Region:Asia

Author(s):Shubham

Product Code:KRAC0845

Pages:97

Published On:August 2025

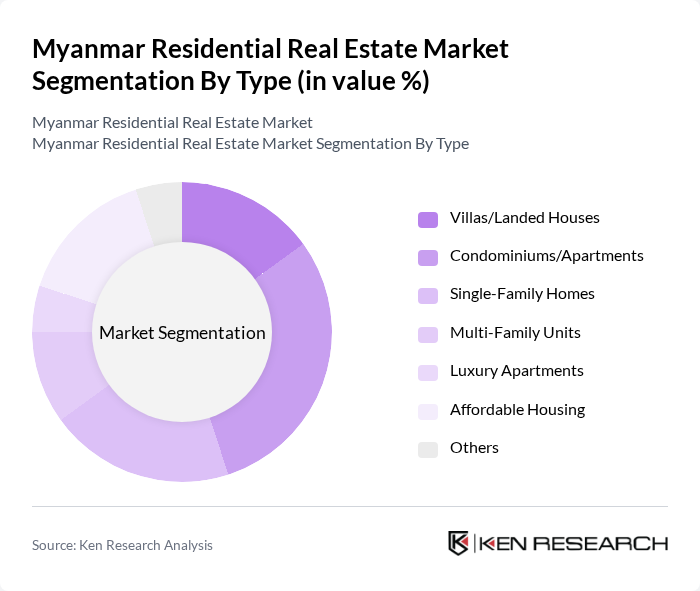

By Type:The residential real estate market in Myanmar is segmented into Villas/Landed Houses, Condominiums/Apartments, Single-Family Homes, Multi-Family Units, Luxury Apartments, Affordable Housing, and Others. Among these, Condominiums/Apartments have gained significant traction due to urbanization and the increasing preference for modern living spaces, especially among younger generations and urban professionals. The demand for affordable housing is also rising, driven by the expanding middle class seeking budget-friendly options and supported by government initiatives for low-cost housing .

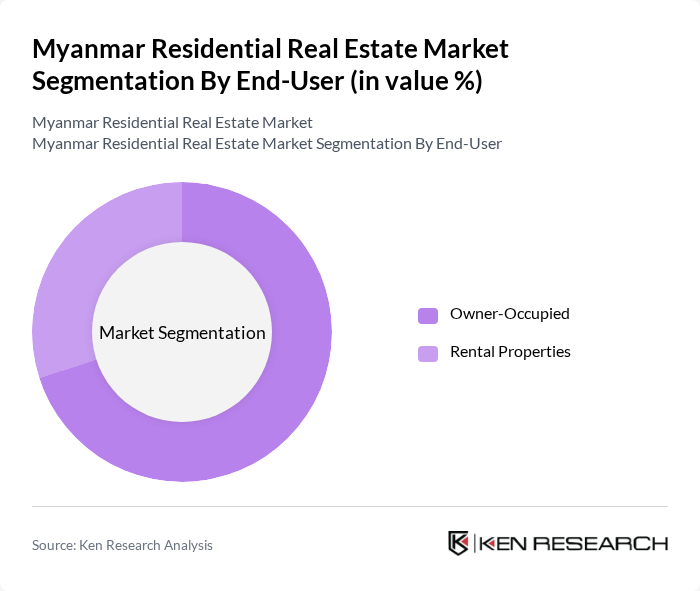

By End-User:The market is also segmented by end-user categories, which include Owner-Occupied and Rental Properties. The Owner-Occupied segment is currently leading the market, as many individuals and families prefer to invest in their own homes rather than renting. This trend is fueled by the increasing availability of financing options, government incentives aimed at promoting home ownership, and a cultural preference for property investment .

The Myanmar Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yoma Strategic Holdings Ltd., Shwe Taung Development Co., Ltd., Myanmar Property Development Public Co., Ltd., Golden Land Real Estate Development Ltd., City Mart Holdings Co., Ltd., Star City (Yoma Strategic Holdings Project), Marga Landmark, Asia World Company Ltd., Max Myanmar Group, Capital Development Limited, Capital Diamond Star Group, Myanmar Economic Holdings Limited, Htoo Group of Companies, Aung Myin Hmu Construction Co., Ltd., Dagon International Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The Myanmar residential real estate market is poised for gradual recovery as political stability improves and economic reforms take root. Urbanization will continue to drive demand for housing, particularly in major cities. Additionally, the government's commitment to affordable housing and infrastructure development will enhance market conditions. As digitalization progresses, real estate transactions will become more efficient, attracting both local and foreign investors. Overall, the market is expected to evolve, presenting new opportunities for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Villas/Landed Houses Condominiums/Apartments Single-Family Homes Multi-Family Units Luxury Apartments Affordable Housing Others |

| By End-User | Owner-Occupied Rental Properties |

| By Price Range | Below $50,000 $50,000 - $100,000 $100,000 - $200,000 Above $200,000 |

| By Location | Yangon Mandalay Naypyidaw Mawlamyine Other Cities |

| By Construction Type | New Constructions Renovations Pre-Owned Properties |

| By Financing Type | Cash Purchases Mortgages Government Loans |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 120 | First-time homebuyers, Investors |

| Real Estate Developers | 60 | Project Managers, Business Development Managers |

| Real Estate Agents | 50 | Sales Agents, Brokers |

| Property Management Firms | 40 | Property Managers, Operations Directors |

| Government Housing Officials | 40 | Policy Makers, Urban Planners |

The Myanmar residential real estate market is valued at approximately USD 1.4 billion, driven by urbanization, rising disposable incomes, and a growing middle class seeking home ownership. This valuation reflects a five-year historical analysis of market trends and developments.