Region:Africa

Author(s):Shubham

Product Code:KRAB4491

Pages:89

Published On:October 2025

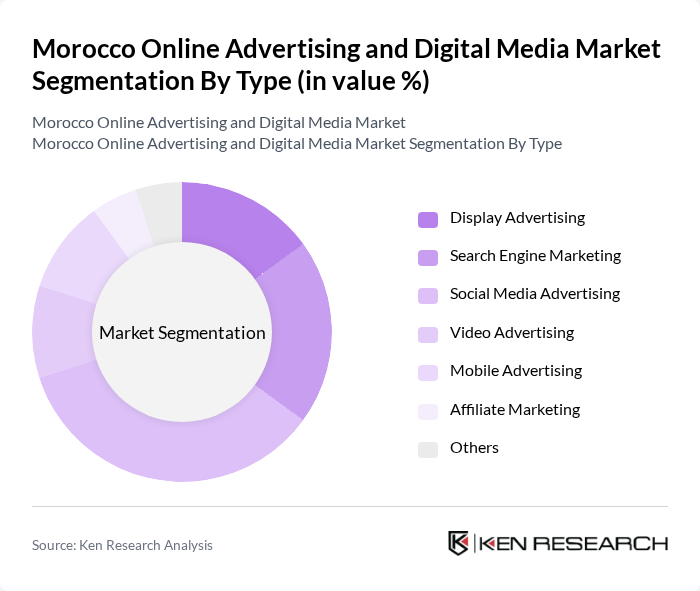

By Type:The market is segmented into various types of online advertising, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Mobile Advertising, Affiliate Marketing, and Others. Among these, Social Media Advertising has emerged as a dominant force, driven by the widespread use of platforms like Facebook, Instagram, and TikTok. Businesses are increasingly leveraging these platforms to reach targeted audiences effectively, resulting in higher engagement rates and return on investment.

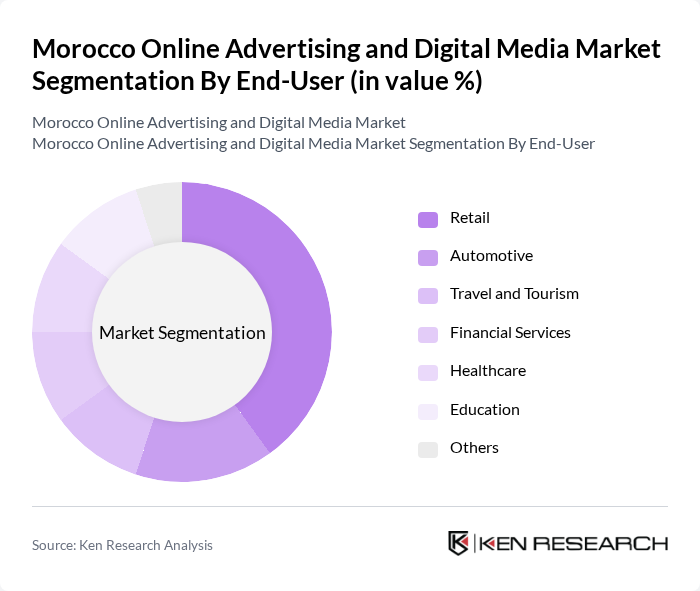

By End-User:The online advertising market is also segmented by end-user industries, including Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Education, and Others. The Retail sector leads the market, as e-commerce continues to grow in Morocco. Retailers are increasingly investing in online advertising to attract customers, promote their products, and enhance brand visibility, particularly through social media and search engine marketing.

The Morocco Online Advertising and Digital Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adwa Group, Digital Morocco, Webedia Morocco, Havas Morocco, DDB Morocco, Publicis Groupe Morocco, WPP Morocco, Ogilvy Morocco, M6 Publicité, Adcom Morocco, Kobalt Marketing, Adverty, Clicks Marketing, E-Advertising Morocco, MediaCom Morocco contribute to innovation, geographic expansion, and service delivery in this space.

The future of Morocco's online advertising and digital media market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves and more businesses embrace e-commerce, the demand for innovative advertising solutions will likely increase. Additionally, the integration of artificial intelligence and machine learning in advertising strategies is expected to enhance targeting and personalization, leading to more effective campaigns. Overall, the market is poised for significant growth, with new opportunities emerging in various digital channels.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Mobile Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education Others |

| By Platform | Social Media Platforms Search Engines Websites Mobile Apps Email Marketing Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Product Launch Campaigns Seasonal Promotions Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Geographic Targeting Contextual Targeting Others |

| By Budget Size | Small Budgets Medium Budgets Large Budgets Others |

| By Duration | Short-term Campaigns Long-term Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Digital Advertising Strategies | 150 | Marketing Managers, Business Owners |

| Consumer Engagement with Online Ads | 100 | General Consumers, Social Media Users |

| Trends in E-commerce Advertising | 80 | E-commerce Managers, Digital Marketing Specialists |

| Impact of Mobile Advertising | 70 | Mobile App Developers, Advertising Executives |

| Effectiveness of Social Media Campaigns | 90 | Social Media Managers, Content Creators |

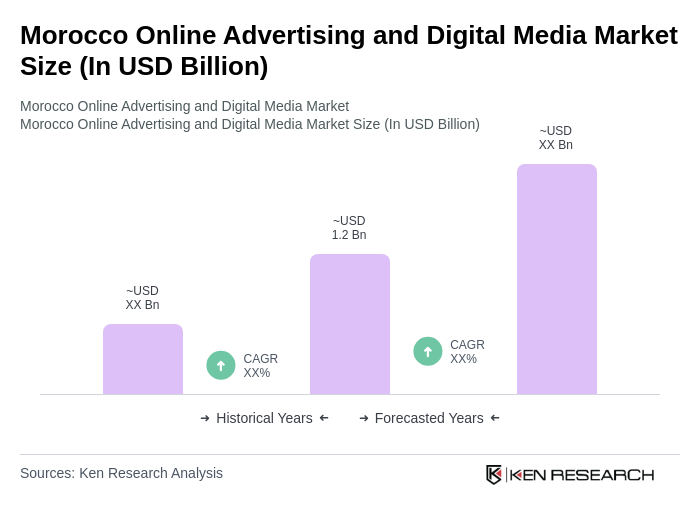

The Morocco Online Advertising and Digital Media Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, smartphone usage, and the digital transformation of businesses seeking effective consumer engagement through online platforms.