Region:Europe

Author(s):Rebecca

Product Code:KRAB4075

Pages:85

Published On:October 2025

By Type:The market is segmented into various types of facility management services, including Hard Facility Management Services, Soft Facility Management Services, Integrated Facility Management (IFM), Specialized Services, and Others. Each of these segments plays a crucial role in addressing the diverse needs of clients across different sectors. Hard services encompass technical and structural maintenance such as HVAC, electrical, plumbing, and building maintenance. Soft services include cleaning, security, landscaping, and waste management. Integrated Facility Management involves the bundling of multiple services under a single contract for operational efficiency, while Specialized Services address niche requirements like energy management, pest control, and catering .

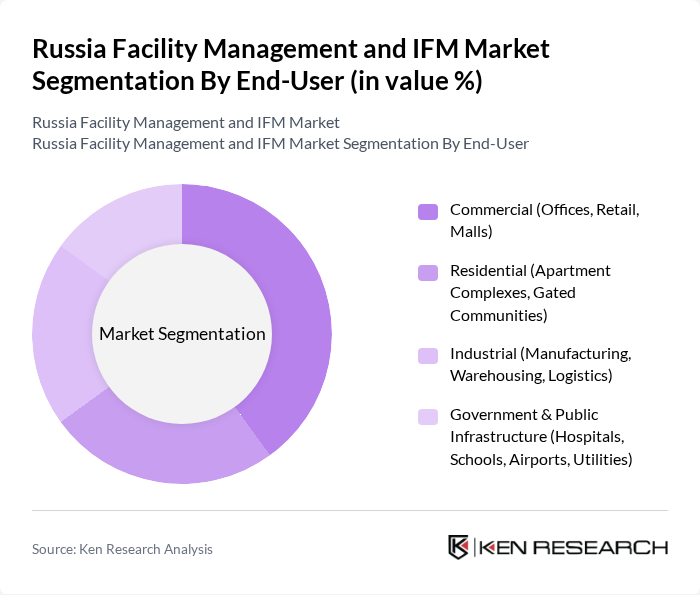

By End-User:The facility management market is categorized by end-users, including Commercial, Residential, Industrial, and Government & Public Infrastructure. Each end-user segment has unique requirements and service expectations, influencing the overall market dynamics. The commercial segment, comprising offices, retail, and malls, accounts for the largest share, driven by ongoing investments in commercial real estate and the need for professional management of business environments. The residential segment includes apartment complexes and gated communities, while the industrial segment covers manufacturing, warehousing, and logistics. Government & Public Infrastructure encompasses hospitals, schools, airports, and utilities .

The Russia Facility Management and IFM Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services Russia, Sodexo Russia, CBRE Russia, JLL Russia (Jones Lang LaSalle), G4S Russia, Cushman & Wakefield Russia, Bilfinger Tebodin Russia, OCS Group Russia, MEBIS Facility Management, Apleona Russia, Dussmann Group Russia, Spectrum Group, Renaissance Facility Management, Rentokil Initial Russia, City Service Russia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Russia appears promising, driven by increasing urbanization and technological advancements. As businesses seek to enhance operational efficiency, the adoption of integrated facility management solutions is expected to rise. Additionally, the growing emphasis on sustainability will likely lead to more investments in green building technologies. These trends indicate a shift towards smarter, more efficient management practices that align with global sustainability goals, positioning the market for significant growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Facility Management Services (e.g., HVAC, Electrical, Plumbing, Building Maintenance) Soft Facility Management Services (e.g., Cleaning, Security, Landscaping, Waste Management) Integrated Facility Management (IFM) Specialized Services (e.g., Energy Management, Pest Control, Catering) Others |

| By End-User | Commercial (Offices, Retail, Malls) Residential (Apartment Complexes, Gated Communities) Industrial (Manufacturing, Warehousing, Logistics) Government & Public Infrastructure (Hospitals, Schools, Airports, Utilities) |

| By Service Model | Outsourced Facility Management In-House Facility Management Hybrid Model |

| By Sector | Healthcare Education Retail Hospitality |

| By Geographic Coverage | Central Federal District Northwestern Federal District Volga Federal District Urals Federal District Siberian Federal District Others |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Investment Source | Domestic Investment Foreign Direct Investment Public-Private Partnerships Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 80 | Facility Managers, Operations Directors |

| Commercial Real Estate Management | 70 | Property Managers, Asset Managers |

| Public Sector Facility Services | 60 | Government Facility Coordinators, Procurement Officers |

| Healthcare Facility Management | 50 | Healthcare Administrators, Facility Directors |

| Educational Institution Facility Services | 40 | Campus Facility Managers, Administrative Heads |

The Russia Facility Management and Integrated Facility Management (IFM) Market is valued at approximately USD 18 billion, driven by urbanization, commercial real estate expansion, and a growing demand for integrated services that enhance operational efficiency.