France Online Loan and P2P Lending Platforms Market Overview

- The France Online Loan and P2P Lending Platforms Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for alternative financing solutions, particularly among consumers and small businesses seeking quick access to funds. The rise of digital platforms has facilitated easier loan applications and approvals, contributing to the market's expansion.

- Key cities such as Paris, Lyon, and Marseille dominate the market due to their high population density and economic activity. These urban centers are hubs for innovation and technology, attracting both borrowers and lenders. The concentration of financial services and a growing tech-savvy population further enhance the appeal of online lending platforms in these regions.

- In 2023, the French government implemented regulations to enhance consumer protection in the online lending sector. This includes mandatory transparency in loan terms and conditions, ensuring that borrowers are fully informed about interest rates and fees. Such regulations aim to foster trust in the P2P lending ecosystem and promote responsible lending practices.

France Online Loan and P2P Lending Platforms Market Segmentation

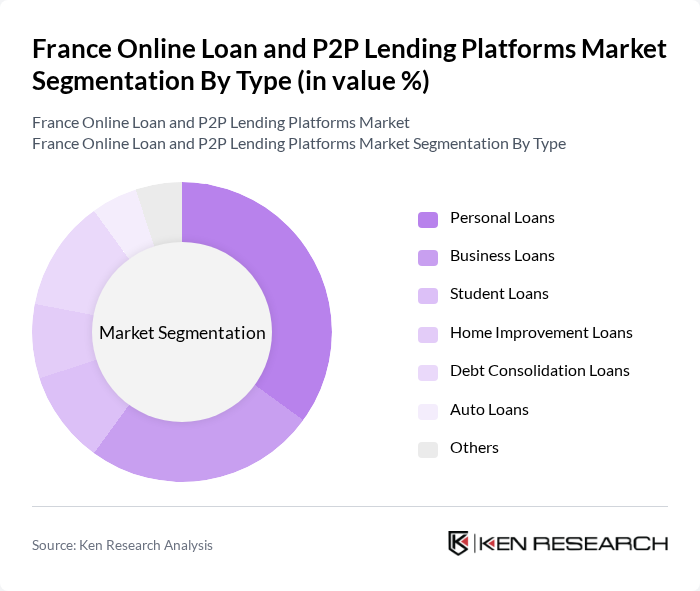

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, home improvement loans, debt consolidation loans, auto loans, and others. Personal loans are particularly popular due to their flexibility and ease of access, catering to a wide range of consumer needs. Business loans are also significant, driven by the increasing number of startups and SMEs seeking funding for growth and operations.

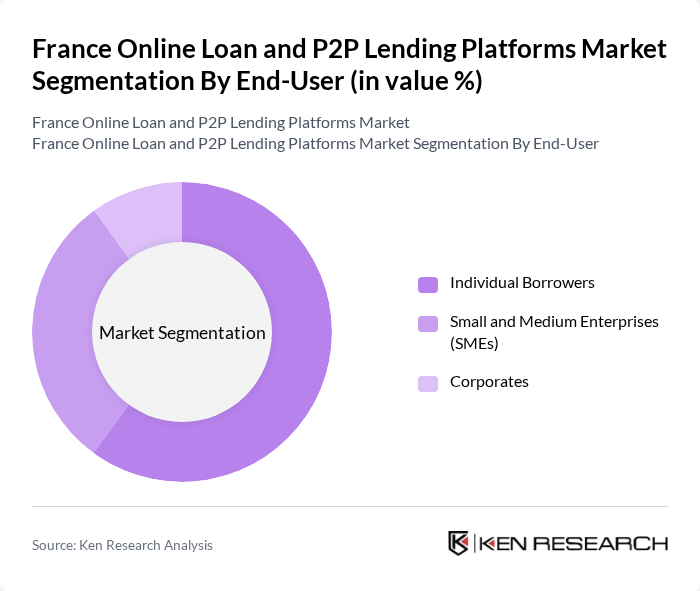

By End-User:The end-user segmentation includes individual borrowers, small and medium enterprises (SMEs), and corporates. Individual borrowers dominate the market, driven by the increasing need for personal financing options for various purposes such as home renovations, travel, and emergencies. SMEs are also a significant segment, as they often require quick access to funds for operational expenses and growth initiatives.

France Online Loan and P2P Lending Platforms Market Competitive Landscape

The France Online Loan and P2P Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Younited Credit, Pret d'Union, Lendix, October, Lendosphere, Unilend, Cashper, Prêt d'Union, Finexkap, WeShareBonds, Lendico, Credit.fr, Fundimmo, PretUp, Lendopolis contribute to innovation, geographic expansion, and service delivery in this space.

France Online Loan and P2P Lending Platforms Market Industry Analysis

Growth Drivers

- Increasing Demand for Alternative Financing:The demand for alternative financing in France has surged, with the online lending market reaching approximately €5.5 billion in future. This growth is driven by a significant number of small and medium-sized enterprises (SMEs) seeking quick access to funds, as traditional banks tighten lending criteria. In future, the number of online loan applications is projected to exceed 1.6 million, reflecting a shift towards more accessible financial solutions for both individuals and businesses.

- Rise of Digital Financial Services:The digital financial services sector in France is expected to grow by 13% annually, driven by increased smartphone penetration, which reached 87% in future. This trend facilitates the adoption of online loan platforms, allowing consumers to access loans conveniently. Additionally, the number of digital wallets in use has surpassed 22 million, indicating a growing comfort with online transactions and lending, further propelling the online loan market.

- Supportive Regulatory Environment:France's regulatory framework has evolved to support online lending, with the government implementing consumer protection laws that enhance transparency. In future, the French government allocated €350 million to promote fintech innovation, fostering a conducive environment for P2P lending platforms. This regulatory support is expected to attract more investors and borrowers, contributing to a projected increase in market activity by 16% in future.

Market Challenges

- High Competition Among Platforms:The online loan and P2P lending market in France is characterized by intense competition, with over 160 platforms vying for market share. This saturation leads to aggressive pricing strategies, which can erode profit margins. In future, the average interest rate for online loans was around 6.7%, but competition has driven some platforms to offer rates as low as 4.7%, impacting overall profitability and sustainability.

- Risk of Default by Borrowers:The risk of borrower default remains a significant challenge for online lending platforms. In future, the default rate for P2P loans in France was approximately 3.5%, which poses a financial risk to lenders. As economic conditions fluctuate, particularly with inflation projected to remain above 2.5% in future, platforms must enhance their credit assessment processes to mitigate potential losses from defaults.

France Online Loan and P2P Lending Platforms Market Future Outlook

The future of the online loan and P2P lending market in France appears promising, driven by technological advancements and evolving consumer preferences. As mobile lending solutions gain traction, platforms are expected to enhance user experiences through streamlined applications and faster approvals. Additionally, the integration of artificial intelligence in credit scoring will likely improve risk assessment, fostering greater trust among consumers. These trends indicate a robust growth trajectory for the market, with increasing participation from both borrowers and investors.

Market Opportunities

- Expansion into Underserved Regions:There is a significant opportunity for online lending platforms to expand into underserved regions in France, where traditional banking services are limited. Approximately 22% of rural areas lack access to conventional banking, presenting a market potential for online lenders to fill this gap and cater to local needs effectively.

- Development of Niche Lending Products:The development of niche lending products tailored to specific demographics, such as students or freelancers, can enhance market penetration. With over 2.2 million students in France, targeted loan products can address their unique financial needs, creating a lucrative segment for online lenders to explore and capitalize on.