Region:Europe

Author(s):Shubham

Product Code:KRAA0936

Pages:92

Published On:August 2025

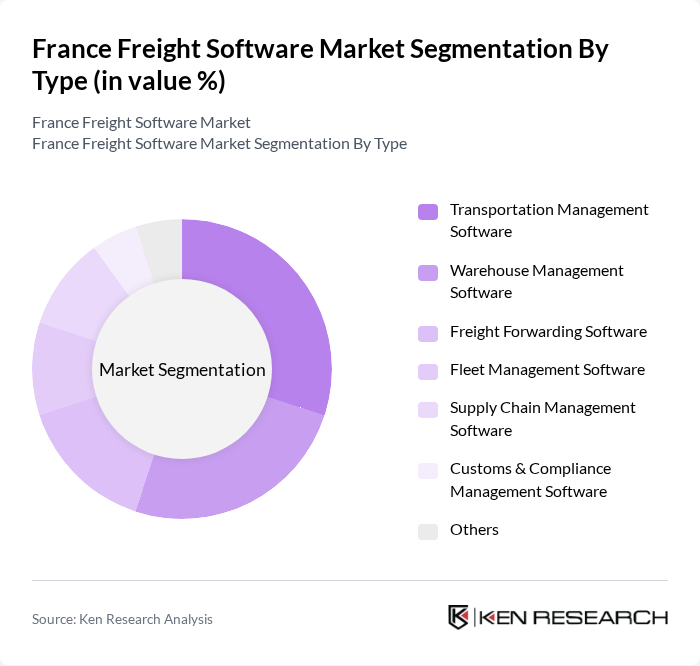

By Type:The freight software market can be segmented into various types, including Transportation Management Software, Warehouse Management Software, Freight Forwarding Software, Fleet Management Software, Supply Chain Management Software, Customs & Compliance Management Software, and Others. Each of these segments plays a crucial role in streamlining logistics operations, enabling real-time data exchange, optimizing routes, and enhancing supply chain efficiency through automation and integration of digital platforms .

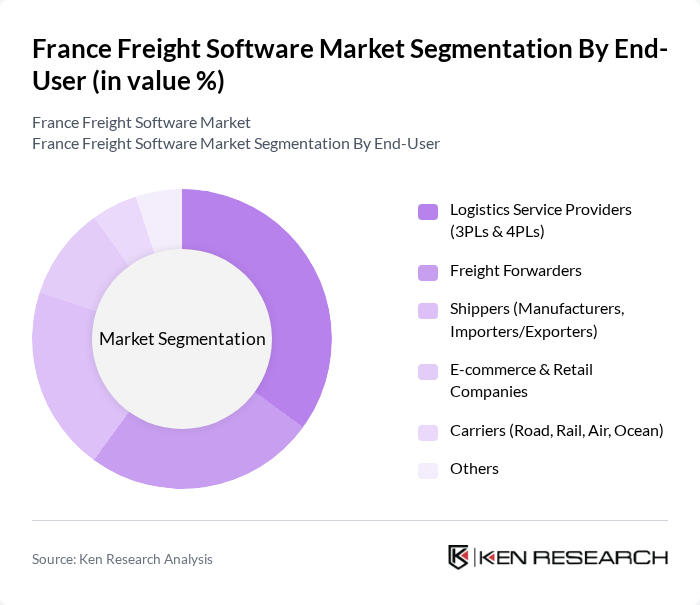

By End-User:The end-user segmentation includes Logistics Service Providers (3PLs & 4PLs), Freight Forwarders, Shippers (Manufacturers, Importers/Exporters), E-commerce & Retail Companies, Carriers (Road, Rail, Air, Ocean), and Others. Each end-user category has unique requirements and contributes differently to the overall market dynamics. Logistics service providers and freight forwarders are the primary adopters, leveraging advanced software for real-time tracking, compliance, and operational efficiency, while shippers and e-commerce companies increasingly invest in digital platforms to optimize supply chain visibility and customer service .

The France Freight Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Descartes Systems Group, WiseTech Global (CargoWise), Transporeon (Trimble Inc.), Generix Group, Akanea Développement, Hardis Group, DDS Logistics, Project44, FourKites, BluJay Solutions (now part of E2open), Shippeo, Kuebix (Trimble Inc.) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the freight software market in France appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly prioritize sustainability, the integration of green logistics practices is expected to gain traction. Furthermore, the rise of e-commerce will continue to shape logistics strategies, prompting software providers to innovate. The anticipated growth in digital transformation initiatives will likely enhance operational efficiencies, positioning the French freight software market for robust development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Forwarding Software Fleet Management Software Supply Chain Management Software Customs & Compliance Management Software Others |

| By End-User | Logistics Service Providers (3PLs & 4PLs) Freight Forwarders Shippers (Manufacturers, Importers/Exporters) E-commerce & Retail Companies Carriers (Road, Rail, Air, Ocean) Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Functionality | Order Management Inventory Management Shipment Tracking & Visibility Freight Rate Management Reporting and Analytics Document Management & EDI |

| By Industry Vertical | Automotive Consumer Goods Pharmaceuticals & Healthcare Food and Beverage Industrial & Manufacturing Others |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Management Software Users | 100 | Logistics Coordinators, IT Managers |

| Supply Chain Optimization Solutions | 80 | Supply Chain Analysts, Operations Managers |

| Warehouse Management Systems | 60 | Warehouse Managers, Inventory Control Specialists |

| Transportation Management Systems | 90 | Transport Managers, Fleet Coordinators |

| Integration of Freight Software with ERP | 50 | ERP Consultants, Business Analysts |

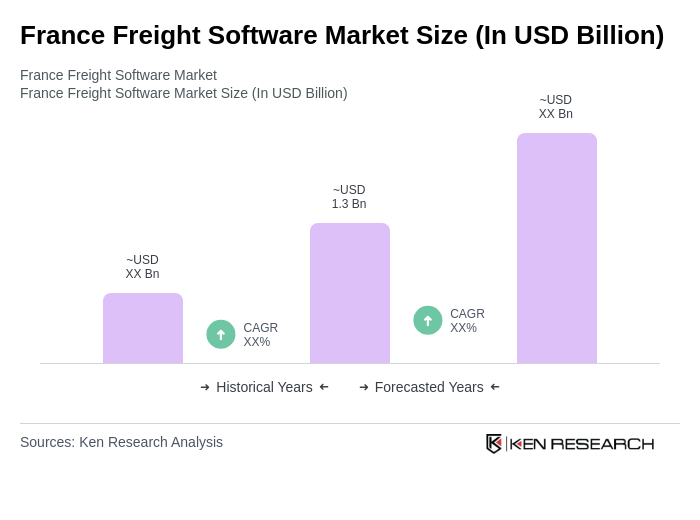

The France Freight Software Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and the need for real-time tracking in supply chains.