Region:Central and South America

Author(s):Shubham

Product Code:KRAB6547

Pages:86

Published On:October 2025

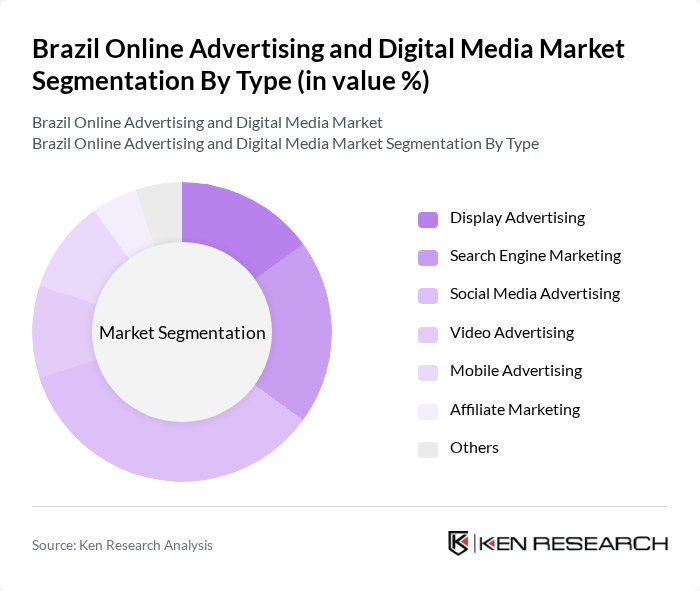

By Type:The online advertising market in Brazil is segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Mobile Advertising, Affiliate Marketing, and Others. Among these, Social Media Advertising has emerged as a dominant force, driven by the widespread use of platforms like Facebook, Instagram, and TikTok. Advertisers are increasingly leveraging these platforms to engage with consumers through targeted campaigns, making it a preferred choice for many brands.

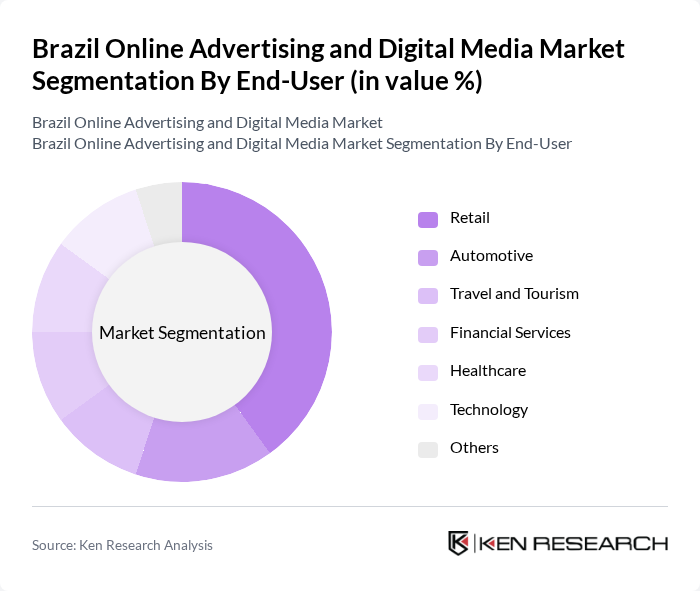

By End-User:The end-user segmentation of the online advertising market includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, and Others. The Retail sector is the leading end-user, as businesses increasingly turn to online advertising to drive sales and enhance customer engagement. The shift towards e-commerce has prompted retailers to invest heavily in digital marketing strategies to capture the attention of online shoppers.

The Brazil Online Advertising and Digital Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Globo, UOL (Universo Online), Facebook Brasil, Google Brasil, Mercado Livre, iFood, OLX Brasil, Magazine Luiza, Via Varejo, Cielo, Nubank, PagSeguro, Lojas Americanas, B2W Digital, Rappi contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian online advertising and digital media market is poised for dynamic growth, driven by technological advancements and evolving consumer behaviors. As brands increasingly adopt programmatic advertising and leverage data analytics, the efficiency of ad spend will improve. Additionally, the integration of AI and machine learning will enhance targeting capabilities, allowing for more personalized consumer experiences. The focus on sustainability in advertising will also shape strategies, as brands seek to align with consumer values and preferences in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Mobile Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Technology Others |

| By Platform | Social Media Platforms Search Engines Websites Mobile Apps Email Marketing Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Retargeting Campaigns Seasonal Promotions Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Geographic Targeting Contextual Targeting Others |

| By Budget Size | Small Budgets Medium Budgets Large Budgets Others |

| By Measurement Metrics | Click-Through Rate (CTR) Conversion Rate Return on Ad Spend (ROAS) Customer Acquisition Cost (CAC) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising | 150 | Social Media Managers, Digital Marketing Strategists |

| Search Engine Marketing | 100 | PPC Specialists, SEO Managers |

| Display Advertising | 80 | Media Buyers, Brand Managers |

| Content Marketing Strategies | 70 | Content Creators, Marketing Directors |

| Programmatic Advertising | 90 | Ad Tech Specialists, Data Analysts |

The Brazil Online Advertising and Digital Media Market is valued at approximately USD 10 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and the rise of e-commerce, which encourages businesses to invest more in online advertising strategies.