Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5889

Pages:90

Published On:October 2025

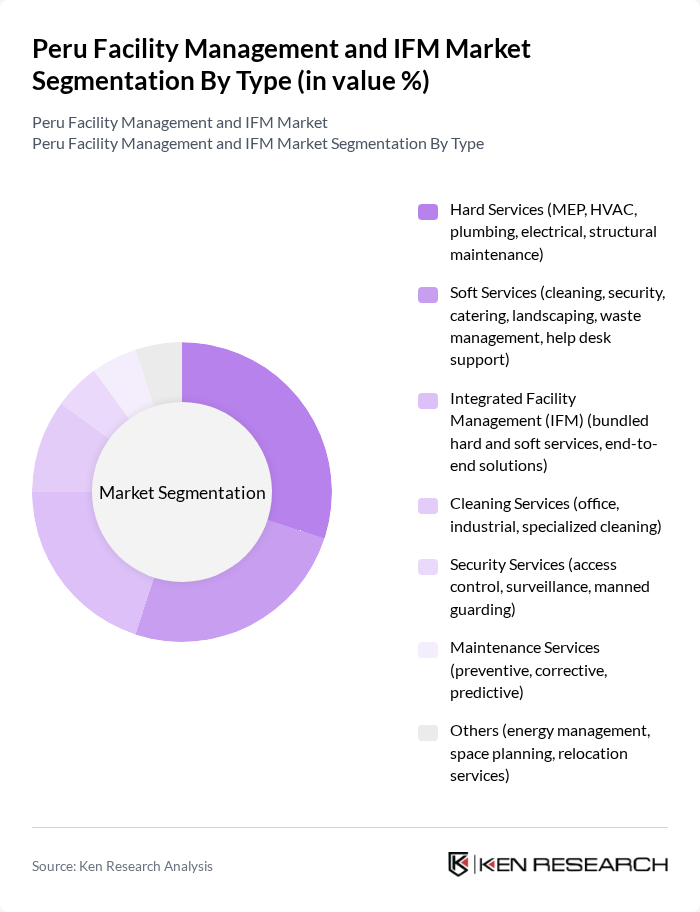

By Type:The market is segmented into Hard Services, Soft Services, Integrated Facility Management, Cleaning Services, Security Services, Maintenance Services, and Others. Hard Services include mechanical, electrical, and plumbing (MEP), HVAC, and structural maintenance, which are critical for operational continuity. Soft Services encompass cleaning, security, catering, landscaping, waste management, and help desk support, focusing on workplace experience and compliance. Integrated Facility Management (IFM) combines both hard and soft services, delivering bundled, end-to-end solutions for clients seeking streamlined operations. Cleaning Services address specialized and routine cleaning needs in offices and industrial settings. Security Services provide access control, surveillance, and manned guarding. Maintenance Services cover preventive, corrective, and predictive maintenance, while Others include energy management, space planning, and relocation services.

The Hard Services segment leads the market, reflecting the essential role of mechanical, electrical, and plumbing services in ensuring facility uptime and regulatory compliance. The increasing complexity of building systems and the adoption of smart technologies have heightened the need for specialized expertise in this segment. As organizations focus on infrastructure optimization and sustainability, demand for Hard Services continues to rise.

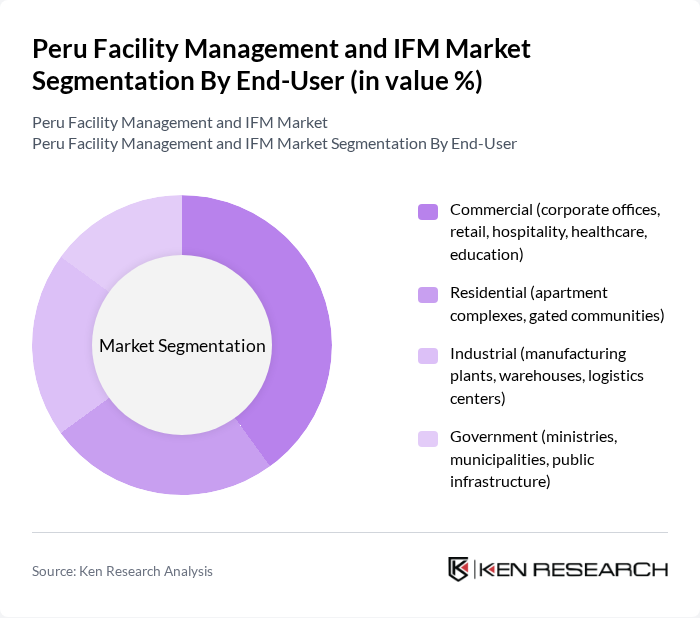

By End-User:The market is segmented by end-user into Commercial, Residential, Industrial, and Government sectors. The Commercial segment includes corporate offices, retail, hospitality, healthcare, and education facilities, which require comprehensive facility management for operational excellence and regulatory adherence. Residential covers apartment complexes and gated communities, focusing on resident safety and amenity management. Industrial encompasses manufacturing plants, warehouses, and logistics centers, prioritizing asset uptime and safety. Government includes ministries, municipalities, and public infrastructure, with an emphasis on compliance and public service delivery.

The Commercial segment remains the largest end-user, propelled by the proliferation of office spaces, retail outlets, and hospitality venues in Peru’s urban centers. Facility management in this sector is increasingly influenced by the adoption of digital solutions, sustainability mandates, and the need to deliver superior occupant experiences.

The Peru Facility Management and IFM Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo Perú, CBRE Perú, JLL Perú (Jones Lang LaSalle), G4S Perú, Grupo Eulen Perú, Seranco, Grupo Aliada, Grupo Prosegur Perú, Grupo Ospinas, Grupo Graña y Montero (GyM Facility Services), Grupo Romero (through subsidiaries), Grupo Breca (through subsidiaries), Grupo Falabella (through subsidiaries), Local specialized providers (e.g., Limagas, Limpieza Total, Segurmax) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Peru appears promising, driven by urbanization and technological advancements. As cities expand, the demand for integrated facility management solutions will likely increase, fostering innovation and efficiency. Additionally, the focus on sustainability will push service providers to adopt greener practices. With the government’s commitment to infrastructure development, the market is poised for growth, creating opportunities for both established and new players to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (MEP, HVAC, plumbing, electrical, structural maintenance) Soft Services (cleaning, security, catering, landscaping, waste management, help desk support) Integrated Facility Management (IFM) (bundled hard and soft services, end-to-end solutions) Cleaning Services (office, industrial, specialized cleaning) Security Services (access control, surveillance, manned guarding) Maintenance Services (preventive, corrective, predictive) Others (energy management, space planning, relocation services) |

| By End-User | Commercial (corporate offices, retail, hospitality, healthcare, education) Residential (apartment complexes, gated communities) Industrial (manufacturing plants, warehouses, logistics centers) Government (ministries, municipalities, public infrastructure) |

| By Service Model | Outsourced (third-party providers, total FM) In-House (internal teams, self-managed) |

| By Region | Lima (metropolitan area, largest market) Arequipa (growing commercial and industrial hubs) Trujillo (emerging urban center) Cusco (tourism-driven demand) Others (regional cities, rural areas) |

| By Contract Type | Fixed-Term Contracts Service Level Agreements (SLAs) |

| By Pricing Model | Fixed Pricing Variable Pricing |

| By Technology Adoption | Traditional Methods (manual processes, legacy systems) Smart Technologies (IoT, AI, cloud platforms, mobile apps) Others (hybrid models, niche solutions) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Property Management | 120 | Facility Managers, Property Owners |

| Residential Facility Services | 100 | Building Managers, Homeowners Association Leaders |

| Integrated Facility Management Solutions | 80 | Operations Directors, Service Coordinators |

| Soft Services in Corporate Offices | 60 | HR Managers, Office Administrators |

| Hard Services in Industrial Facilities | 90 | Maintenance Supervisors, Safety Officers |

The Peru Facility Management and Integrated Facility Management (IFM) Market is valued at approximately USD 1.1 billion, driven by urbanization, infrastructure modernization, and the growing demand for outsourced services across various sectors.