Region:Europe

Author(s):Shubham

Product Code:KRAB5567

Pages:80

Published On:October 2025

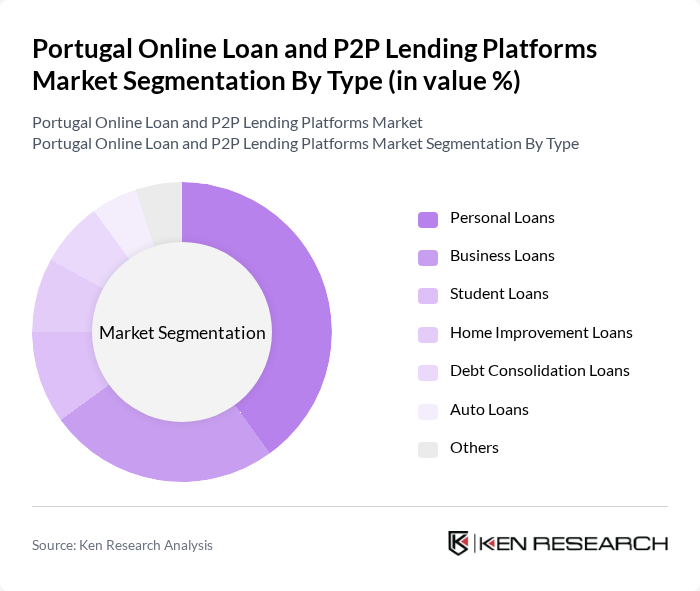

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, home improvement loans, debt consolidation loans, auto loans, and others. Each of these segments caters to different consumer needs and preferences, with personal loans being the most popular due to their versatility and ease of access.

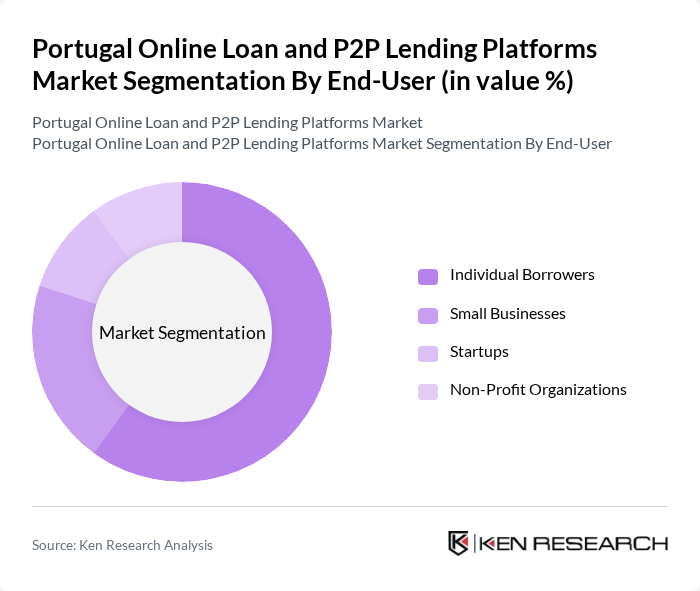

By End-User:The end-user segmentation includes individual borrowers, small businesses, startups, and non-profit organizations. Individual borrowers dominate the market, driven by the increasing need for personal financing solutions, while small businesses and startups are also significant contributors due to their reliance on external funding for growth and operations.

The Portugal Online Loan and P2P Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raize, PPLend, Mintos, Bondora, Lendico, Creditea, Unilend, Fellow Finance, BNI Europa, Lendico Portugal, Kiva, Funding Circle, PeerBerry, Younited Credit, Afluenta contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online loan and P2P lending market in Portugal appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy increases, more individuals are likely to embrace online lending solutions. Additionally, the integration of artificial intelligence in credit scoring is expected to enhance risk assessment, making lending more efficient. The market is also likely to see a rise in sustainable lending practices, aligning with global trends towards responsible finance and ethical investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Home Improvement Loans Debt Consolidation Loans Auto Loans Others |

| By End-User | Individual Borrowers Small Businesses Startups Non-Profit Organizations |

| By Loan Amount | Micro Loans Small Loans Medium Loans Large Loans |

| By Loan Duration | Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Interest Rate Type | Fixed Interest Rates Variable Interest Rates |

| By Platform Type | Online Marketplaces Direct Lending Platforms Hybrid Platforms |

| By Geographic Focus | Urban Areas Rural Areas Nationwide |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 150 | Individuals aged 25-45, Middle-income earners |

| Small Business Owners | 100 | Entrepreneurs, Business Managers |

| Financial Advisors | 80 | Investment Consultants, Financial Planners |

| P2P Lending Platform Users | 120 | Active users of P2P platforms, Tech-savvy individuals |

| Regulatory Experts | 50 | Policy Makers, Compliance Officers |

The Portugal Online Loan and P2P Lending Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing demand for digital financial services and peer-to-peer lending as an alternative to traditional banking.