France Residential Real Estate Market Overview

- The France Residential Real Estate Market is valued at approximately EUR 1.1 trillion, based on a five-year historical analysis. This valuation reflects stabilizing prices, a recent surge in transactions, and a strong demand for urban properties, particularly in Paris and other major cities . Growth is primarily driven by increasing urbanization, improved purchasing power due to lower interest rates, and a renewed focus on energy-efficient housing, which has encouraged both domestic and foreign investments in residential properties .

- Key cities dominating the market include Paris, Lyon, and Marseille. Paris remains a global hub for business and culture, attracting a diverse population and significant investment. Lyon is recognized for its economic dynamism and quality of life, while Marseille benefits from its strategic location as a Mediterranean port city, enhancing its appeal for residential developments .

- In 2023, the French government implemented the "Loi Climat et Résilience," mandating stricter energy efficiency standards for residential buildings. This regulation aims to reduce greenhouse gas emissions and promote sustainable living, impacting new constructions and renovations across the residential real estate sector. The market has responded with increased demand for properties featuring eco-friendly materials and energy-efficient appliances .

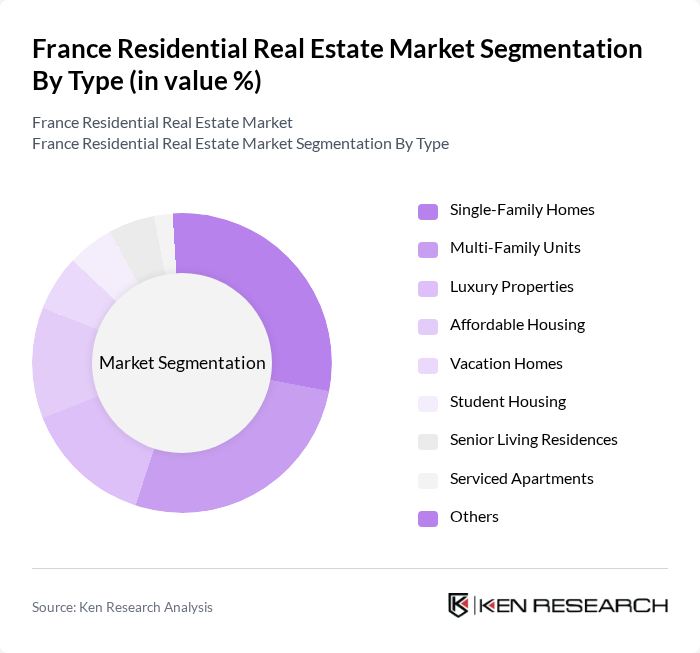

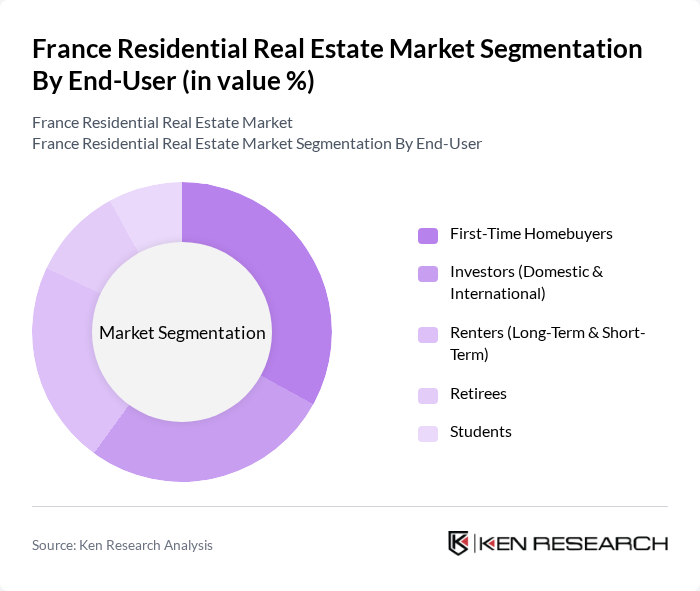

France Residential Real Estate Market Segmentation

By Type:The residential real estate market is segmented into Single-Family Homes, Multi-Family Units, Luxury Properties, Affordable Housing, Vacation Homes, Student Housing, Senior Living Residences, Serviced Apartments, and Others. Urban areas show the highest demand, especially for multi-family units and luxury properties, while affordable housing and senior living residences are increasingly prioritized due to demographic shifts and government incentives for sustainable development .

By End-User:The end-user segmentation includes First-Time Homebuyers, Investors (Domestic & International), Renters (Long-Term & Short-Term), Retirees, and Students. First-time homebuyers and investors remain the largest segments, driven by favorable financing conditions and a stable economic outlook. Demand for rental properties is sustained by urban migration and the growing student population, while retirees increasingly seek senior living residences and properties in quieter regions .

France Residential Real Estate Market Competitive Landscape

The France Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nexity, Bouygues Immobilier, Kaufman & Broad, Icade, Altarea Cogedim, Eiffage Immobilier, Sogeprom, Groupe Pichet, Les Nouveaux Constructeurs, Immobilière 3F, Promogim, Groupe Gambetta, Marignan, Vinci Immobilier, CDC Habitat, Foncia, Orpi, Century 21 France, La Française REM, Groupe Arcade-VYV contribute to innovation, geographic expansion, and service delivery in this space.

France Residential Real Estate Market Industry Analysis

Growth Drivers

- Urbanization Trends:France's urban population is projected to reach 81% by future, up from 80% in 2020, according to the World Bank. This urban migration drives demand for residential properties, particularly in metropolitan areas like Paris and Lyon. The influx of residents into cities increases the need for housing, leading to a surge in new construction projects. Additionally, urban areas are becoming more attractive due to improved infrastructure and amenities, further fueling residential real estate growth.

- Low-Interest Rates:The European Central Bank's interest rates are expected to remain low, around 0.5% in future, encouraging borrowing for home purchases. This favorable lending environment has led to a significant increase in mortgage approvals, with over 1.2 million loans granted in recent periods. Lower borrowing costs make homeownership more accessible, stimulating demand in the residential real estate market. Consequently, this trend is expected to continue driving property sales and investments in the coming years.

- Government Incentives for Homebuyers:The French government has introduced various incentives to promote homeownership, including the zero-interest loan (PTZ) program, which has allocated €1.5 billion for future. This initiative aims to assist first-time buyers, particularly in rural areas, by providing financial support. Additionally, tax reductions for new builds and renovations are expected to further stimulate the market. These measures are crucial in making housing more affordable and accessible, thus driving market growth.

Market Challenges

- High Property Prices:The average property price in France reached €3,100 per square meter in recent periods, a significant increase from €2,900 in 2020. This surge in prices poses a challenge for potential buyers, particularly first-time homeowners. The high cost of living in urban areas exacerbates the affordability crisis, making it difficult for many to enter the housing market. As a result, this trend may lead to a slowdown in sales and increased demand for rental properties.

- Regulatory Hurdles:The French residential real estate market faces numerous regulatory challenges, including stringent zoning laws and lengthy approval processes for new developments. In recent periods, it took an average of over 12 months to obtain building permits in urban areas, according to government statistics. These delays can hinder the timely delivery of new housing projects, exacerbating the existing supply shortage. Consequently, developers may be discouraged from investing in new projects, limiting market growth potential.

France Residential Real Estate Market Future Outlook

The France residential real estate market is poised for continued evolution, driven by urbanization and changing consumer preferences. As remote work becomes more prevalent, demand for larger homes in suburban areas is expected to rise. Additionally, the focus on energy-efficient housing will likely shape new developments, aligning with environmental regulations. The market will also see increased investment in smart home technologies, enhancing living experiences. Overall, these trends indicate a dynamic landscape that will adapt to the needs of modern residents.

Market Opportunities

- Growth in Rental Market:With property prices soaring, the rental market is expected to thrive, particularly in urban centers. In recent periods, rental demand surged by 15%, driven by young professionals seeking affordable housing options. This trend presents opportunities for investors to capitalize on the growing need for rental properties, especially in high-demand areas, ensuring steady returns on investment.

- Investment in Renovation Projects:The French government has allocated €2 billion for renovation projects aimed at improving energy efficiency in existing homes. This initiative is expected to create a surge in demand for renovation services, providing opportunities for contractors and developers. As homeowners seek to upgrade their properties, the renovation market will play a crucial role in enhancing property values and sustainability.