Germany Online Loan and P2P Lending Platforms Market Overview

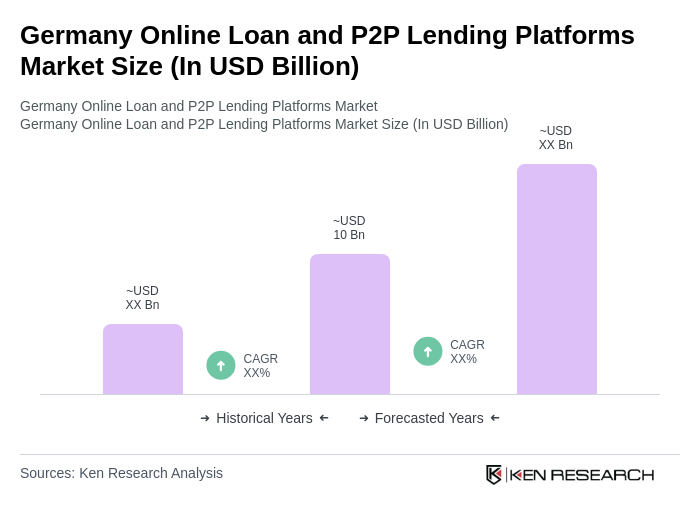

- The Germany Online Loan and P2P Lending Platforms Market is valued at USD 10 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for alternative lending solutions, and the growing trend of financial technology innovations that enhance user experience and accessibility.

- Key cities such as Berlin, Frankfurt, and Munich dominate the market due to their robust financial ecosystems, high concentration of tech startups, and a large pool of potential borrowers. These urban centers are also home to numerous fintech companies that facilitate peer-to-peer lending and online loan services, making them pivotal in shaping the market landscape.

- In 2023, the German government implemented regulations requiring all online lending platforms to adhere to strict consumer protection laws, including transparent disclosure of loan terms and interest rates. This regulation aims to enhance consumer trust and ensure fair lending practices across the industry, thereby fostering a more stable and reliable lending environment.

Germany Online Loan and P2P Lending Platforms Market Segmentation

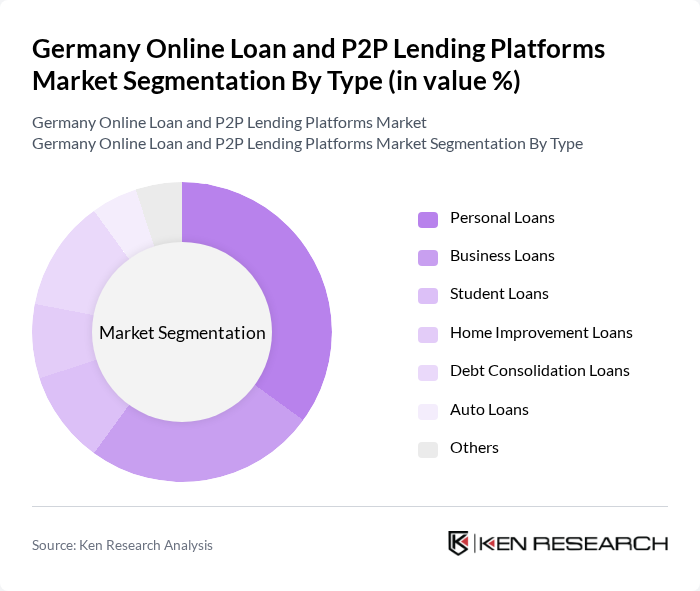

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, home improvement loans, debt consolidation loans, auto loans, and others. Personal loans are particularly popular due to their flexibility and ease of access, catering to a wide range of consumer needs. Business loans are also significant, driven by the increasing number of startups and SMEs seeking funding for growth and innovation.

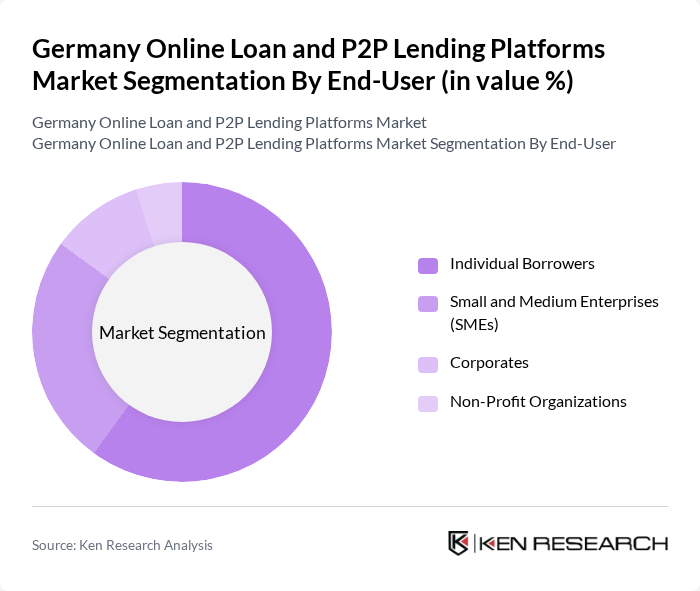

By End-User:The end-user segmentation includes individual borrowers, small and medium enterprises (SMEs), corporates, and non-profit organizations. Individual borrowers dominate the market, driven by the increasing need for personal financing solutions, while SMEs are also significant contributors as they seek accessible funding options to support their operations and growth.

Germany Online Loan and P2P Lending Platforms Market Competitive Landscape

The Germany Online Loan and P2P Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Auxmoney, Funding Circle, Smava, Lendico, Kapilendo, Mintos, Bondora, Kreditech, Viventor, PeerBerry, N26, Revolut, Kiva, Zencap, Lendico contribute to innovation, geographic expansion, and service delivery in this space.

Germany Online Loan and P2P Lending Platforms Market Industry Analysis

Growth Drivers

- Increasing Demand for Alternative Financing:The demand for alternative financing in Germany has surged, with the online lending market reaching approximately €7.8 billion in future. This growth is driven by a significant number of small and medium-sized enterprises (SMEs) seeking quick access to funds, as traditional banks often impose lengthy approval processes. In future, the number of online loan applications is projected to increase by 15%, reflecting a shift towards more accessible financial solutions for both consumers and businesses.

- Rise of Digital Financial Services:The digital financial services sector in Germany is expected to grow to €12.5 billion by future, fueled by advancements in technology and increased internet penetration. With over 95% of the population having access to the internet, online loan platforms are capitalizing on this trend. The convenience of digital transactions and the ability to compare loan options online are key factors driving consumer adoption of these services, leading to a projected 20% increase in user engagement on P2P lending platforms.

- Enhanced Consumer Awareness:Consumer awareness regarding online lending options has significantly improved, with 70% of Germans now familiar with P2P lending platforms. This increase in awareness is attributed to targeted marketing campaigns and educational initiatives by industry players. As consumers become more informed about the benefits of online loans, including lower interest rates and faster processing times, the market is expected to see a 10% rise in new users in future, further solidifying the position of online lending in the financial landscape.

Market Challenges

- Regulatory Compliance Costs:Regulatory compliance remains a significant challenge for online loan and P2P lending platforms in Germany. The costs associated with adhering to regulations, such as the implementation of the PSD2 directive, can exceed €1.2 million annually for mid-sized platforms. These financial burdens can limit the ability of smaller players to compete effectively, potentially stifling innovation and market growth as they struggle to allocate resources towards compliance rather than expansion.

- Competition from Traditional Banks:Traditional banks in Germany are increasingly entering the online lending space, leveraging their established customer bases and brand trust. In future, banks accounted for approximately 62% of the total lending market, posing a significant threat to P2P platforms. As banks enhance their digital offerings, the competitive landscape is expected to intensify, making it challenging for online lenders to differentiate themselves and capture market share in the coming years.

Germany Online Loan and P2P Lending Platforms Market Future Outlook

The future of the online loan and P2P lending market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms continue to innovate, the integration of AI and machine learning will enhance risk assessment and customer service. Additionally, the growing trend towards sustainable lending practices is likely to attract environmentally conscious borrowers. These factors, combined with a supportive regulatory environment, will foster a more competitive and dynamic market landscape, encouraging further growth and diversification in financial offerings.

Market Opportunities

- Expansion of Digital Platforms:The expansion of digital platforms presents a significant opportunity for growth, with an estimated 35% increase in user registrations expected by future. As more consumers seek convenient online solutions, platforms that enhance user experience and streamline application processes will likely capture a larger market share, driving overall industry growth.

- Collaboration with Financial Institutions:Collaborating with established financial institutions can provide P2P platforms with access to a broader customer base and additional resources. Partnerships are projected to increase by 30% in future, allowing for shared technology and risk management strategies, ultimately enhancing the credibility and reach of online lending services in Germany.