Region:Middle East

Author(s):Shubham

Product Code:KRAD0789

Pages:86

Published On:August 2025

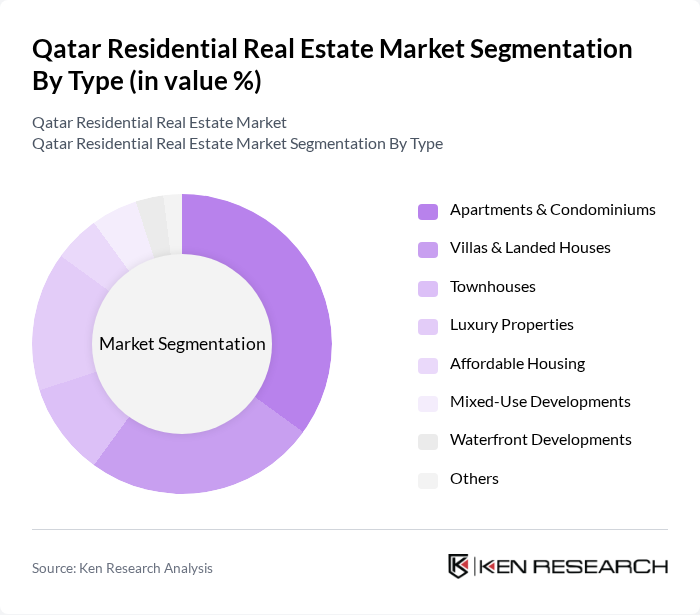

By Type:The residential real estate market in Qatar is segmented into apartments and condominiums, villas and landed houses, townhouses, luxury properties, affordable housing, mixed-use developments, waterfront developments, and others. Apartments and condominiums remain the most popular choice, driven by affordability, proximity to urban amenities, and strong rental demand among expatriates. Villas and landed houses are experiencing the fastest growth, fueled by high-net-worth individuals and families seeking larger living spaces. The demand for luxury properties continues to rise, supported by affluent expatriates and local buyers seeking premium experiences. Mixed-use and waterfront developments are gaining traction due to their integrated lifestyle offerings and strategic locations.

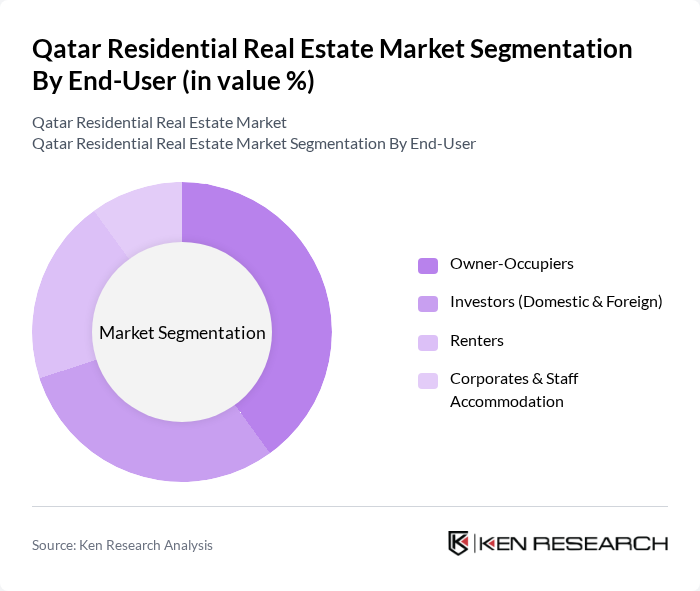

By End-User:The end-user segmentation of the residential real estate market includes owner-occupiers, domestic and foreign investors, renters, and corporates/staff accommodation. Owner-occupiers form a substantial segment, driven by local families and expatriates seeking long-term housing. Investors are increasingly active, attracted by favorable regulations and strong returns, while renters continue to seek affordable options in urban centers. Corporates and staff accommodation remain significant, supporting workforce housing needs in key business districts.

The Qatar Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatari Diar Real Estate Investment Company, Barwa Real Estate Group, United Development Company (UDC), Ezdan Holding Group, Al Bandary Real Estate, Al Jazeera Real Estate Investment, Mazaya Qatar Real Estate Development, Qatar Real Estate Investment Company (Alaqaria), Al Asmakh Real Estate Development Company, The Pearl-Qatar (Developed by UDC), Qatari Investors Group Real Estate, Al Fardan Properties, Just Real Estate, Regency Real Estate, SAK Holding Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's residential real estate market appears promising, driven by ongoing economic diversification and urbanization trends. As the population continues to grow, the demand for affordable housing and innovative living solutions will likely increase. Additionally, the integration of smart technologies and sustainable practices in new developments is expected to shape the market landscape. With government support for infrastructure and housing initiatives, the sector is poised for resilience and adaptability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments & Condominiums Villas & Landed Houses Townhouses Luxury Properties Affordable Housing Mixed-Use Developments Waterfront Developments Others |

| By End-User | Owner-Occupiers Investors (Domestic & Foreign) Renters Corporates & Staff Accommodation |

| By Price Range | Below QAR 1 Million QAR 1 Million - QAR 3 Million QAR 3 Million - QAR 5 Million Above QAR 5 Million |

| By Location | Doha Al Rayyan Lusail The Pearl-Qatar Al Wakrah Al Khor Others |

| By Development Stage | Pre-Construction (Off-plan) Under Construction Completed |

| By Financing Type | Mortgage Financing Cash Purchases Developer/Structured Financing |

| By Property Management Type | Self-Managed Professionally Managed REITs & Institutional Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time homebuyers, Investors |

| Rental Market Participants | 80 | Tenants, Landlords |

| Real Estate Developers | 50 | Project Managers, Development Managers |

| Real Estate Agents | 40 | Sales Agents, Brokers |

| Government Housing Officials | 40 | Policy Makers, Urban Planners |

The Qatar Residential Real Estate Market is valued at approximately USD 13.45 billion, reflecting significant growth driven by urbanization, infrastructure investments, and a rising expatriate population seeking housing solutions.