Region:Asia

Author(s):Rebecca

Product Code:KRAA2428

Pages:84

Published On:August 2025

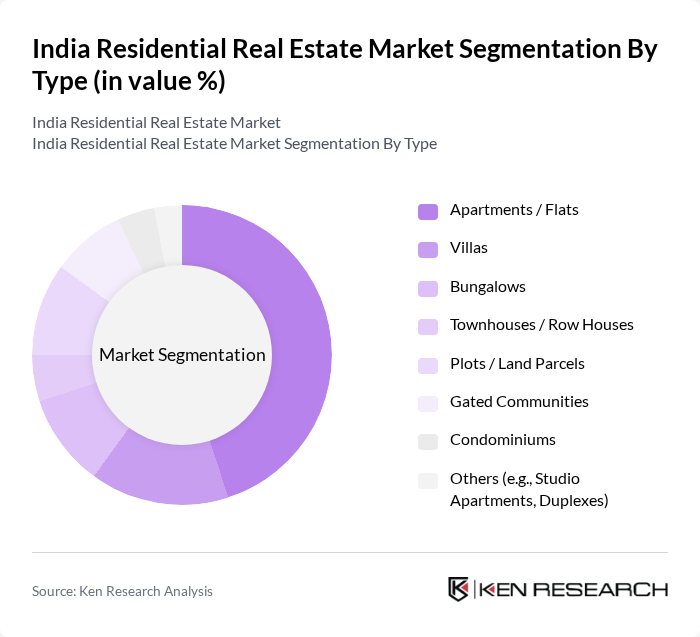

By Type:The residential real estate market is segmented into Apartments/Flats, Villas, Bungalows, Townhouses/Row Houses, Plots/Land Parcels, Gated Communities, Condominiums, and Others (e.g., Studio Apartments, Duplexes). Among these,Apartments/Flatsdominate the market, accounting for the majority of sales volume due to their affordability, availability in urban areas, and suitability for the growing population of first-time homebuyers and renters. The trend toward compact, high-density living spaces in metropolitan cities has further solidified their market leadership. Recent market data indicates that apartments and condominiums together account for more than 60% of residential sales, reflecting urban density and land economics .

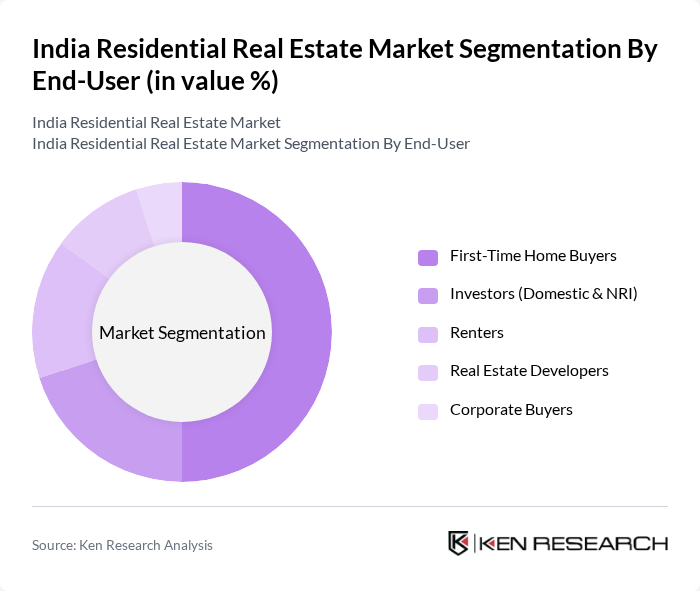

By End-User:The end-user segmentation includes First-Time Home Buyers, Investors (Domestic & NRI), Renters, Real Estate Developers, and Corporate Buyers.First-Time Home Buyersrepresent the largest segment, driven by favorable government policies, increased affordability, and urban migration. The aspiration for home ownership among younger demographics, coupled with rising disposable incomes and easier access to home loans, has significantly boosted this segment's growth, making it a key driver in the residential real estate market .

The India Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as DLF Limited, Godrej Properties, Oberoi Realty, Brigade Enterprises, Prestige Estates Projects Ltd., Sobha Limited, Mahindra Lifespace Developers Ltd., Puravankara Limited, Ashiana Housing Ltd., Unitech Limited, Kolte-Patil Developers Ltd., Indiabulls Real Estate Ltd., Sunteck Realty Ltd., Parsvnath Developers Ltd., Phoenix Mills Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India residential real estate market appears promising, driven by ongoing urbanization and government initiatives aimed at boosting affordable housing. As infrastructure projects progress, connectivity will improve, enhancing property values. Additionally, the increasing adoption of technology in real estate transactions is expected to streamline processes, making it easier for buyers and investors to engage in the market. Overall, these trends indicate a robust growth trajectory for the sector in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments / Flats Villas Bungalows Townhouses / Row Houses Plots / Land Parcels Gated Communities Condominiums Others (e.g., Studio Apartments, Duplexes) |

| By End-User | First-Time Home Buyers Investors (Domestic & NRI) Renters Real Estate Developers Corporate Buyers |

| By Region | North India (Delhi NCR, Chandigarh, Lucknow, Jaipur) South India (Bengaluru, Chennai, Hyderabad, Kochi) East India (Kolkata, Bhubaneswar, Guwahati) West India (Mumbai MMR, Pune, Ahmedabad, Surat) Tier II & III Cities |

| By Price Range | Below INR 50 Lakhs (Affordable) INR 50 Lakhs - INR 1 Crore (Mid-Segment) INR 1 Crore - INR 2 Crore (Premium) Above INR 2 Crore (Luxury) |

| By Investment Source | Domestic Investors Non-Resident Indian (NRI) Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Financing Method | Home Loans / Mortgages Cash Purchases Lease Financing / Rent-to-Own Others (e.g., Crowdfunding, REITs) |

| By Policy Support | Subsidies Tax Exemptions Housing Finance Schemes Pradhan Mantri Awas Yojana (PMAY) & Other Government Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Developers | 60 | Project Managers, Business Development Heads |

| Real Estate Agents and Brokers | 50 | Real Estate Agents, Brokerage Owners |

| Homebuyers in Urban Areas | 80 | First-time Buyers, Investors |

| Financial Institutions Offering Home Loans | 40 | Loan Officers, Mortgage Advisors |

| Urban Planning Authorities | 40 | Urban Planners, Policy Makers |

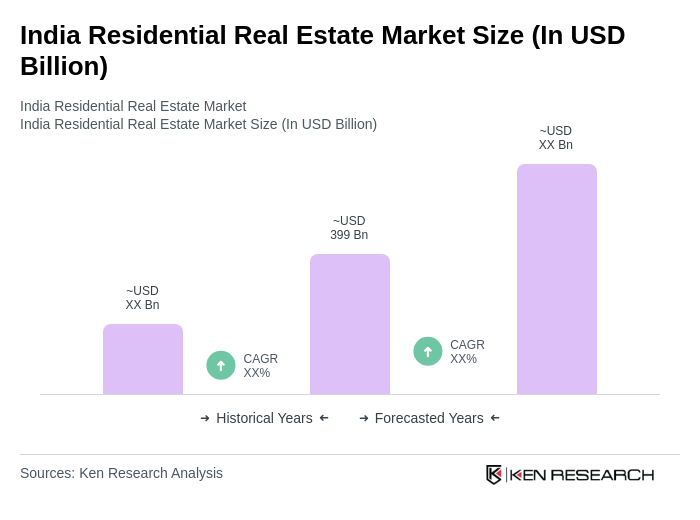

The India Residential Real Estate Market is valued at approximately USD 399 billion, driven by urbanization, rising incomes, and government initiatives supporting affordable housing. The market is experiencing significant growth, particularly in premium and luxury segments in major urban centers.