Region:Europe

Author(s):Rebecca

Product Code:KRAB4077

Pages:87

Published On:October 2025

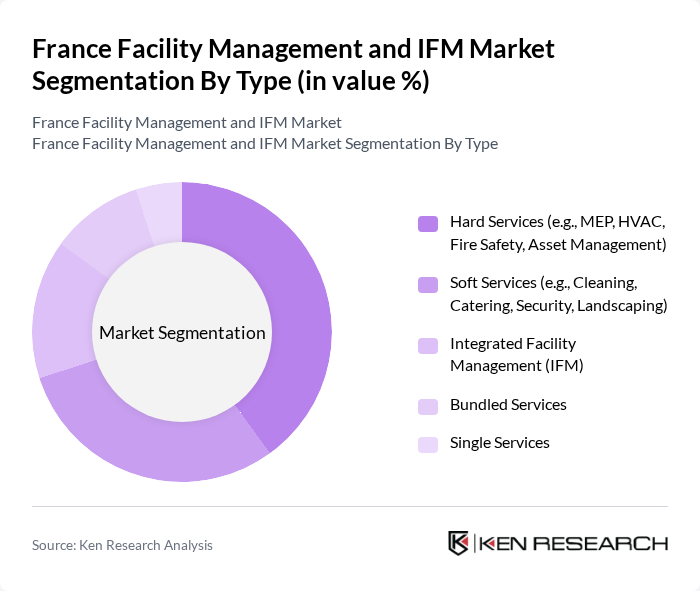

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Facility Management (IFM), Bundled Services, and Single Services. Each of these segments plays a crucial role in addressing the diverse needs of facility management, with hard services (such as MEP, HVAC, and fire safety) ensuring the operational integrity of physical assets, and soft services (such as cleaning, catering, and security) enhancing occupant experience and workplace wellness. Integrated Facility Management contracts are increasingly preferred for their ability to streamline vendor management and deliver holistic solutions.

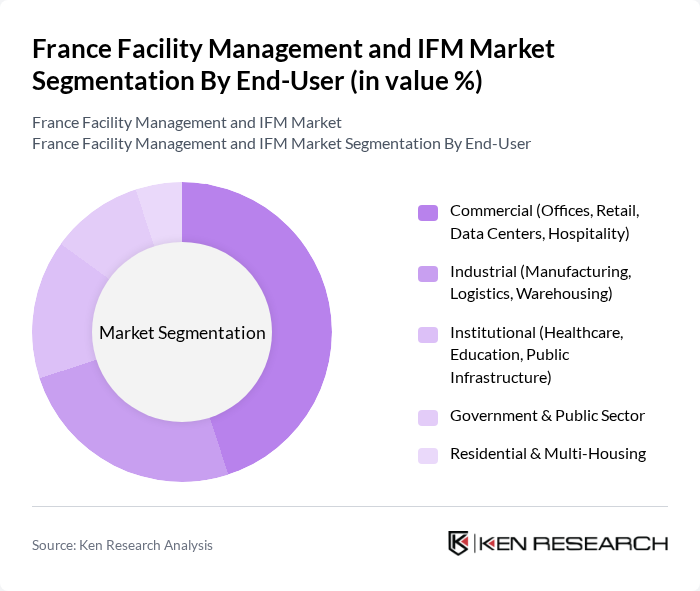

By End-User:The end-user segmentation includes Commercial, Industrial, Institutional, Government & Public Sector, Residential & Multi-Housing, and Others. Each segment reflects the specific needs and requirements of different sectors utilizing facility management services. The commercial segment, encompassing offices, retail, data centers, and hospitality, remains dominant due to the concentration of high-value assets and complex operational requirements. Industrial and institutional segments are driven by manufacturing, logistics, healthcare, and education, with increasing emphasis on compliance and sustainability.

The France Facility Management and IFM Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sodexo, ISS Facility Services (ISS France), CBRE France, JLL (Jones Lang LaSalle), Bouygues Energies & Services, Vinci Facilities, Atalian Global Services, ENGIE Solutions, Elior Group, Derichebourg Multiservices, Samsic Facility, Armonia (formerly Phone Régie), Apleona France, Seris Security, Dalkia (EDF Group), GSF Groupe, Apave, Fiducial, Groupe Onet, Colliers International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in France is poised for transformation, driven by technological advancements and a heightened focus on sustainability. As organizations increasingly adopt integrated facility management solutions, the demand for smart technologies will continue to rise. Furthermore, the emphasis on employee well-being and green initiatives will shape service offerings, encouraging providers to innovate. In future, the market is expected to witness a significant shift towards data-driven strategies, enhancing operational efficiency and service quality across sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., MEP, HVAC, Fire Safety, Asset Management) Soft Services (e.g., Cleaning, Catering, Security, Landscaping) Integrated Facility Management (IFM) Bundled Services Single Services |

| By End-User | Commercial (Offices, Retail, Data Centers, Hospitality) Industrial (Manufacturing, Logistics, Warehousing) Institutional (Healthcare, Education, Public Infrastructure) Government & Public Sector Residential & Multi-Housing Others (Entertainment, Sports Venues) |

| By Service Model | Outsourced Facility Management In-House Facility Management Hybrid/Bundled Model |

| By Region | Île-de-France (Paris Region) Auvergne-Rhône-Alpes Provence-Alpes-Côte d'Azur Nouvelle-Aquitaine Hauts-de-France Occitanie Others |

| By Application | Facility Maintenance & Technical Services Cleaning & Environmental Services Security & Surveillance Catering & Hospitality Landscaping & Outdoor Services Others |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment (FDI) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 60 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 50 | Campus Facility Managers, Procurement Officers |

| Retail Facility Management | 40 | Store Managers, Regional Facility Directors |

| Industrial Facility Services | 50 | Plant Managers, Safety Officers |

The France Facility Management and IFM Market is valued at approximately USD 73 billion, driven by the demand for efficient building management solutions, smart technologies, and a focus on sustainability and energy efficiency.