Region:North America

Author(s):Geetanshi

Product Code:KRAA0195

Pages:93

Published On:August 2025

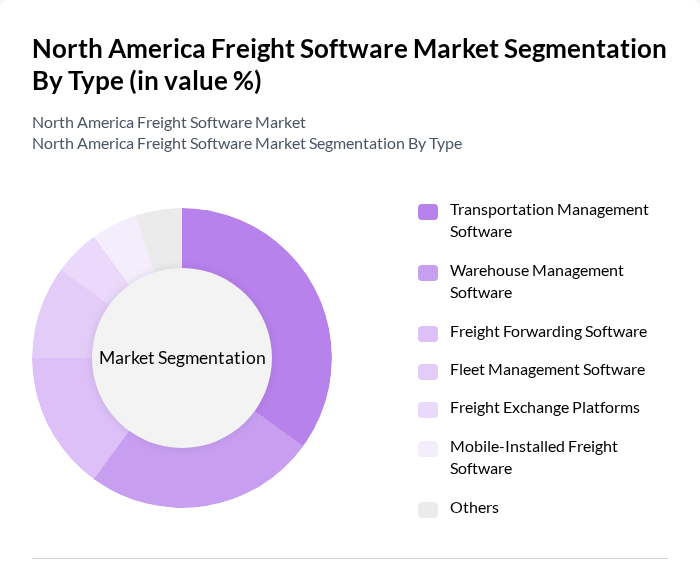

By Type:The freight software market is segmented into various types, including Transportation Management Software, Warehouse Management Software, Freight Forwarding Software, Fleet Management Software, Freight Exchange Platforms, Mobile-Installed Freight Software, and Others. Among these, Transportation Management Software is the leading segment, driven by the increasing need for efficient route planning, load optimization, and cost reduction in logistics operations. The demand for real-time visibility, cloud-based deployment, and advanced analytics in transportation processes has further propelled the growth of this segment .

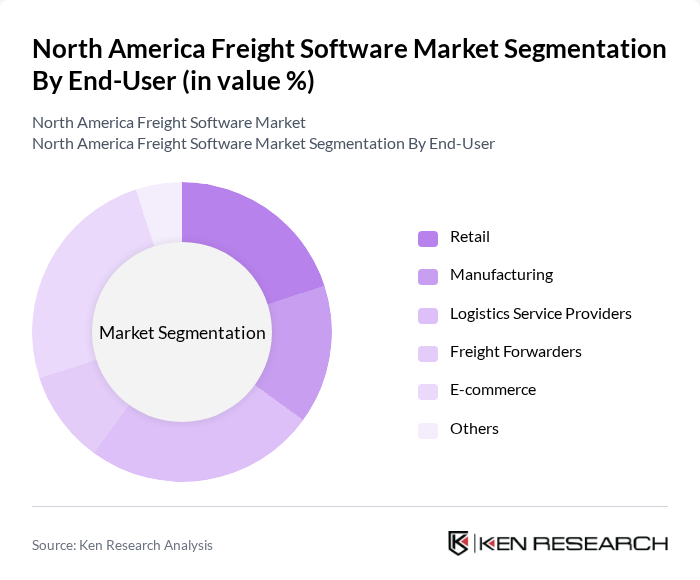

By End-User:The freight software market is also segmented by end-users, including Retail, Manufacturing, Logistics Service Providers, Freight Forwarders, E-commerce, and Others. The E-commerce sector is currently the dominant end-user, driven by the rapid growth of online shopping and the need for efficient logistics solutions to handle increased order volumes. Retail and Logistics Service Providers also play significant roles, as they seek to optimize their supply chains and improve customer satisfaction .

The North America Freight Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Descartes Systems Group, WiseTech Global (CargoWise), Flexport, Oracle Corporation, SAP SE, Manhattan Associates, Trimble Inc., C.H. Robinson (Navisphere), Project44, FourKites, Freightos, Kuebix (A Trimble Company), BluJay Solutions (now part of E2open), MercuryGate International, Transporeon (A Trimble Company) contribute to innovation, geographic expansion, and service delivery in this space.

The North American freight software market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As automation and artificial intelligence become integral to logistics operations, companies will increasingly invest in innovative solutions to enhance efficiency. Furthermore, the emphasis on sustainability will shape software development, with a focus on reducing carbon footprints. This dynamic environment presents opportunities for companies to leverage technology to meet regulatory demands and improve service delivery, ensuring competitiveness in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Forwarding Software Fleet Management Software Freight Exchange Platforms Mobile-Installed Freight Software Others |

| By End-User | Retail Manufacturing Logistics Service Providers Freight Forwarders E-commerce Others |

| By Deployment Model | On-Premises Cloud-Based SaaS (Software-as-a-Service) Hybrid Others |

| By Region | United States Canada Mexico |

| By Functionality | Order Management Inventory Management Shipment Tracking Reporting & Analytics Route Optimization Digital Documentation Others |

| By Industry Vertical | Automotive Pharmaceuticals Consumer Goods Food & Beverage Electronics Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Management Software Adoption | 100 | Logistics Directors, IT Managers |

| Supply Chain Optimization Tools | 70 | Supply Chain Analysts, Operations Managers |

| Transportation Management Systems | 60 | Procurement Managers, Fleet Managers |

| Warehouse Management Solutions | 50 | Warehouse Supervisors, Inventory Control Managers |

| Real-time Tracking and Visibility Software | 40 | Logistics Coordinators, Customer Service Managers |

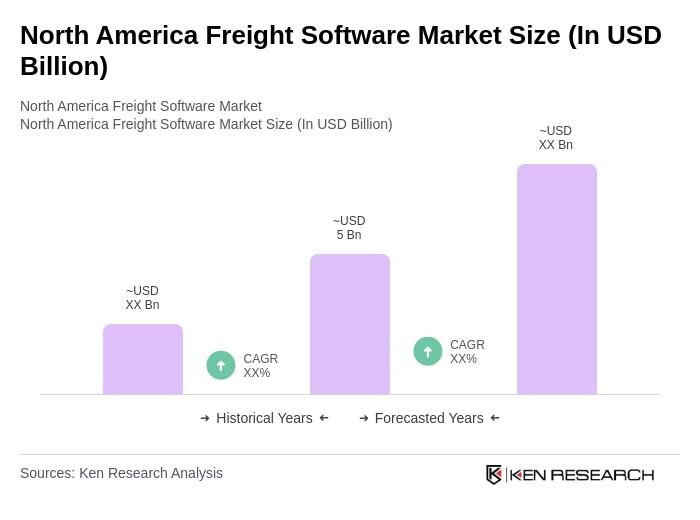

The North America Freight Software Market is valued at approximately USD 5 billion, driven by the increasing demand for digital logistics solutions, e-commerce growth, and the need for real-time tracking and management of freight operations.