Region:Europe

Author(s):Shubham

Product Code:KRAA0773

Pages:83

Published On:August 2025

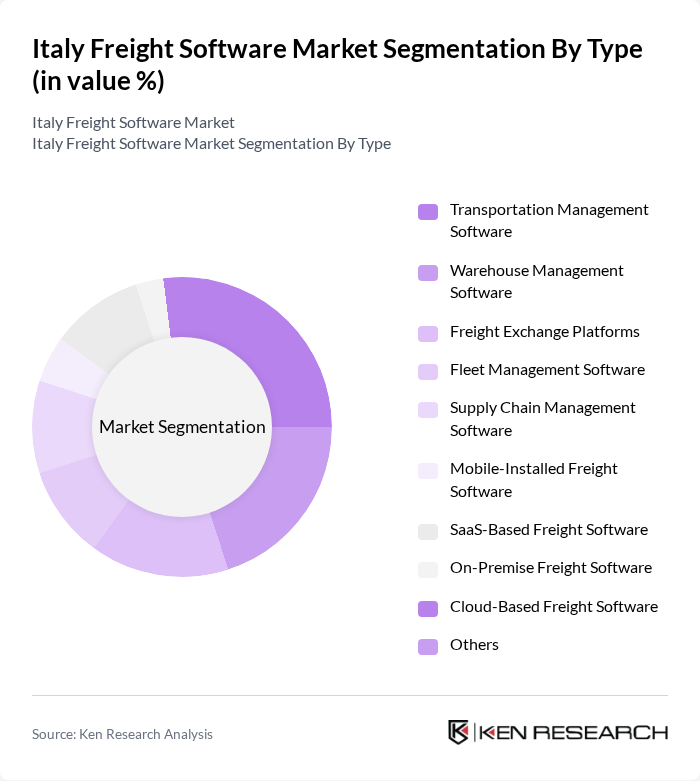

By Type:The freight software market in Italy is segmented by solution type, including Transportation Management Software, Warehouse Management Software, Freight Exchange Platforms, Fleet Management Software, Supply Chain Management Software, Mobile-Installed Freight Software, SaaS-Based Freight Software, On-Premise Freight Software, Cloud-Based Freight Software, and Others. These solutions are integral for automating logistics processes, optimizing route planning, managing inventory, facilitating carrier selection, and providing real-time visibility across the supply chain .

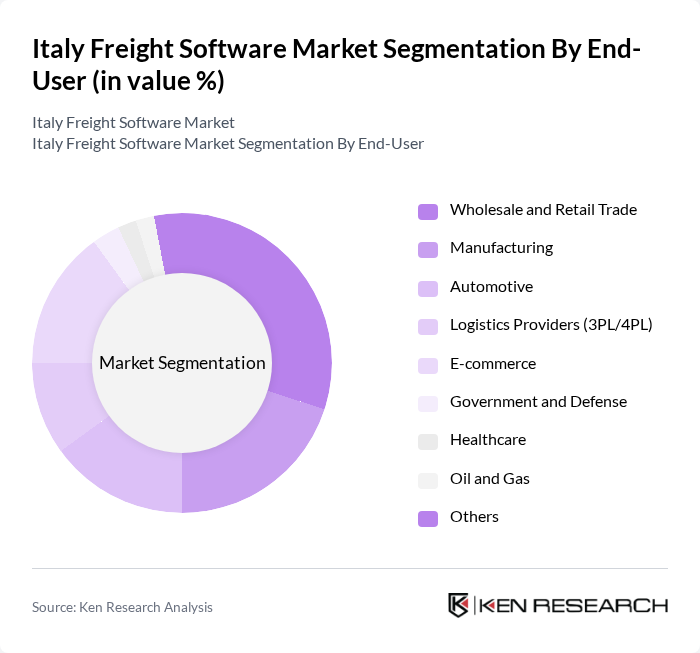

By End-User:The end-user segmentation includes Wholesale and Retail Trade, Manufacturing, Automotive, Logistics Providers (3PL/4PL), E-commerce, Government and Defense, Healthcare, Oil and Gas, and Others. These sectors leverage freight software to optimize logistics networks, automate documentation, improve shipment visibility, and enhance supply chain resilience, reflecting the broad applicability of these technologies in Italy’s evolving logistics landscape .

The Italy Freight Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Descartes Systems Group, WiseTech Global (CargoWise), Transporeon (Trimble Inc.), Freightos, Project44, FourKites, Generix Group, TESISQUARE, Beta 80 Group, Zucchetti Group, Rail Cargo Group (ÖBB), BluJay Solutions (now part of E2open) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy freight software market appears promising, driven by technological advancements and evolving consumer expectations. As logistics companies increasingly adopt digital solutions, the focus will shift towards enhancing operational efficiency and sustainability. The integration of IoT and AI technologies will facilitate real-time tracking and predictive analytics, enabling companies to respond swiftly to market demands. Additionally, the growing emphasis on sustainable practices will likely lead to innovations in eco-friendly logistics solutions, further shaping the industry's landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Exchange Platforms Fleet Management Software Supply Chain Management Software Mobile-Installed Freight Software SaaS-Based Freight Software On-Premise Freight Software Cloud-Based Freight Software Others |

| By End-User | Wholesale and Retail Trade Manufacturing Automotive Logistics Providers (3PL/4PL) E-commerce Government and Defense Healthcare Oil and Gas Others |

| By Application | Freight Forwarding Last-Mile Delivery Inventory Management Route Optimization Data Management Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-As-You-Go |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | Northern Italy Central Italy Southern Italy Islands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Software Solutions | 100 | Logistics Managers, IT Directors |

| Rail Freight Management Systems | 60 | Operations Managers, Supply Chain Analysts |

| Air Cargo Software Platforms | 50 | Freight Forwarders, Cargo Operations Managers |

| Maritime Freight Solutions | 40 | Shipping Managers, Port Operations Supervisors |

| Integrated Freight Management Systems | 70 | Business Development Managers, Software Engineers |

The Italy Freight Software Market is valued at approximately USD 270 million, reflecting a significant growth driven by the increasing demand for efficient logistics solutions and the rapid expansion of e-commerce in the region.