Region:Africa

Author(s):Geetanshi

Product Code:KRAB0088

Pages:84

Published On:August 2025

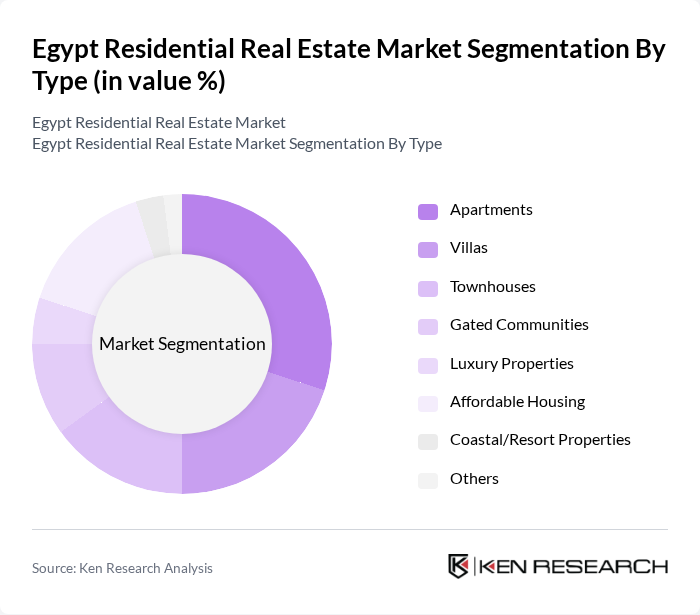

By Type:The residential real estate market is segmented into apartments, villas, townhouses, gated communities, luxury properties, affordable housing, coastal/resort properties, and others. Apartments and condominiums represent the largest segment, driven by urbanization and demand for more affordable, space-efficient housing. Villas and townhouses cater to higher-income groups seeking larger living spaces, while gated communities and luxury properties appeal to affluent buyers prioritizing privacy and amenities. Affordable housing remains a government focus to address the needs of lower- and middle-income families. Coastal and resort properties are increasingly popular among investors and vacation home buyers, especially in areas like the North Coast and Red Sea resorts .

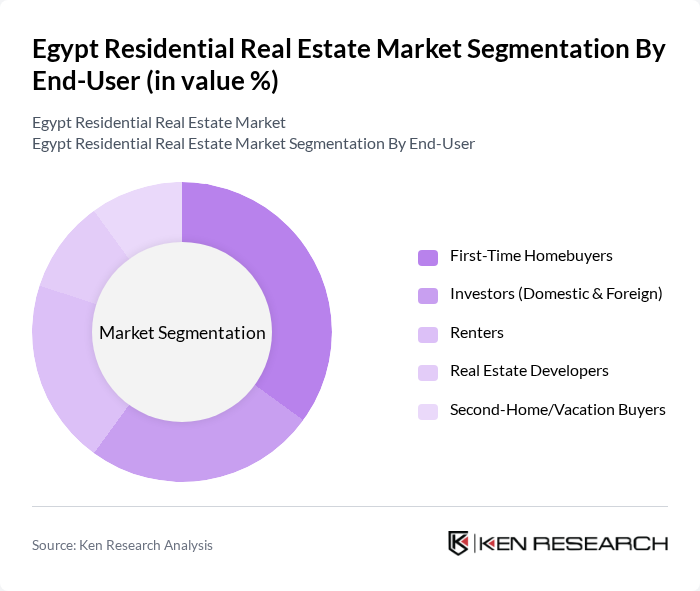

By End-User:The end-user segmentation includes first-time homebuyers, investors (both domestic and foreign), renters, real estate developers, and second-home/vacation buyers. First-time homebuyers and renters constitute the largest segments, reflecting the country’s young demographic and urban migration trends. Investors are increasingly active, seeking real estate as a hedge against inflation and currency volatility. Real estate developers and second-home/vacation buyers are also significant, particularly in the context of new resort and coastal developments .

The Egypt Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palm Hills Developments, Emaar Misr, SODIC (Sixth of October Development & Investment Company), Talaat Moustafa Group Holding (TMG Holding), Madinet Nasr for Housing and Development (MNHD), New Giza, Orascom Development Egypt, City Edge Developments, Misr Italia Properties, Al Ahly Sabbour Developments, Arab Developers Holding, Mountain View, El Nasr Housing and Development, Amer Group, Hassan Allam Properties contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's residential real estate market appears promising, driven by ongoing urbanization and government support for housing initiatives. As the population continues to grow, demand for affordable housing will remain high, prompting developers to innovate and adapt. Additionally, the integration of smart technologies and sustainable practices is expected to gain traction, aligning with global trends. Overall, the market is poised for growth, provided that economic stability and regulatory improvements are achieved.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments Villas Townhouses Gated Communities Luxury Properties Affordable Housing Coastal/Resort Properties Others |

| By End-User | First-Time Homebuyers Investors (Domestic & Foreign) Renters Real Estate Developers Second-Home/Vacation Buyers |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Location | Urban Areas (e.g., Cairo, Alexandria) Suburban Areas (e.g., New Cairo, 6th of October, Sheikh Zayed) Coastal Areas (e.g., North Coast, Ain Sokhna, Ras El Hekma) Rural Areas |

| By Property Size | Small Properties (<100 sqm) Medium Properties (100–200 sqm) Large Properties (>200 sqm) |

| By Development Stage | Pre-Construction Under Construction Completed |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 120 | First-time homebuyers, Investors |

| Real Estate Developers | 60 | Project Managers, Sales Directors |

| Real Estate Agents | 50 | Sales Agents, Market Analysts |

| Financial Institutions | 40 | Mortgage Advisors, Loan Officers |

| Urban Planners | 40 | City Planners, Policy Makers |

The Egypt Residential Real Estate Market is valued at approximately USD 21 billion, driven by urbanization, population growth, and sustained demand for housing solutions. This market has attracted significant domestic and foreign investments, particularly in urban areas.