Region:Asia

Author(s):Shubham

Product Code:KRAA2253

Pages:86

Published On:August 2025

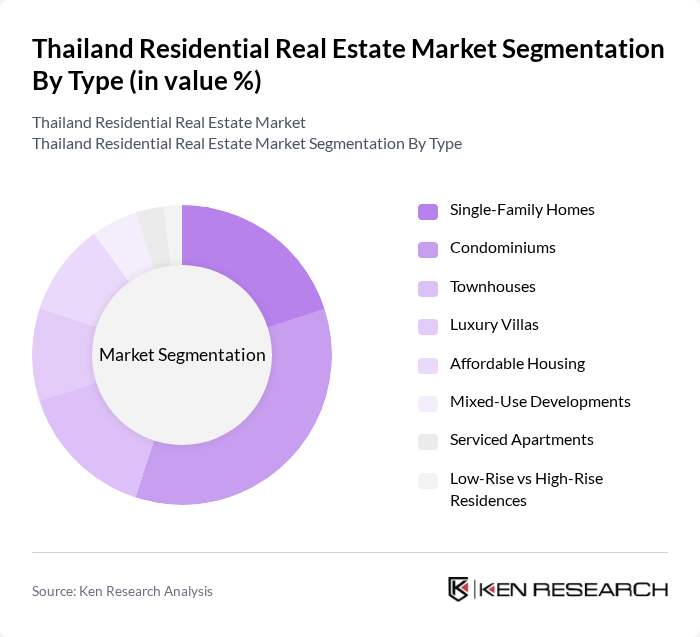

By Type:The residential real estate market in Thailand is segmented into Single-Family Homes, Condominiums, Townhouses, Luxury Villas, Affordable Housing, Mixed-Use Developments, Serviced Apartments, and Low-Rise vs High-Rise Residences.Condominiumshave gained significant popularity, particularly in urban centers, due to urbanization and the increasing number of young professionals seeking convenient living spaces. The demand forLuxury Villasis also on the rise in tourist hotspots such as Phuket and Pattaya, driven by affluent international buyers seeking vacation homes and investment properties .

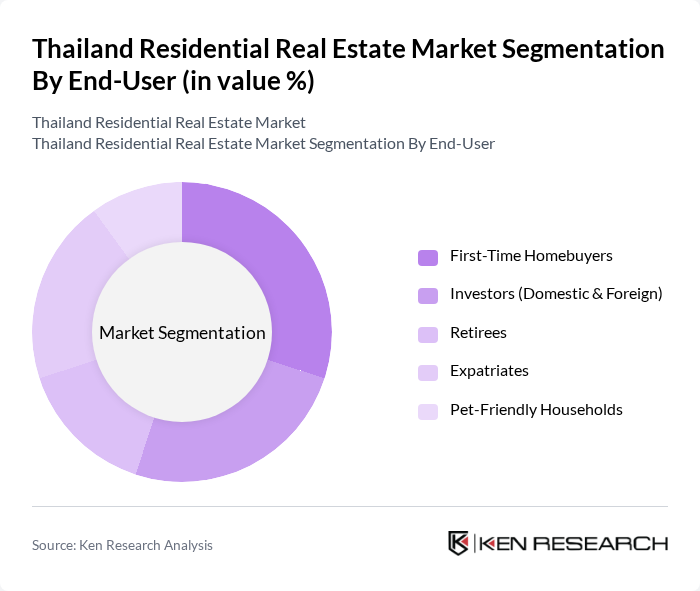

By End-User:The end-user segmentation of the residential real estate market includes First-Time Homebuyers, Investors (Domestic & Foreign), Retirees, Expatriates, and Pet-Friendly Households.First-Time Homebuyersrepresent a significant portion of the market, supported by government incentives and favorable financing options. Both domestic and foreign investors are increasingly attracted to the market due to its potential for rental income and capital appreciation, especially in urban and tourist-driven areas. Retirees and expatriates are drawn by lifestyle factors and Thailand’s relatively affordable cost of living .

The Thailand Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sansiri Public Company Limited, Property Perfect Public Company Limited, Ananda Development Public Company Limited, Land and Houses Public Company Limited, Supalai Public Company Limited, L.P.N. Development Public Company Limited, Central Pattana Public Company Limited, Major Development Public Company Limited, Pruksa Real Estate Public Company Limited, AP (Thailand) Public Company Limited, Origin Property Public Company Limited, Quality Houses Public Company Limited, Raimon Land Public Company Limited, Noble Development Public Company Limited, SC Asset Corporation Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand residential real estate market is poised for transformation, driven by evolving consumer preferences and technological advancements. The demand for eco-friendly homes is expected to rise, aligning with global sustainability trends. Additionally, the integration of smart home technologies will enhance living experiences, attracting tech-savvy buyers. As urbanization continues, the shift towards suburban living will create new opportunities for developers to cater to families seeking affordable housing options in less congested areas.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Condominiums Townhouses Luxury Villas Affordable Housing Mixed-Use Developments Serviced Apartments Low-Rise vs High-Rise Residences |

| By End-User | First-Time Homebuyers Investors (Domestic & Foreign) Retirees Expatriates Pet-Friendly Households |

| By Price Range | Below 1 Million THB Million - 3 Million THB Million - 5 Million THB Million - 10 Million THB Above 10 Million THB |

| By Location | Bangkok Metropolitan Area Central Thailand Northern Thailand Southern Thailand Eastern Economic Corridor (EEC) Resort Destinations (Phuket, Pattaya, Hua Hin, Chiang Mai) |

| By Development Stage | Pre-Construction Under Construction Completed |

| By Financing Type | Bank Loans Developer Financing Cash Purchases Mortgage for Foreigners |

| By Ownership Type | Freehold Leasehold Joint Ventures Foreign Quota (Condominiums) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Condominium Buyers | 60 | First-time homebuyers, Young professionals |

| Luxury Property Investors | 40 | High-net-worth individuals, Real estate investors |

| Suburban Family Home Buyers | 50 | Families, Relocating professionals |

| Real Estate Agents | 45 | Residential property agents, Market analysts |

| Property Developers | 40 | Project managers, Business development executives |

The Thailand residential real estate market is valued at approximately USD 29 billion, driven by urbanization, rising disposable incomes, and government initiatives aimed at stimulating home ownership among the growing middle class.