Region:Central and South America

Author(s):Shubham

Product Code:KRAB4486

Pages:91

Published On:October 2025

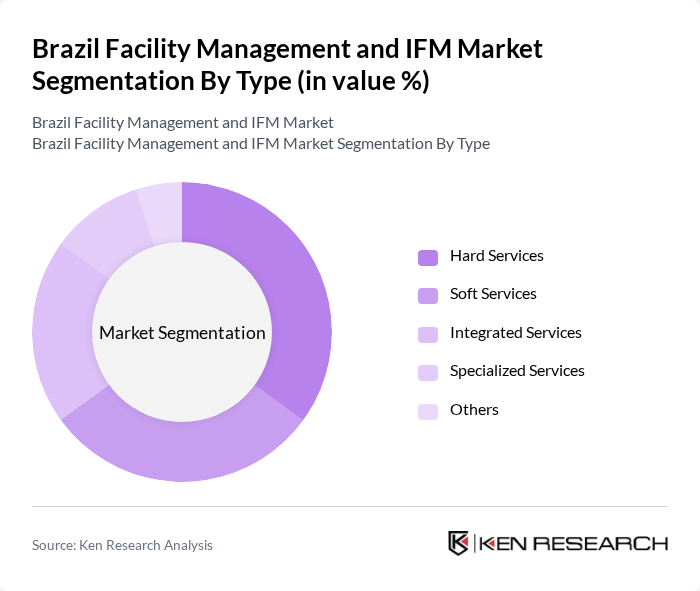

By Type:The segmentation by type includes Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass maintenance and repair tasks, while Soft Services include cleaning and security. Integrated Services combine both hard and soft services for streamlined management. Specialized Services cater to specific needs such as landscaping or pest control, and Others cover miscellaneous services.

The Hard Services segment is currently dominating the market due to the essential nature of maintenance and repair tasks in ensuring the operational efficiency of facilities. As businesses increasingly focus on minimizing downtime and maintaining asset value, the demand for hard services has surged. This trend is particularly evident in sectors such as healthcare and industrial, where equipment reliability is critical. The integration of technology in maintenance processes is also enhancing service delivery, making hard services a key area of growth.

By End-User:The end-user segmentation includes Commercial, Residential, Industrial, and Government sectors. The Commercial segment is driven by the need for efficient management of office spaces, while Residential focuses on maintaining living environments. The Industrial segment addresses the unique needs of manufacturing facilities, and Government encompasses public sector buildings and services.

The Commercial segment leads the market, accounting for a significant share due to the high demand for facility management services in office buildings and retail spaces. As businesses increasingly outsource these services to focus on core activities, the need for professional management of commercial properties has grown. This trend is further supported by the rise in flexible workspaces and the need for enhanced operational efficiency in managing large office complexes.

The Brazil Facility Management and IFM Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS World, JLL (Jones Lang LaSalle), CBRE Group, Sodexo, G4S, Aramark, Compass Group, C&W Services, Mitie Group, Serco Group, ABM Industries, Brookfield Properties, EMCOR Group, OCS Group, Vebego contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil facility management market appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt smart building solutions, the demand for integrated facility management services is expected to rise. Additionally, the government's focus on infrastructure investment, projected to reach R$ 100 billion in the future, will further stimulate market growth. Companies that adapt to these trends and invest in innovative solutions will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Commercial Residential Industrial Government |

| By Service Model | Outsourced In-House Hybrid |

| By Sector | Healthcare Education Retail Hospitality |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Performance-Based Contracts |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment Joint Ventures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Space Management | 150 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 100 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Facility Management | 80 | Campus Facility Managers, Administrative Heads |

| Retail Space Maintenance | 70 | Store Managers, Property Management Executives |

| Industrial Facility Operations | 90 | Plant Managers, Safety Officers |

The Brazil Facility Management and Integrated Facility Management (IFM) Market is valued at approximately USD 15 billion, reflecting significant growth driven by urbanization, demand for efficient building management solutions, and the outsourcing of facility management services by businesses.