Region:Middle East

Author(s):Rebecca

Product Code:KRAA0325

Pages:80

Published On:August 2025

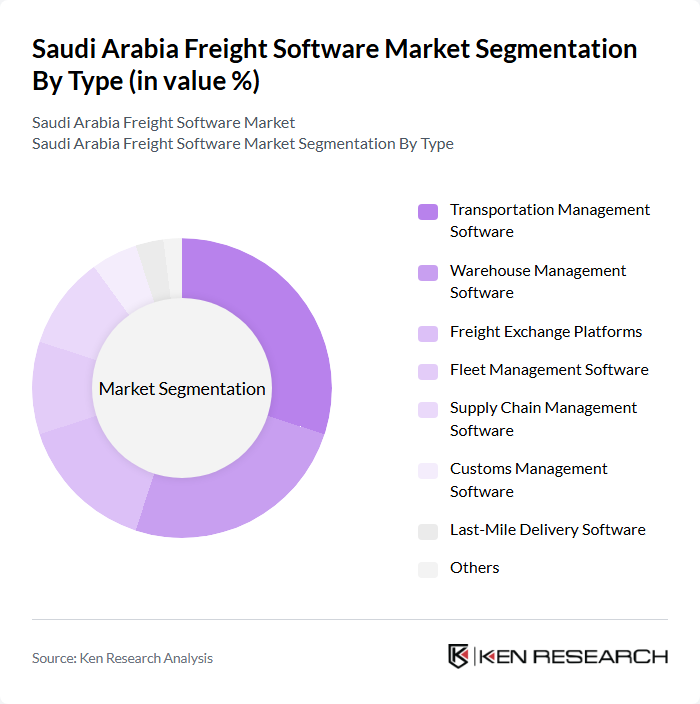

By Type:The freight software market can be segmented into various types, including Transportation Management Software, Warehouse Management Software, Freight Forwarding Software, Fleet Management Software, Customs Management Software, Last-Mile Delivery Software, and Others. Among these, Transportation Management Software is the most dominant segment, driven by the increasing need for efficient transportation solutions and real-time tracking capabilities. The growing e-commerce sector has also significantly contributed to the demand for Last-Mile Delivery Software, which is essential for ensuring timely deliveries to customers .

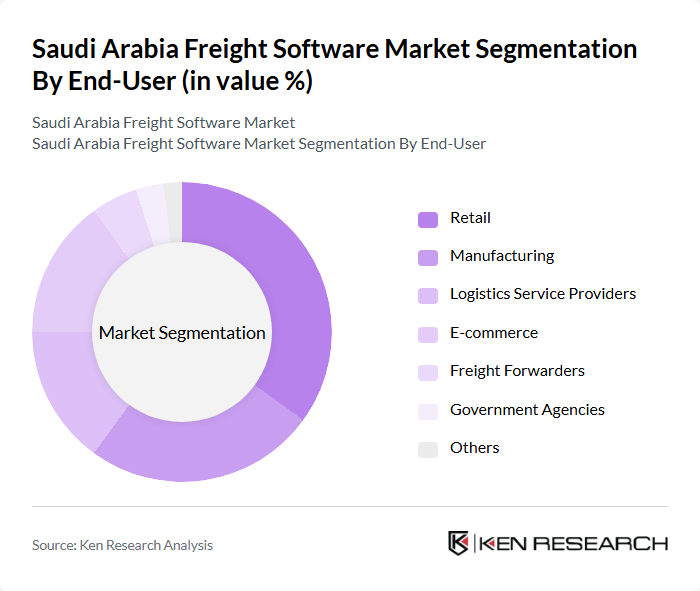

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Logistics Service Providers, Automotive, Oil & Gas, Healthcare & Pharmaceuticals, and Others. The Retail & E-commerce sector is the leading end-user, driven by the rapid growth of online shopping and the need for efficient logistics solutions to meet customer expectations. The Manufacturing sector also plays a significant role, as companies seek to optimize their supply chains and improve operational efficiency .

The Saudi Arabia Freight Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, Infor, Blue Yonder (formerly JDA Software), Manhattan Associates, Descartes Systems Group, WiseTech Global (CargoWise), Transporeon, Freightos, FourKites, Project44, Shipwell, Logiwa, Wared Logistics, Mosanada Logistics Services, Aramex, Kuehne + Nagel, FedEx Corporation, UPS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia freight software market appears promising, driven by technological advancements and increasing digital transformation initiatives. As businesses seek to enhance operational efficiency, the integration of AI and machine learning into freight software will become more prevalent. Additionally, the ongoing development of smart cities will create a conducive environment for innovative logistics solutions, further propelling the adoption of freight software across various sectors in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Forwarding Software Fleet Management Software Customs Management Software Last-Mile Delivery Software Others |

| By End-User | Retail & E-commerce Manufacturing Logistics Service Providers Automotive Oil & Gas Healthcare & Pharmaceuticals Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Functionality | Order Management Inventory Management Shipping Management Real-Time Tracking & Visibility Reporting and Analytics Route Optimization Others |

| By Industry Vertical | Automotive Pharmaceuticals Consumer Goods Electronics Food & Beverage Construction Oil & Gas Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Freight Management | 60 | Logistics Coordinators, Supply Chain Managers |

| Retail Logistics Software Adoption | 50 | IT Managers, Operations Directors |

| Manufacturing Supply Chain Solutions | 45 | Procurement Managers, Production Supervisors |

| Freight Forwarding Technology Trends | 55 | Business Development Managers, Technology Officers |

| Logistics Software Integration Challenges | 40 | Systems Analysts, Project Managers |

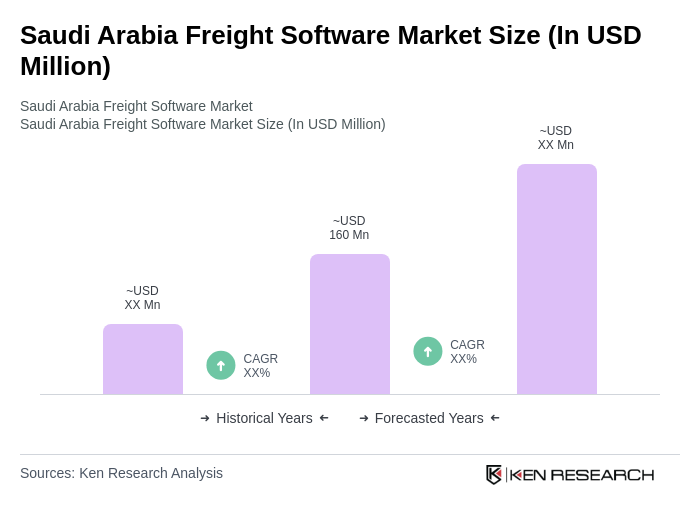

The Saudi Arabia Freight Software Market is valued at approximately USD 160 million, reflecting a significant growth driven by the increasing demand for efficient logistics solutions and the rise of e-commerce, supported by government initiatives under Vision 2030.