Region:Europe

Author(s):Dev

Product Code:KRAA7195

Pages:94

Published On:September 2025

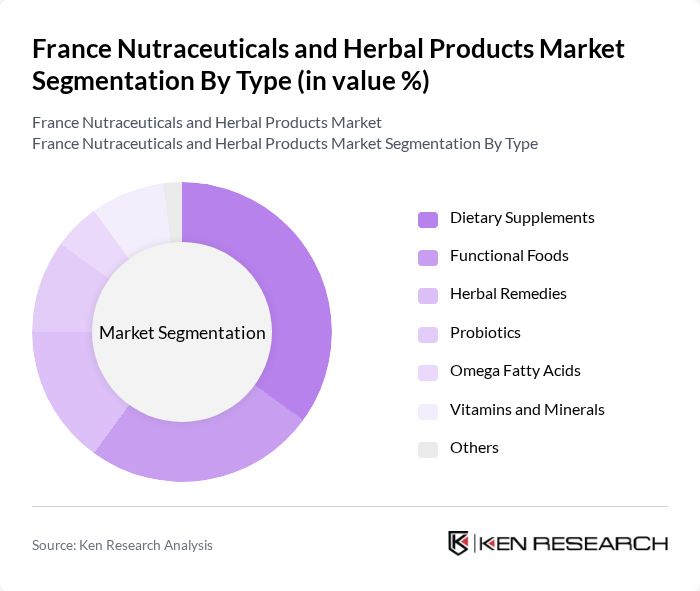

By Type:The nutraceuticals and herbal products market can be segmented into various types, including dietary supplements, functional foods, herbal remedies, probiotics, omega fatty acids, vitamins and minerals, and others. Among these, dietary supplements are currently the leading sub-segment, driven by increasing consumer awareness regarding health benefits and preventive healthcare. The demand for vitamins and minerals is also significant, as consumers seek to fill nutritional gaps in their diets. The trend towards natural and organic products has further propelled the growth of herbal remedies and probiotics, as consumers prefer products with fewer synthetic ingredients.

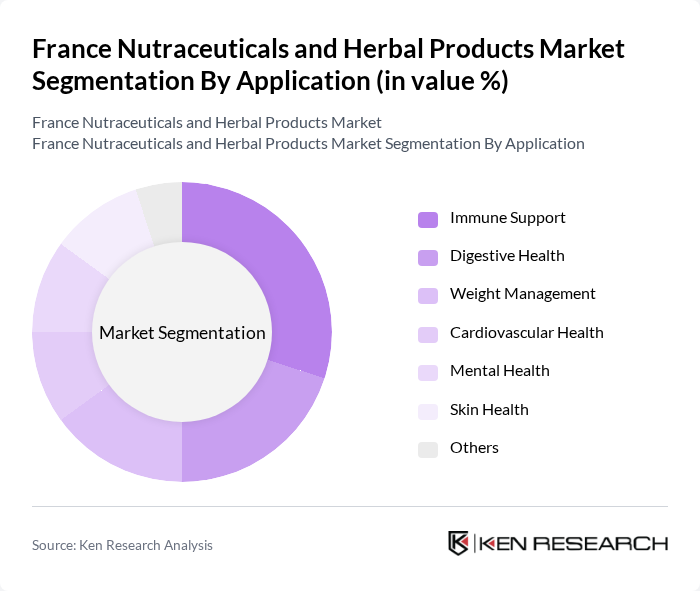

By Application:The applications of nutraceuticals and herbal products are diverse, including immune support, digestive health, weight management, cardiovascular health, mental health, skin health, and others. Immune support products are currently leading the market, particularly in light of recent global health concerns. Digestive health products are also gaining traction as consumers increasingly recognize the importance of gut health. The rising prevalence of lifestyle-related diseases has driven demand for weight management and cardiovascular health products, while mental health and skin health applications are emerging as significant growth areas.

The France Nutraceuticals and Herbal Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Nestlé S.A., Danone S.A., Arkopharma S.A., Solgar Inc., Nature's Way Products, LLC, DSM Nutritional Products, GNC Holdings, Inc., Amway Corporation, Swisse Wellness Pty Ltd., BioCare Copenhagen A/S, Herbalife Nutrition Ltd., Blackmores Limited, Usana Health Sciences, Inc., Nature's Bounty, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France nutraceuticals and herbal products market appears promising, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, companies are expected to leverage data analytics to tailor products to individual health needs. Additionally, the integration of digital health solutions will enhance consumer engagement, while sustainability practices in sourcing will resonate with environmentally conscious consumers, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dietary Supplements Functional Foods Herbal Remedies Probiotics Omega Fatty Acids Vitamins and Minerals Others |

| By Application | Immune Support Digestive Health Weight Management Cardiovascular Health Mental Health Skin Health Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Pharmacies Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Lifestyle Choices |

| By Packaging Type | Bottles Sachets Blister Packs Jars Others |

| By Brand Positioning | Premium Brands Mid-Range Brands Budget Brands |

| By Product Form | Tablets Capsules Powders Liquids Gummies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Herbal Supplements | 150 | Health-conscious Consumers, Nutrition Enthusiasts |

| Retail Distribution Channels for Nutraceuticals | 100 | Retail Managers, Category Buyers |

| Market Trends in Functional Foods | 80 | Food Scientists, Product Developers |

| Regulatory Impact on Herbal Products | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Consumer Awareness of Nutraceutical Benefits | 120 | General Consumers, Health Practitioners |

The France Nutraceuticals and Herbal Products Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by increasing health consciousness and a preference for natural and organic products among consumers.