Region:Europe

Author(s):Rebecca

Product Code:KRAB4670

Pages:89

Published On:October 2025

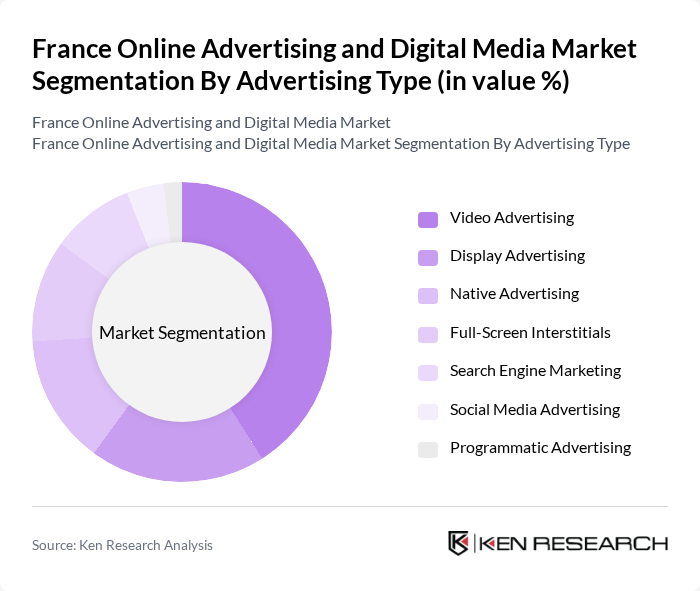

By Advertising Type:The advertising type segmentation includes various methods through which businesses engage consumers online. The subsegments are Video Advertising, Display Advertising, Native Advertising, Full-Screen Interstitials, Search Engine Marketing, Social Media Advertising, and Programmatic Advertising. Among these, Video Advertising has emerged as a dominant force, driven by the increasing consumption of video content across platforms like YouTube and social media. The engaging nature of video ads, combined with their ability to convey messages effectively, has made them a preferred choice for advertisers. Influencer marketing and content-driven campaigns are also gaining traction, leveraging high engagement rates and trust among French consumers .

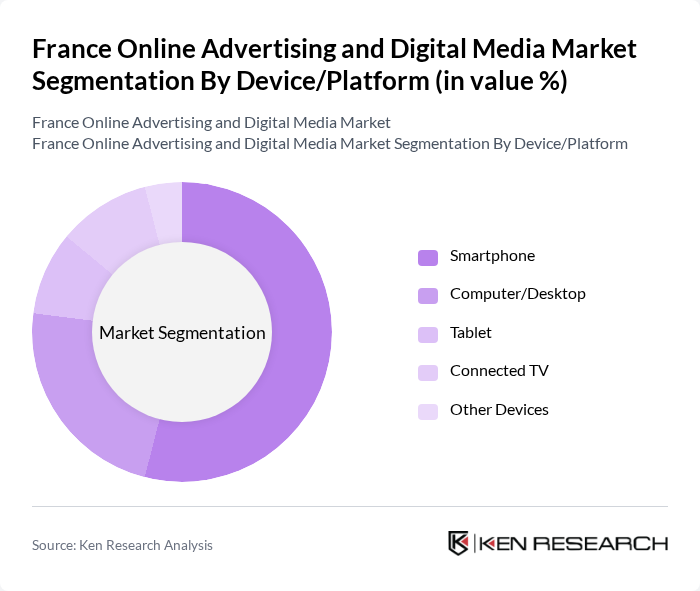

By Device/Platform:This segmentation focuses on the various devices and platforms used for online advertising. The subsegments include Smartphone, Computer/Desktop, Tablet, Connected TV, and Other Devices. Smartphones have become the leading platform for online advertising, accounting for a significant share of ad spend. The convenience and accessibility of mobile devices have led to a surge in mobile advertising, as consumers increasingly engage with brands through apps and mobile-optimized websites. Connected TV and tablet advertising are also experiencing growth, reflecting the diversification of digital media consumption in France .

The France Online Advertising and Digital Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alphabet Inc. (Google), Meta Platforms Inc. (Facebook/Instagram), Amazon.com Inc., Microsoft Corporation, ByteDance Ltd. (TikTok), X Corp. (formerly Twitter), Adobe Inc., Criteo S.A., Publicis Groupe S.A., Havas Group, Dentsu Aegis Network, Verizon Communications Inc., Tencent Holdings Ltd., Baidu Inc., AOL (Verizon Media) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online advertising and digital media market in France appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt data-driven strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Additionally, the growing emphasis on sustainability in marketing practices will shape advertising strategies, encouraging brands to align with eco-conscious consumers. This dynamic environment will foster innovation and adaptability, positioning the market for continued growth and transformation.

| Segment | Sub-Segments |

|---|---|

| By Advertising Type | Video Advertising Display Advertising Native Advertising Full-Screen Interstitials Search Engine Marketing Social Media Advertising Programmatic Advertising |

| By Device/Platform | Smartphone Computer/Desktop Tablet Connected TV Other Devices |

| By End-User Industry | Retail & E-commerce Automotive Travel and Tourism Financial Services Healthcare & Pharmaceuticals Technology & Telecommunications Media & Entertainment |

| By Advertising Format | Banner Ads Video Ads Rich Media Ads Sponsored Content Interactive Ads |

| By Pricing Model | Cost Per Click (CPC) Cost Per Mille (CPM) Cost Per Action (CPA) Cost Per View (CPV) Fixed Rate |

| By Customer Segment | B2B B2C C2C Others |

| By Policy Support | Subsidies for Digital Marketing Tax Incentives for Startups Grants for Innovation in Advertising Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 50 | Agency Executives, Media Planners |

| Brand Marketing Departments | 40 | Brand Managers, Marketing Directors |

| Consumer Insights and Analytics | 45 | Data Analysts, Market Researchers |

| Social Media Advertising | 60 | Social Media Managers, Content Strategists |

| Programmatic Advertising Platforms | 50 | Product Managers, Ad Tech Specialists |

The France Online Advertising and Digital Media Market is valued at approximately USD 13.9 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and the digitalization of businesses seeking effective consumer engagement through targeted online campaigns.