Region:North America

Author(s):Shubham

Product Code:KRAC0792

Pages:82

Published On:August 2025

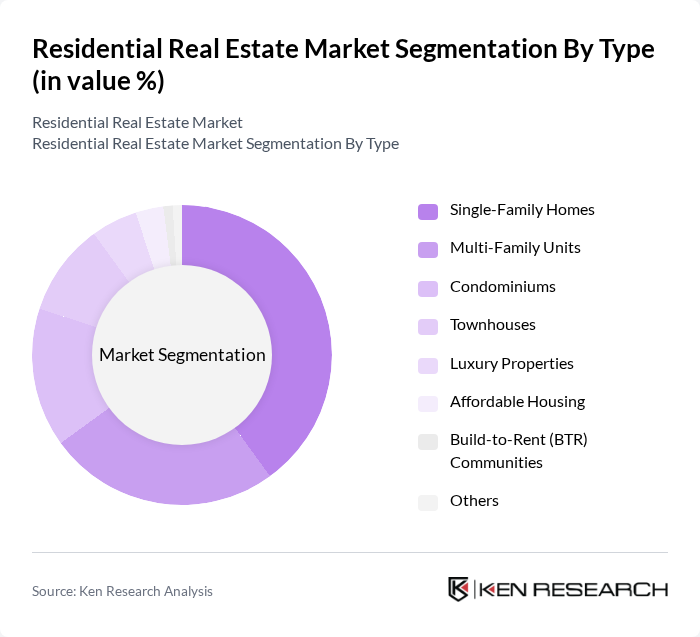

By Type:The residential real estate market can be segmented into various types, including Single-Family Homes, Multi-Family Units, Condominiums, Townhouses, Luxury Properties, Affordable Housing, Build-to-Rent (BTR) Communities, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of residential living options. The rise of Build-to-Rent communities and increased demand for luxury properties in urban centers are notable trends shaping the segment landscape .

The Single-Family Homes segment dominates the market due to its appeal among families and first-time homebuyers seeking stability and space. This segment has seen consistent demand driven by accessible mortgage rates and a strong desire for homeownership. Multi-Family Units are also gaining traction, particularly in urban areas where rental demand is high. The trend towards urban living and the need for affordable housing options have made this segment increasingly popular, especially among young professionals and investors. The Build-to-Rent model is emerging as a significant trend, offering flexibility and amenities for renters who prefer not to buy .

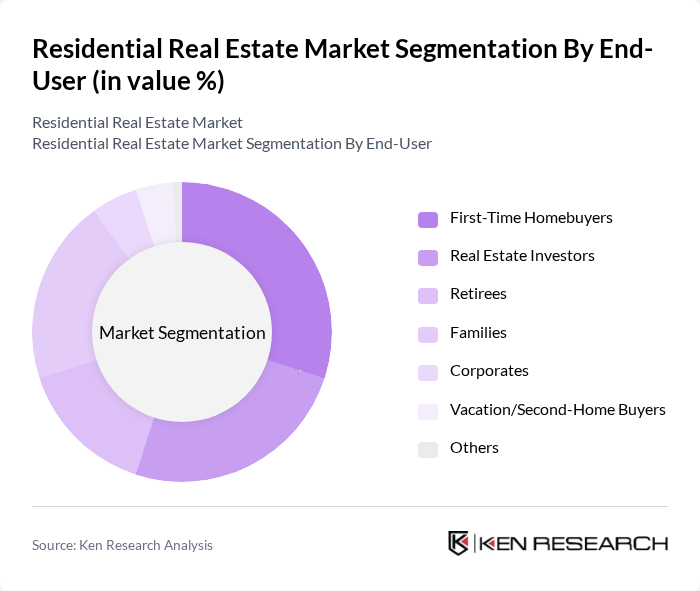

By End-User:The residential real estate market is segmented by end-users, including First-Time Homebuyers, Real Estate Investors, Retirees, Families, Corporates, Vacation/Second-Home Buyers, and Others. Each group has distinct motivations and financial capabilities, influencing their purchasing decisions and preferences. The growing presence of institutional investors and the increasing share of first-time buyers, supported by government incentives, are shaping end-user trends .

First-Time Homebuyers represent a significant portion of the market, driven by favorable financing options and government incentives. This demographic is often motivated by the desire for stability and investment in their future. Real Estate Investors are also a key segment, capitalizing on rental opportunities and property appreciation. Families, seeking larger living spaces and community amenities, contribute to the demand for Single-Family Homes and Multi-Family Units, further shaping market dynamics. The rise of remote work and flexible living arrangements is also influencing end-user behavior, especially among younger buyers and investors .

The Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Keller Williams Realty, RE/MAX Holdings, Inc., Coldwell Banker Real Estate LLC, Century 21 Real Estate LLC, Berkshire Hathaway HomeServices, eXp Realty, Redfin Corporation, Compass, Inc., Zillow Group, Inc., Opendoor Technologies Inc., Realty ONE Group, Douglas Elliman Real Estate, The Corcoran Group, Sotheby's International Realty, Realty Executives, Invitation Homes Inc., Lennar Corporation, D.R. Horton, Inc., Toll Brothers, Inc., Camden Property Trust contribute to innovation, geographic expansion, and service delivery in this space.

The residential real estate market in None is poised for a dynamic future, driven by ongoing urbanization and technological advancements. As remote work becomes more entrenched, demand for homes with dedicated office spaces is expected to rise. Additionally, sustainability will play a crucial role, with a growing emphasis on energy-efficient homes. The integration of smart home technologies will further enhance property appeal, attracting tech-savvy buyers and investors looking for modern living solutions in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Multi-Family Units Condominiums Townhouses Luxury Properties Affordable Housing Build-to-Rent (BTR) Communities Others |

| By End-User | First-Time Homebuyers Real Estate Investors Retirees Families Corporates Vacation/Second-Home Buyers Others |

| By Price Range | Below $200,000 $200,000 - $500,000 $500,000 - $1,000,000 Above $1,000,000 |

| By Location | Urban Areas Suburban Areas Rural Areas Waterfront Properties Gated Communities Master-Planned Communities Others |

| By Financing Type | Conventional Loans FHA Loans VA Loans Cash Purchases Institutional Investment Others |

| By Property Condition | New Construction Resale Properties Foreclosures Fixer-Uppers Others |

| By Investment Purpose | Primary Residence Rental Income Vacation Homes Flipping Short-Term Rentals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| First-time Homebuyers | 100 | Individuals aged 25-35, looking to purchase their first home |

| Real Estate Investors | 80 | Experienced investors with portfolios of residential properties |

| Real Estate Agents | 60 | Agents specializing in residential properties across various regions |

| Home Sellers | 50 | Individuals currently in the process of selling their homes |

| Market Analysts | 40 | Professionals with expertise in real estate market trends and forecasts |

The residential real estate market is valued at approximately USD 10.7 trillion, driven by factors such as urbanization, low-interest mortgage products, and a growing population seeking homeownership. This valuation reflects a comprehensive analysis over the past five years.