Region:Europe

Author(s):Dev

Product Code:KRAA1532

Pages:89

Published On:August 2025

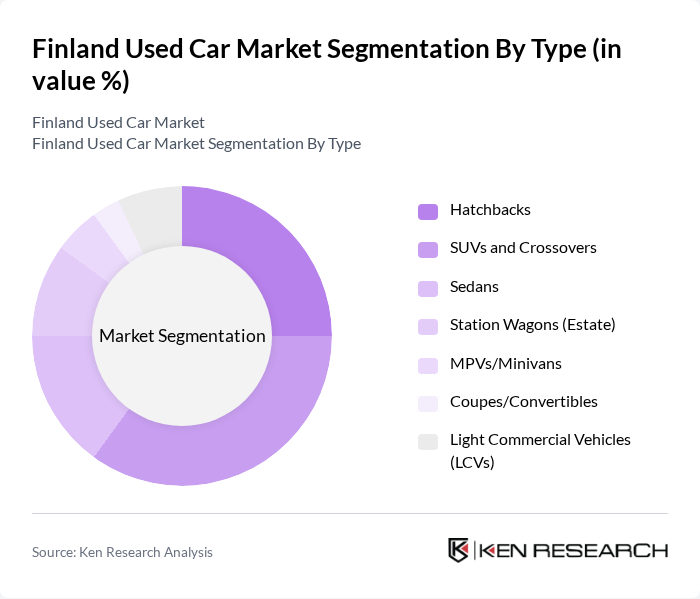

By Type:The used car market in Finland is segmented into hatchbacks, SUVs and crossovers, sedans, station wagons, MPVs/minivans, coupes/convertibles, and light commercial vehicles (LCVs). SUVs and crossovers have gained significant popularity due to their versatility and spaciousness, appealing to families and outdoor enthusiasts. Hatchbacks remain a strong contender, particularly among urban dwellers seeking compact and fuel-efficient options. The demand for station wagons is driven by their practicality for both personal and commercial use. Mid-size cars (such as Volkswagen Passat and Mercedes C-Class) also represent a substantial share of the Finnish market, reflecting consumer preferences for balanced size and comfort.

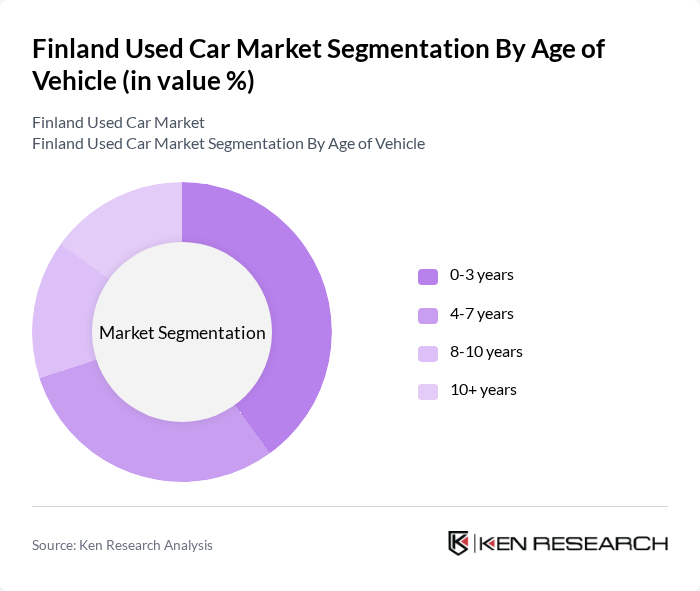

By Age of Vehicle:The age of vehicles in the used car market is categorized into four segments: 0-3 years, 4-7 years, 8-10 years, and 10+ years. The 0-3 years segment is particularly dominant as consumers are increasingly looking for relatively new vehicles that offer modern features and warranties. Vehicles aged 4-7 years also see significant interest due to their balance of affordability and reliability. The older segments (8-10 years and 10+ years) cater to budget-conscious buyers seeking lower-priced options.

The Finland Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nettiauto (Alma Media), Tori.fi (includes Auto category; part of Schibsted/OLX Europe as applicable), Kamux Oyj, Rinta-Joupin Autoliike Oy (Rinta-Jouppi), LänsiAuto Oy, SAKA Finland Oy (Suomen Autokauppa Oy), Hedin Automotive Oy (incl. Hedin Certified), Veho Oy Ab (Mercedes-Benz dealer; used car operations), Auto1 Group SE (AUTO1.com/Autohero), K-Caara Oy (Kesko) — includes K Auto used car operations, Bilia Oy Ab (Volvo dealer; used cars), Secto Automotive Oy (fleet and remarketing), Delta Auto Oy, MetroAuto Oy, J. Rinta-Jouppi Oy (Jaakko Rinta-Jouppi) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the used car market in Finland appears promising, driven by increasing urbanization and a growing preference for sustainable transportation. As disposable incomes rise, consumers are likely to invest more in used vehicles, particularly electric and hybrid models. Additionally, the expansion of online sales platforms will facilitate easier access to used cars, enhancing market dynamics. Overall, the combination of these factors is expected to create a vibrant used car market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hatchbacks SUVs and Crossovers Sedans Station Wagons (Estate) MPVs/Minivans Coupes/Convertibles Light Commercial Vehicles (LCVs) |

| By Age of Vehicle | 3 years 7 years 10 years + years |

| By Condition | Certified Pre-Owned (CPO) Non-Certified |

| By Sales Channel | Organized Retailers/Dealership Groups Independent Dealers Private Sales Online Marketplaces |

| By Financing Options | Cash Purchases Bank/Dealer Loans Leasing/Private Leasing Subscription Models |

| By Geographic Distribution | Uusimaa (incl. Helsinki) Southwest Finland (Varsinais-Suomi) Pirkanmaa North Ostrobothnia (Pohjois-Pohjanmaa) Ostrobothnia & Satakunta Central Finland (Keski-Suomi) Eastern Finland (incl. North & South Karelia) Lapland (Lappi) |

| By Powertrain/Fuel Type | Petrol Diesel Hybrid (HEV/PHEV) Battery Electric Vehicles (BEV) Alternative Fuels (e.g., E85, Gas/Biogas) |

| By Brand Origin | Nordic/Scandinavian (e.g., Volvo, Polestar) European (e.g., Volkswagen, Skoda, BMW, Mercedes-Benz) Asian (e.g., Toyota, Kia, Hyundai, Nissan) American (e.g., Ford, Tesla) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 80 | Dealership Owners, Sales Managers |

| Recent Used Car Buyers | 120 | Consumers aged 25-55, First-time Buyers |

| Automotive Industry Experts | 40 | Market Analysts, Automotive Consultants |

| Regulatory Bodies | 30 | Policy Makers, Regulatory Officers |

| Automotive Financing Institutions | 40 | Loan Officers, Financial Advisors |

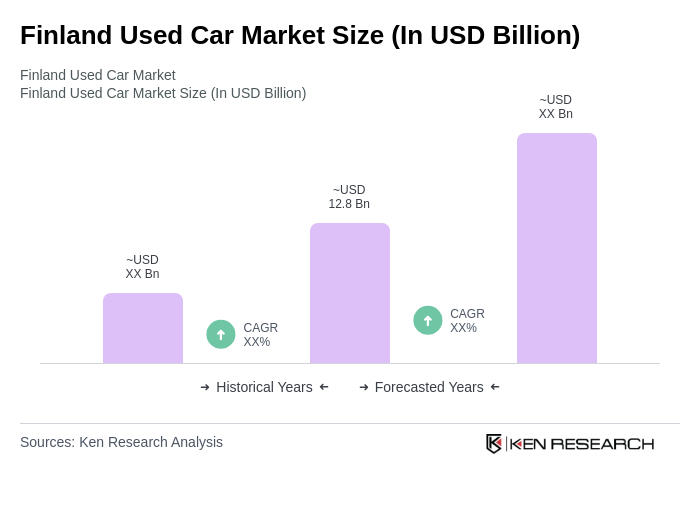

The Finland Used Car Market is valued at approximately USD 12.8 billion, driven by increasing consumer demand for affordable transportation options and the rising costs of new vehicles. This market has seen significant growth in transactions as consumers prefer used cars over new ones.