Region:Middle East

Author(s):Shubham

Product Code:KRAB4485

Pages:95

Published On:October 2025

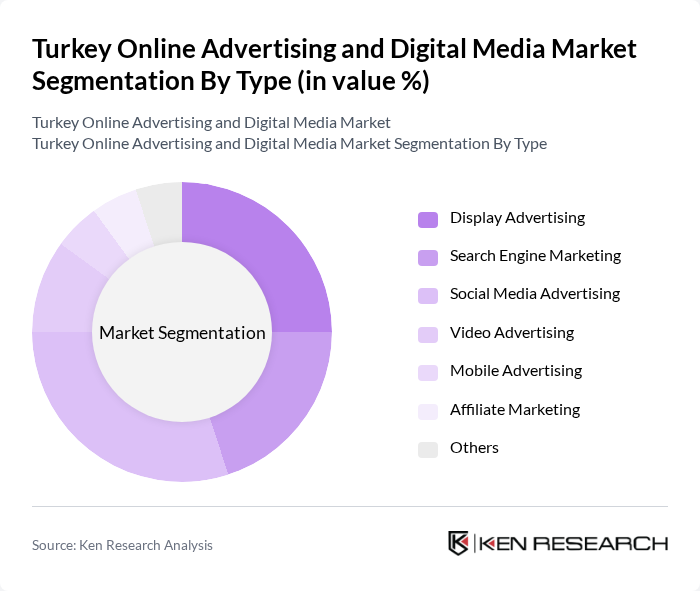

By Type:The market is segmented into various types of online advertising, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Mobile Advertising, Affiliate Marketing, and Others. Each of these segments plays a crucial role in shaping the overall market dynamics, with specific trends and consumer preferences influencing their growth.

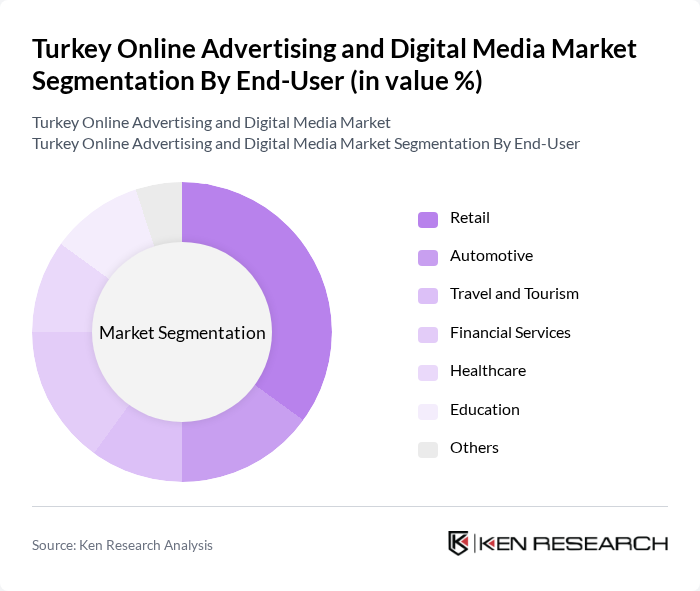

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Education, and Others. Each sector utilizes online advertising differently, with varying levels of investment and engagement based on their target audiences and marketing strategies.

The Turkey Online Advertising and Digital Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Facebook, Inc., Amazon Advertising, Yandex N.V., AdColony, Trendyol, Hepsiburada, Criteo S.A., Taboola, Outbrain, LinkedIn Corporation, Twitter, Inc., Snapchat, Inc., TikTok Inc., Pinterest, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's online advertising and digital media market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt programmatic advertising and leverage artificial intelligence, the efficiency and effectiveness of ad campaigns are expected to improve significantly. Additionally, the rise of immersive technologies, such as augmented reality, will create new avenues for engaging consumers. These trends indicate a dynamic market landscape, where innovation will play a crucial role in shaping advertising strategies and consumer interactions.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Mobile Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education Others |

| By Platform | Social Media Platforms Search Engines Websites Mobile Apps Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Product Launch Campaigns Seasonal Promotions Others |

| By Advertising Format | Text Ads Image Ads Video Ads Interactive Ads Others |

| By Customer Segment | B2B B2C C2C Others |

| By Budget Size | Small Budget Medium Budget Large Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising Insights | 100 | Social Media Managers, Digital Marketing Directors |

| Search Engine Marketing Strategies | 80 | SEO Specialists, PPC Campaign Managers |

| Content Marketing Effectiveness | 70 | Content Strategists, Brand Managers |

| Consumer Engagement Metrics | 90 | Market Researchers, Data Analysts |

| Digital Media Consumption Trends | 85 | Media Planners, Advertising Executives |

The Turkey Online Advertising and Digital Media Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and the digitalization trend among businesses seeking effective consumer engagement through targeted advertising strategies.