Region:Africa

Author(s):Shubham

Product Code:KRAA1091

Pages:87

Published On:August 2025

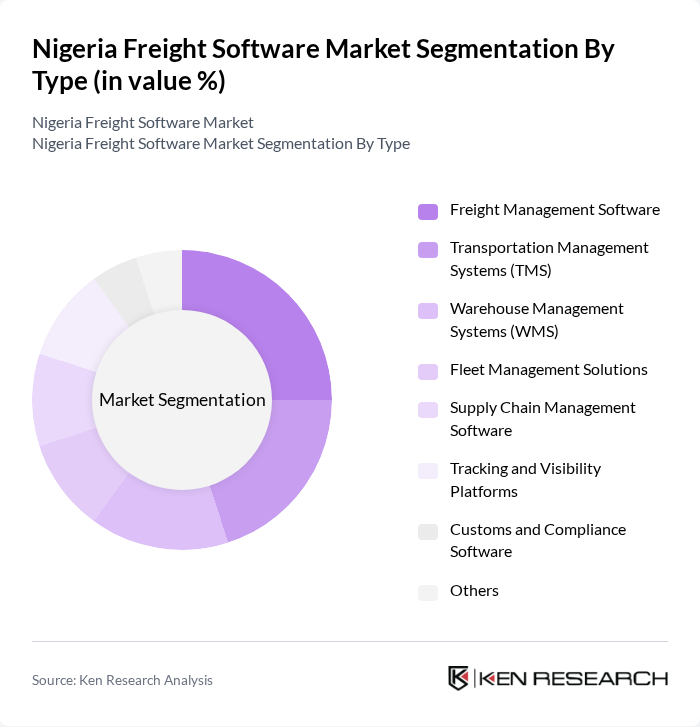

By Type:The freight software market is segmented into various types, including Freight Management Software, Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Fleet Management Solutions, Supply Chain Management Software, Tracking and Visibility Platforms, Customs and Compliance Software, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and meeting the diverse needs of logistics providers. Freight Management Software and TMS are particularly prominent due to their ability to optimize routing, automate documentation, and provide real-time shipment visibility, while WMS and Fleet Management Solutions are increasingly adopted for inventory and asset tracking .

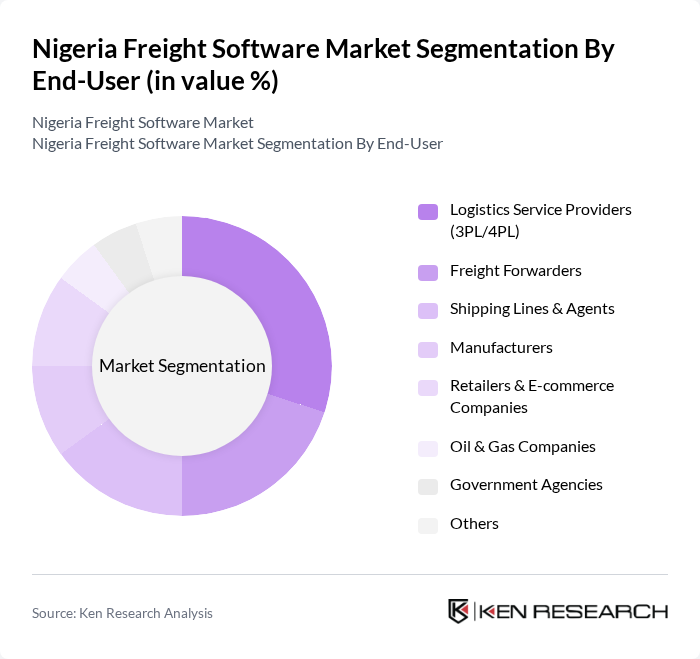

By End-User:The end-user segmentation includes Logistics Service Providers (3PL/4PL), Freight Forwarders, Shipping Lines & Agents, Manufacturers, Retailers & E-commerce Companies, Oil & Gas Companies, Government Agencies, and Others. Each end-user category has unique requirements that drive the demand for specific freight software solutions tailored to their operational needs. Logistics Service Providers and Freight Forwarders represent the largest segments, leveraging software for route optimization, compliance, and real-time tracking, while e-commerce and oil & gas companies increasingly demand integrated platforms for supply chain visibility and regulatory compliance .

The Nigeria Freight Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kobo360, Lori Systems, Sendbox, Haul247, TradeDepot, SAP (Nigeria), Oracle (Nigeria), CargoWise (WiseTech Global), Flexport, Sifax Group, Red Star Express, DHL Global Forwarding (Nigeria), Maersk Nigeria, GIG Logistics, and Speedaf Express contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Nigeria freight software market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As companies continue to embrace digital transformation, the integration of AI and machine learning into freight management systems is expected to enhance operational efficiency. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly logistics practices, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Software Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Fleet Management Solutions Supply Chain Management Software Tracking and Visibility Platforms Customs and Compliance Software Others |

| By End-User | Logistics Service Providers (3PL/4PL) Freight Forwarders Shipping Lines & Agents Manufacturers Retailers & E-commerce Companies Oil & Gas Companies Government Agencies Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Geographic Coverage | National Regional International |

| By Integration Capability | API Integration EDI Integration Manual Integration |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Software Adoption in Manufacturing | 100 | IT Managers, Operations Directors |

| Freight Management Solutions in E-commerce | 80 | eCommerce Operations Managers, Supply Chain Analysts |

| Transport Management Systems in Retail | 70 | Logistics Coordinators, Procurement Managers |

| Customs Compliance Software Usage | 50 | Compliance Officers, Customs Brokers |

| Integration of IoT in Freight Operations | 60 | Technology Officers, Fleet Managers |

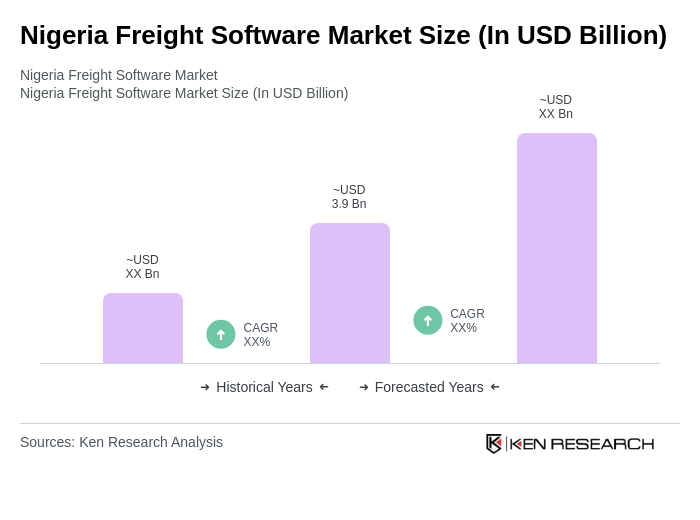

The Nigeria Freight Software Market is valued at approximately USD 3.9 billion, reflecting the growing integration of digital platforms and software solutions in logistics operations, driven by the demand for efficiency and real-time tracking.