Region:Asia

Author(s):Shubham

Product Code:KRAB1261

Pages:88

Published On:October 2025

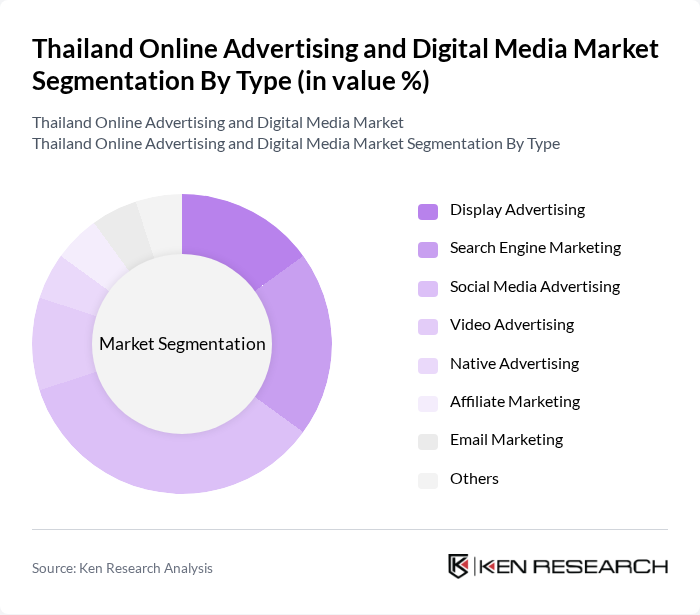

By Type:The market is segmented into Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, Email Marketing, and Others. Social Media Advertising is the leading segment, driven by the widespread use of platforms such as Facebook, Instagram, and TikTok. Advertisers leverage these platforms for targeted audience reach, high engagement rates, and measurable return on investment. Mobile and video advertising formats are experiencing robust growth, reflecting consumer preferences for engaging, mobile-first content .

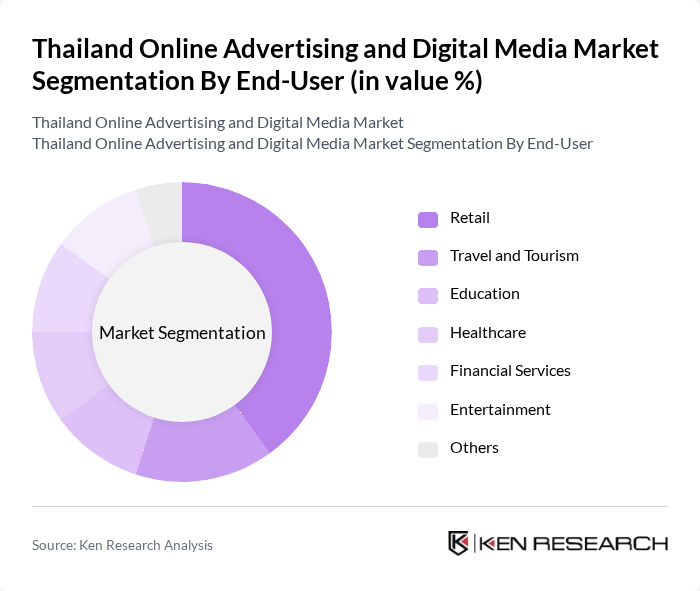

By End-User:The online advertising market is also segmented by end-users, including Retail, Travel and Tourism, Education, Healthcare, Financial Services, Entertainment, and Others. The Retail sector is the largest contributor, as businesses increasingly adopt digital marketing strategies to enhance online presence and drive sales. The rise of e-commerce and omnichannel retailing has accelerated demand for targeted online advertising, making it a critical component of retail marketing strategies. Travel and Tourism, Financial Services, and Entertainment also show strong adoption of digital campaigns to engage consumers .

The Thailand Online Advertising and Digital Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Thailand, Meta (Facebook & Instagram) Thailand, LINE Corporation, TikTok Thailand, AdAsia Holdings, Criteo, iProspect Thailand, Dentsu Thailand, Omnicom Media Group Thailand, GroupM Thailand, Havas Media Thailand, Publicis Groupe Thailand, VGI Global Media, The Trade Desk, Lazada Thailand, Agoda, Central Group, True Corporation, AIS, CP Group, Kasikorn Bank, Bangkok Bank, Thai Airways contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand online advertising and digital media market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt AI-driven solutions, the ability to personalize advertising will enhance engagement and conversion rates. Additionally, the integration of augmented reality in marketing campaigns is expected to create immersive experiences, attracting more consumers. These trends indicate a robust future for the industry, with continuous innovation shaping advertising strategies and consumer interactions.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Email Marketing Others |

| By End-User | Retail Travel and Tourism Education Healthcare Financial Services Entertainment Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Others |

| By Campaign Objective | Brand Awareness Campaigns Lead Generation Campaigns Customer Engagement Campaigns Sales Conversion Campaigns Others |

| By Advertising Format | Banner Ads Sponsored Content Influencer Marketing Email Marketing Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Others |

| By Pricing Model | Cost Per Click (CPC) Cost Per Impression (CPI) Cost Per Acquisition (CPA) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small Business Online Advertising | 100 | Business Owners, Marketing Managers |

| Corporate Digital Marketing Strategies | 80 | CMOs, Digital Marketing Directors |

| Consumer Engagement with Digital Media | 120 | General Consumers, Social Media Users |

| Trends in Mobile Advertising | 70 | Mobile App Developers, Advertising Executives |

| Impact of Video Content on Advertising | 90 | Content Creators, Brand Managers |

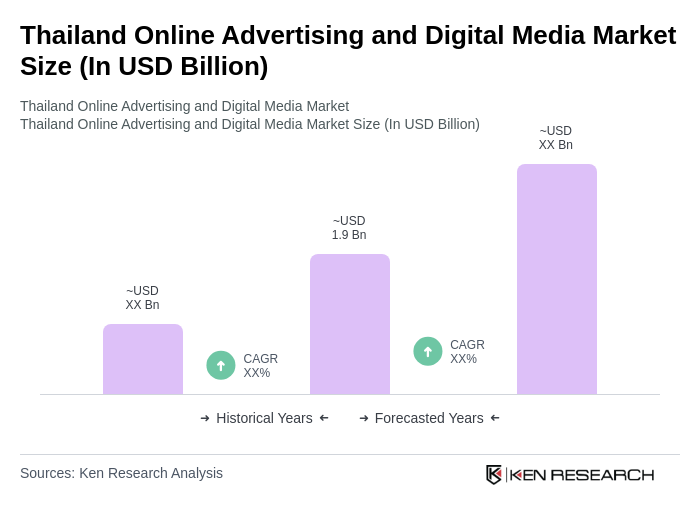

The Thailand Online Advertising and Digital Media Market is valued at approximately USD 1.9 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and the popularity of social media platforms.