Peru Nutraceuticals and Herbal Products Market Overview

- The Peru Nutraceuticals and Herbal Products Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rising trend towards preventive healthcare, and the growing popularity of natural and organic products. The market has seen a significant shift as consumers are increasingly opting for nutraceuticals and herbal products to enhance their overall well-being.

- Lima, Arequipa, and Trujillo are the dominant cities in the Peru Nutraceuticals and Herbal Products Market. Lima, being the capital and the largest city, serves as a major hub for distribution and retail, while Arequipa and Trujillo have seen a rise in health awareness and demand for natural products. The urban population in these cities is more inclined towards adopting healthier lifestyles, contributing to the market's growth.

- In 2023, the Peruvian government implemented regulations to enhance the quality and safety of nutraceuticals and herbal products. This includes mandatory labeling requirements and safety assessments for new products entering the market. The regulation aims to protect consumers and ensure that products meet established health standards, thereby fostering trust in the nutraceuticals sector.

Peru Nutraceuticals and Herbal Products Market Segmentation

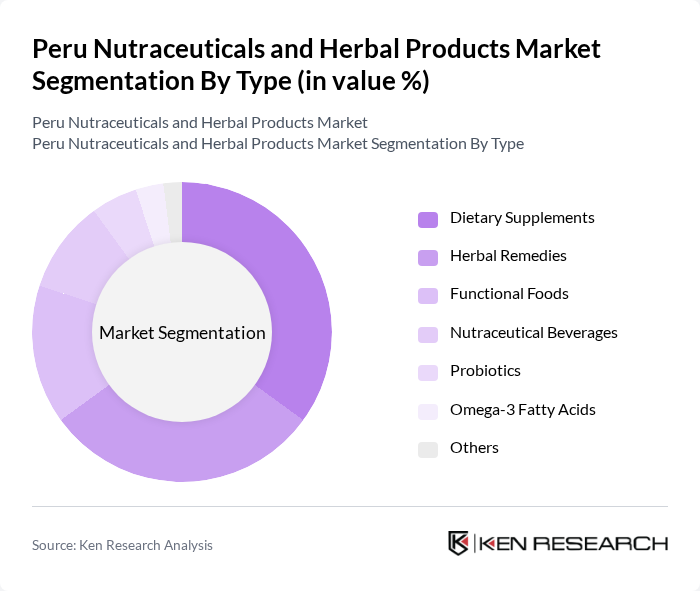

By Type:The market is segmented into various types, including Dietary Supplements, Herbal Remedies, Functional Foods, Nutraceutical Beverages, Probiotics, Omega-3 Fatty Acids, and Others. Among these, Dietary Supplements and Herbal Remedies are the most prominent segments, driven by consumer preferences for health maintenance and disease prevention. The increasing awareness of the benefits of these products has led to a surge in demand, particularly in urban areas.

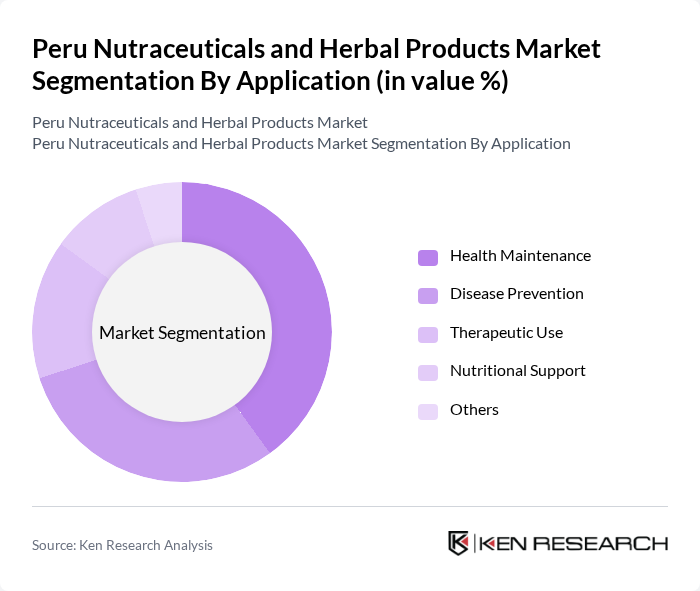

By Application:The applications of nutraceuticals and herbal products include Health Maintenance, Disease Prevention, Therapeutic Use, Nutritional Support, and Others. Health Maintenance and Disease Prevention are the leading applications, as consumers increasingly seek products that promote overall health and prevent illnesses. This trend is particularly evident among the aging population and health-conscious individuals.

Peru Nutraceuticals and Herbal Products Market Competitive Landscape

The Peru Nutraceuticals and Herbal Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nature's Way Products, LLC, NOW Foods, Solgar Inc., Garden of Life, LLC, Blackmores Limited, Herbalife Ltd., Usana Health Sciences, Inc., Swisse Wellness Pty Ltd., Nature's Bounty Co., MegaFood, New Chapter, Inc., Pure Encapsulations, LLC contribute to innovation, geographic expansion, and service delivery in this space.

Peru Nutraceuticals and Herbal Products Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Peruvian population is increasingly prioritizing health, with 60% of adults actively seeking healthier lifestyle choices. This trend is supported by a recent report from the Ministry of Health, indicating a 15% rise in health-related expenditures over the past two years. Additionally, the World Health Organization reported that 70% of Peruvians are now aware of the benefits of nutraceuticals, driving demand for herbal products and supplements that promote overall well-being.

- Rising Demand for Natural Products:The demand for natural and organic products in Peru has surged, with sales of herbal supplements increasing by 25% recently. According to the National Institute of Statistics and Informatics, 40% of consumers prefer natural remedies over synthetic alternatives. This shift is further supported by a growing trend towards sustainability, with 55% of consumers willing to pay more for eco-friendly products, thus enhancing the market for nutraceuticals and herbal offerings.

- Growth in Preventive Healthcare:Preventive healthcare is gaining traction in Peru, with the government investing approximately $250 million in health education programs recently. This initiative has led to a 30% increase in preventive health consultations, encouraging consumers to adopt nutraceuticals as part of their health regimen. The rising prevalence of lifestyle-related diseases, such as diabetes and hypertension, has further fueled interest in preventive solutions, driving the market for herbal products.

Market Challenges

- Regulatory Compliance Issues:The nutraceuticals market in Peru faces significant regulatory hurdles, with over 50% of companies reporting difficulties in meeting local health regulations. The Ministry of Health has implemented stringent guidelines, requiring extensive documentation and testing for product approval. This complexity can delay product launches and increase operational costs, hindering market growth and limiting the entry of new players into the sector.

- High Competition:The Peruvian nutraceuticals market is characterized by intense competition, with over 200 companies vying for market share. This saturation has led to aggressive pricing strategies, with some companies reducing prices by up to 20% to attract consumers. As a result, profit margins are under pressure, making it challenging for smaller firms to sustain operations and innovate, ultimately affecting the overall market dynamics.

Peru Nutraceuticals and Herbal Products Market Future Outlook

The future of the Peru nutraceuticals and herbal products market appears promising, driven by increasing health consciousness and a shift towards preventive healthcare. As consumers continue to seek natural alternatives, the market is likely to witness a surge in innovative product offerings. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, enabling companies to reach a broader audience. Strategic partnerships with local farmers can further enhance product quality and sustainability, positioning the market for robust growth.

Market Opportunities

- Expansion into Rural Markets:Rural areas in Peru present a significant opportunity, with approximately 30% of the population lacking access to quality nutraceuticals. Targeting these markets can increase sales by an estimated $60 million annually, as awareness of health benefits grows. Companies can leverage mobile health initiatives to educate consumers and promote product availability, tapping into an underserved demographic.

- Development of Innovative Products:There is a growing demand for innovative nutraceuticals, particularly those that cater to specific health needs. The market for personalized nutrition is projected to grow by $40 million in the near future. Companies that invest in research and development to create tailored products, such as supplements for immune support or digestive health, can capture a significant share of this emerging segment.