Region:Europe

Author(s):Shubham

Product Code:KRAB1219

Pages:92

Published On:October 2025

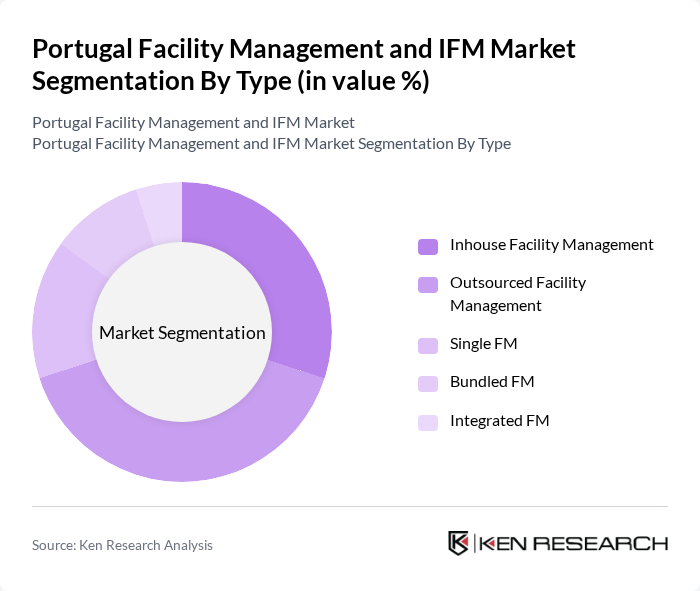

By Type:The market is segmented into various types, including Inhouse Facility Management, Outsourced Facility Management, Single FM, Bundled FM, and Integrated FM. Each of these segments addresses distinct operational needs and strategic priorities. Outsourced and integrated FM solutions are increasingly favored by organizations seeking to optimize operational efficiency, reduce costs, and access specialized expertise, while inhouse FM remains prevalent among institutions with unique or sensitive operational requirements .

By Offering Type:The market is further divided into Hard FM and Soft FM, reflecting the breadth of facility management services. Hard FM encompasses technical services such as maintenance, repair, and energy management, while Soft FM includes cleaning, security, landscaping, and other support services. The adoption of Hard FM is particularly strong in commercial and industrial sectors, driven by regulatory compliance and the need for advanced building systems, whereas Soft FM is widely utilized across all property types for operational support and workplace enhancement .

The Portugal Facility Management and IFM Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services Portugal, CBRE Group, Inc., Sodexo S.A., JLL (Jones Lang LaSalle), G4S Secure Solutions Portugal, Compass Group PLC, Aramark Portugal, Mitie Group PLC, Serco Group plc, Bilfinger SE, Apleona GmbH, C&W Services, OCS Group Limited, Engie Portugal, Veolia Environnement S.A., Infraspeak, Grupo Trivalor, Grupo Securitas Portugal, Grupo Lena, Servilimpa Facility Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Portugal appears promising, driven by technological innovations and a strong emphasis on sustainability. As businesses increasingly adopt integrated facility management solutions, the demand for smart technologies and energy-efficient practices will continue to rise. Additionally, the ongoing investment in infrastructure development is expected to create new opportunities for service providers. In future, the market is likely to witness a shift towards more comprehensive service offerings that prioritize employee well-being and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Inhouse Facility Management Outsourced Facility Management Single FM Bundled FM Integrated FM |

| By Offering Type | Hard FM Soft FM |

| By End-User | Commercial Institutional Public/Infrastructure Industrial Others End Users |

| By Service Model | Outsourced In-House |

| By Sector | Healthcare Education Retail Hospitality |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts |

| By Geographic Coverage | Urban Areas Rural Areas |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 85 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 65 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 55 | Campus Facility Managers, Administrative Heads |

| Commercial Real Estate Management | 75 | Property Managers, Asset Managers |

| Public Sector Facility Management | 50 | Government Facility Managers, Procurement Officers |

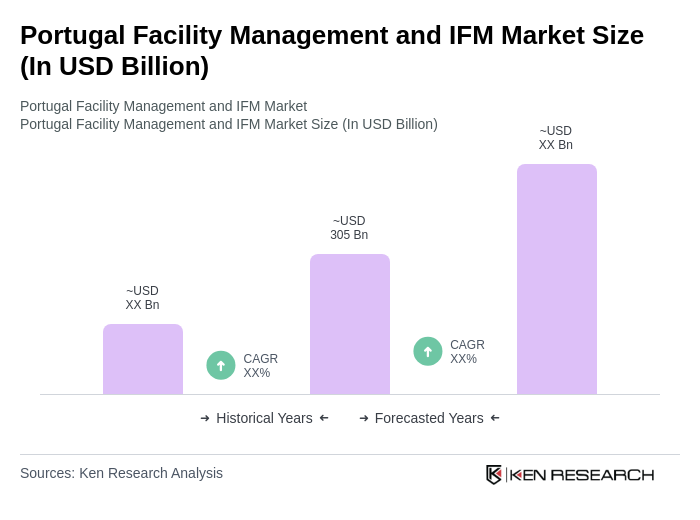

The Portugal Facility Management and IFM Market is valued at approximately USD 305 billion, driven by the demand for efficient building management solutions, technological advancements, and a focus on sustainability in commercial and public infrastructure.