Region:Europe

Author(s):Dev

Product Code:KRAB3029

Pages:92

Published On:October 2025

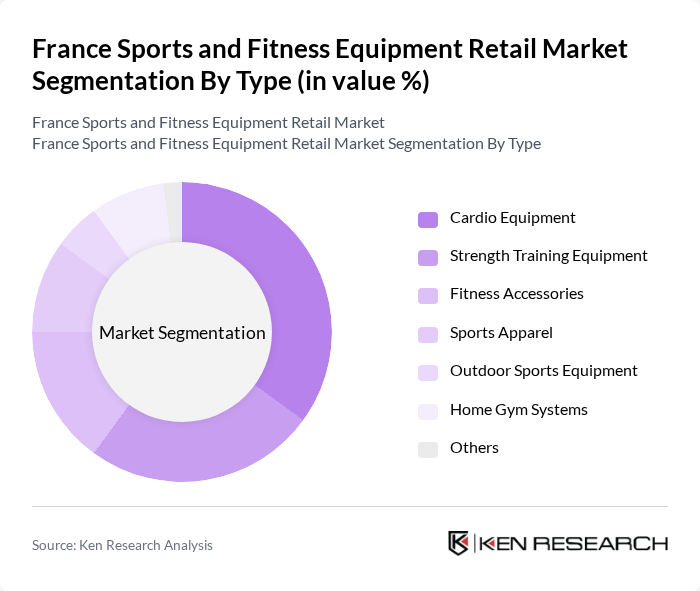

By Type:The market is segmented into various types of sports and fitness equipment, including cardio equipment, strength training equipment, fitness accessories, sports apparel, outdoor sports equipment, home gym systems, and others. Among these, cardio equipment has emerged as the leading segment due to the growing popularity of cardiovascular exercises and the increasing number of individuals engaging in home workouts. The trend towards home fitness solutions has further propelled the demand for this category, as consumers seek effective ways to maintain their fitness routines without the need for gym memberships.

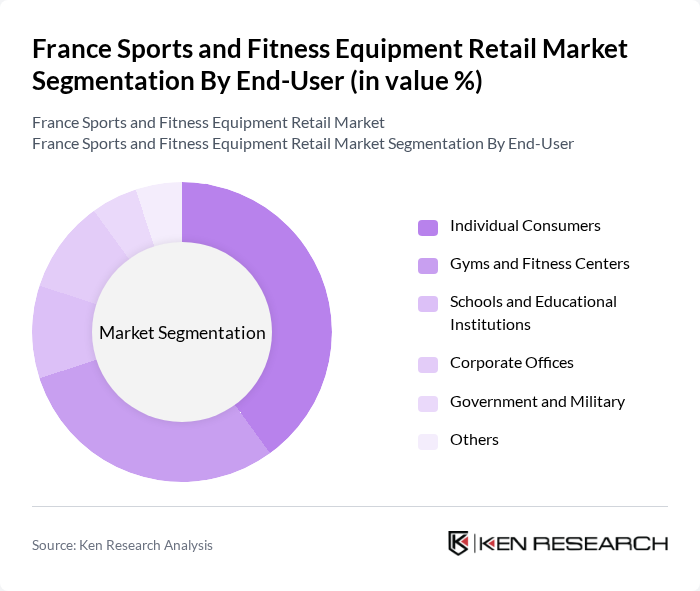

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and educational institutions, corporate offices, government and military, and others. Individual consumers represent the largest segment, driven by the increasing trend of personal fitness and the growing number of people investing in home gym setups. The rise of online fitness communities and social media influencers promoting fitness has also encouraged more individuals to purchase equipment for personal use, leading to a significant market share for this segment.

The France Sports and Fitness Equipment Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon S.A., Go Sport S.A., Intersport France, Fitness Boutique, Amazon.fr, Sport 2000, Boulanger S.A., Cultura S.A., Darty S.A., Decathlon Pro, Sport Leader, Fitness Park, L'Usine à Chapeaux, Kettler France, Domyos contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France sports and fitness equipment retail market appears promising, driven by ongoing trends in health consciousness and technological integration. As consumers increasingly seek personalized fitness solutions, retailers are expected to innovate and diversify their product offerings. Additionally, the rise of subscription-based services and digital fitness platforms will likely reshape consumer engagement, providing opportunities for growth. Companies that adapt to these trends while addressing economic challenges will be well-positioned for success in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cardio Equipment Strength Training Equipment Fitness Accessories Sports Apparel Outdoor Sports Equipment Home Gym Systems Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Educational Institutions Corporate Offices Government and Military Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Direct Sales Distributors and Wholesalers Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Brand | National Brands Private Labels International Brands Emerging Brands |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models Others |

| By Application | Home Use Commercial Use Institutional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Cardio Equipment | 150 | Store Managers, Sales Representatives |

| Strength Training Equipment Purchases | 100 | Fitness Equipment Buyers, Gym Owners |

| Consumer Preferences for Fitness Accessories | 80 | Fitness Enthusiasts, Personal Trainers |

| Market Trends in Home Fitness Solutions | 120 | Home Gym Users, Fitness Influencers |

| Impact of E-commerce on Sports Equipment Sales | 90 | E-commerce Managers, Digital Marketing Specialists |

The France Sports and Fitness Equipment Retail Market is valued at approximately USD 10 billion, reflecting a significant growth trend driven by increasing health consciousness, fitness trends, and the expansion of e-commerce platforms facilitating access to fitness products.