Region:Europe

Author(s):Shubham

Product Code:KRAB1222

Pages:81

Published On:October 2025

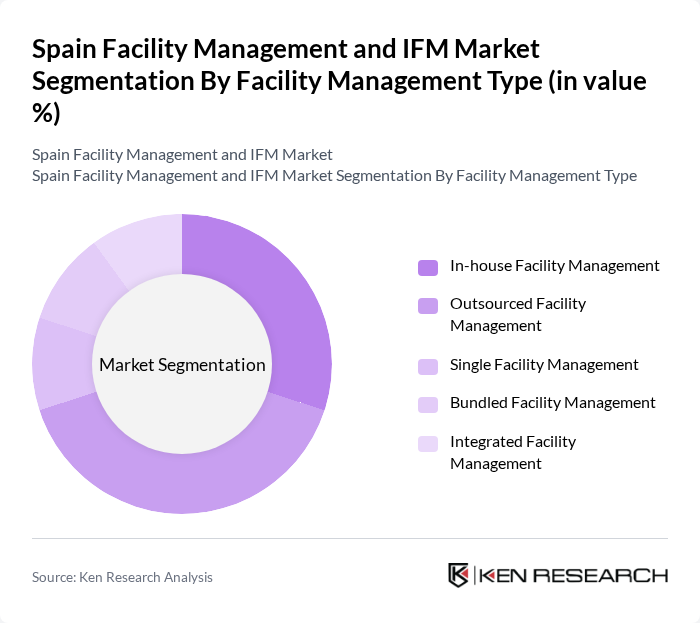

By Facility Management Type:The facility management type segmentation includes various approaches to managing facilities, such as in-house management, outsourced services, and integrated solutions. In-house management refers to organizations directly handling their facility operations, while outsourced services involve third-party providers managing specific or bundled functions. Integrated solutions combine multiple services under a single provider to maximize efficiency and cost savings, increasingly preferred by large commercial and institutional clients .

By Offering Type:The offering type segmentation encompasses hard and soft facility management services. Hard FM includes technical building operations, infrastructure maintenance, and asset management. Soft FM focuses on administrative and support services such as cleaning, security, catering, and workplace experience enhancement. Both segments are critical, with hard FM holding a larger market share, but soft FM is increasingly valued for its role in employee well-being and productivity .

The Spain Facility Management and IFM Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo S.A., CBRE Group, Inc., JLL (Jones Lang LaSalle), Ferrovial Servicios, Acciona Facility Services S.A., Sacyr Facilities, The Mail Company, Licuas S.A., Dussmann Group, Apleona GmbH, Bilfinger SE, Clece S.A., Eulen S.A., Grupo OHL Servicios-Ingesan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Spain appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt integrated facility management solutions, the demand for smart building technologies is expected to rise. Additionally, the trend towards outsourcing facility management services will likely continue, allowing businesses to focus on core operations while leveraging specialized expertise. These developments will create a dynamic environment for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Facility Management Type | In-house Facility Management Outsourced Facility Management Single Facility Management Bundled Facility Management Integrated Facility Management |

| By Offering Type | Hard FM Soft FM |

| By End-User | Commercial Institutional Public/Infrastructure Industrial Others |

| By Geographic Coverage | Major Urban Areas (e.g., Madrid, Barcelona) Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Space Management | 120 | Facility Managers, Property Owners |

| Healthcare Facility Operations | 60 | Operations Directors, Facility Coordinators |

| Educational Institution Facilities | 50 | Campus Facility Managers, Administrative Heads |

| Retail Space Management | 40 | Store Managers, Regional Facility Directors |

| Industrial Facility Maintenance | 55 | Maintenance Supervisors, Safety Officers |

The Spain Facility Management and Integrated Facility Management (IFM) Market is valued at approximately USD 25 billion, reflecting a significant growth trend driven by the demand for efficient building management solutions and the adoption of smart technologies.