Health-Conscious Individuals Elderly Population Pregnant Women Children Others |

| By Distribution Channel | Pharmacies Supermarkets/Hypermarkets Online Retail Health Stores Direct Sales Others |

| By Price Range | Budget Mid-Range Premium |

| By Formulation | Tablets Capsules Powders Liquids Gummies |

| By Brand Type | Local Brands International Brands |

| By Application | Sports Nutrition General Health Weight Management Immune Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Nutritional Supplements | 150 | Store Managers, Sales Representatives |

| Consumer Preferences for Vitamins | 200 | Health-Conscious Consumers, Fitness Enthusiasts |

| Distribution Channels for Supplements | 100 | Distributors, Wholesalers |

| Market Trends in Herbal Supplements | 80 | Herbal Product Retailers, Nutritionists |

| Impact of Health Campaigns on Supplement Sales | 120 | Public Health Officials, Marketing Managers |

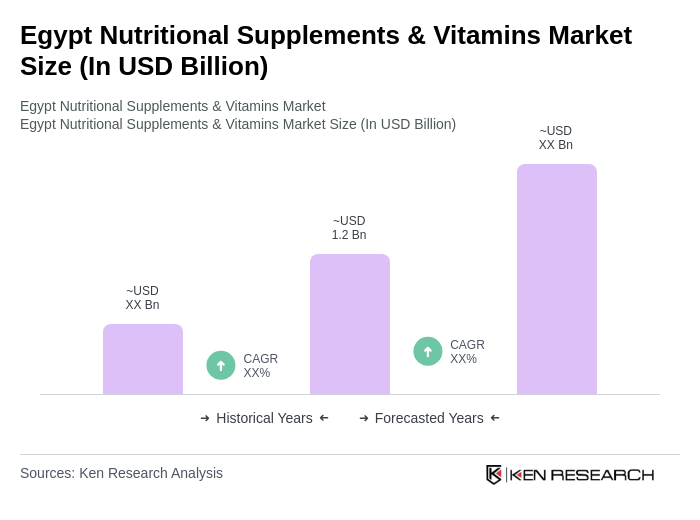

The Egypt Nutritional Supplements & Vitamins Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health awareness and a shift towards preventive healthcare among consumers.