Region:Africa

Author(s):Dev

Product Code:KRAA0391

Pages:89

Published On:August 2025

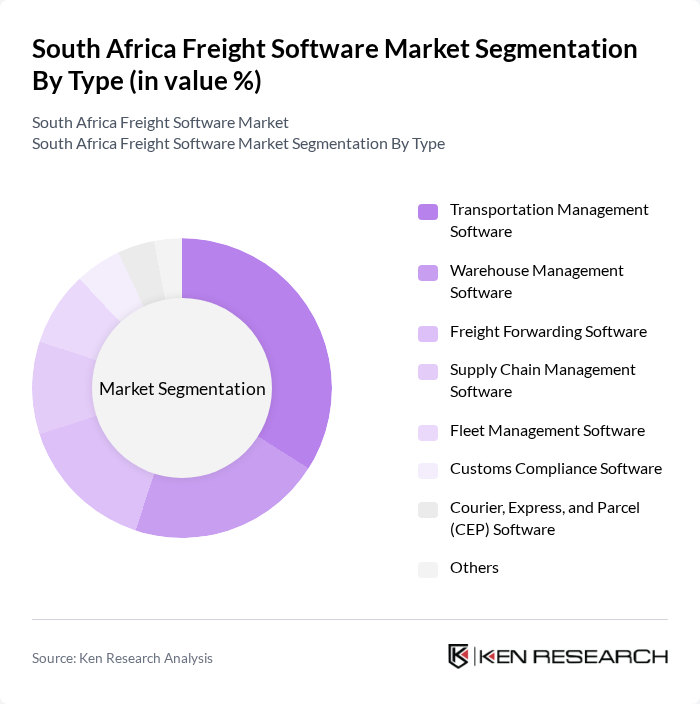

By Type:The freight software market is segmented into Transportation Management Software, Warehouse Management Software, Freight Forwarding Software, Supply Chain Management Software, Fleet Management Software, Customs Compliance Software, Courier, Express, and Parcel (CEP) Software, and Others. Transportation Management Software leads the segment due to its essential role in optimizing logistics operations, reducing costs, and improving service delivery. The increasing complexity of supply chains, demand for real-time visibility, and the integration of digital freight platforms are driving the adoption of these solutions .

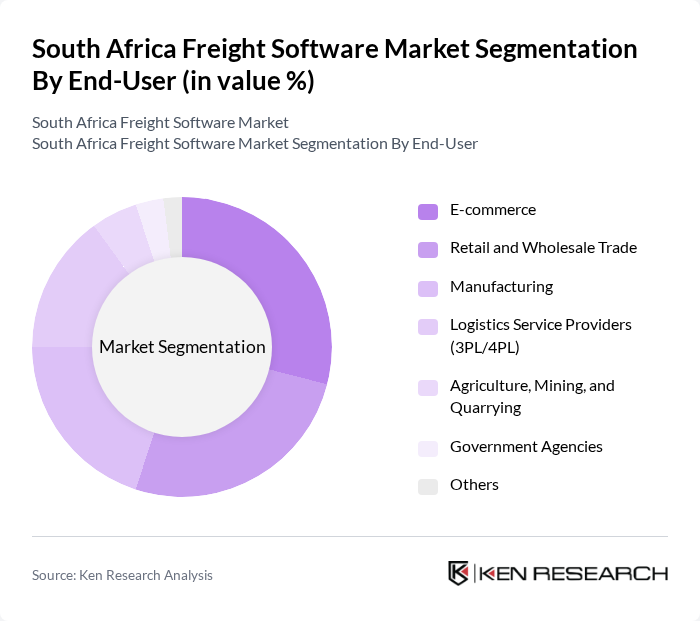

By End-User:The market is segmented by end-user into Retail and Wholesale Trade, Manufacturing, Logistics Service Providers (3PL/4PL), E-commerce, Agriculture, Mining, and Quarrying, Government Agencies, and Others. The E-commerce segment is currently the most dominant due to the rapid expansion of online shopping, which necessitates efficient logistics and delivery solutions. Retailers and logistics providers are increasingly investing in freight software to enhance supply chain capabilities and meet customer expectations for fast, transparent delivery .

The South Africa Freight Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as WiseTech Global (CargoWise), SAP SE, Oracle Corporation, Manhattan Associates, Descartes Systems Group, BluJay Solutions (now part of E2open), Freightos, Dovetail Business Solutions (South Africa), Strato IT Group (South Africa), Transnova (South Africa), FourKites, Project44, Kuebix (a Trimble company), Shipwell, and SMC³ contribute to innovation, geographic expansion, and service delivery in this space.

The South Africa freight software market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt cloud-based solutions, the demand for real-time tracking and user-friendly interfaces will rise. Additionally, sustainability initiatives will shape software development, pushing providers to integrate eco-friendly practices. The focus on AI and machine learning will enhance operational efficiency, enabling businesses to adapt to market changes swiftly and effectively, ensuring long-term growth and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Forwarding Software Supply Chain Management Software Fleet Management Software Customs Compliance Software Courier, Express, and Parcel (CEP) Software Others |

| By End-User | Retail and Wholesale Trade Manufacturing Logistics Service Providers (3PL/4PL) E-commerce Agriculture, Mining, and Quarrying Government Agencies Others |

| By Industry Vertical | Automotive Pharmaceuticals Consumer Goods Food and Beverage Electronics Oil and Gas Construction Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Mpumalanga Limpopo Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Functionality | Order Management Inventory Management Shipment Tracking Reporting and Analytics Customer Relationship Management Customs Documentation and Compliance Real-Time Visibility and Alerts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Management Software Users | 100 | Logistics Coordinators, IT Managers |

| Warehouse Management System Implementers | 60 | Warehouse Managers, Operations Directors |

| Transportation Management System Users | 70 | Supply Chain Analysts, Fleet Managers |

| Software Development Firms in Freight | 40 | Product Managers, Software Engineers |

| End-Users in E-commerce Logistics | 50 | eCommerce Managers, Fulfillment Supervisors |

The South Africa Freight Software Market is valued at approximately USD 1.1 billion, driven by the increasing demand for efficient logistics solutions, e-commerce growth, and advancements in technology such as cloud computing and artificial intelligence.