Region:Middle East

Author(s):Shubham

Product Code:KRAA0744

Pages:87

Published On:August 2025

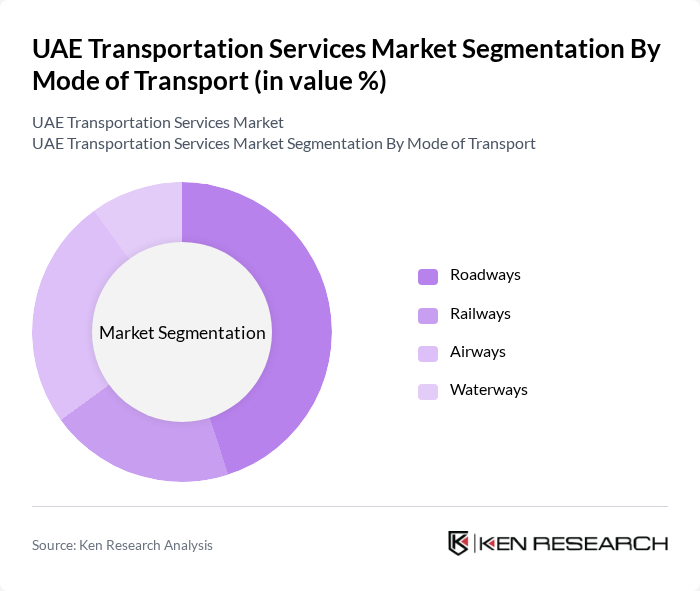

By Mode of Transport:The transportation services market can be segmented into four primary modes: Roadways, Railways, Airways, and Waterways. Each mode plays a crucial role in the overall transportation ecosystem, catering to different needs and preferences of consumers and businesses. Roadways remain the dominant mode due to the UAE's extensive road infrastructure and the high volume of both passenger and freight movement. Railways are expanding, supported by national projects such as Etihad Rail, while airways and waterways are vital for international connectivity and trade .

The Roadways segment is the dominant mode of transport in the UAE Transportation Services Market, accounting for a significant share. This is largely due to the extensive road network and the high reliance on road transport for both passenger and freight movement. The convenience and flexibility offered by road transport make it the preferred choice for many consumers and businesses, especially for last-mile delivery services. Additionally, the growth of e-commerce and the introduction of electric and autonomous trucks have further boosted the demand for road transportation services .

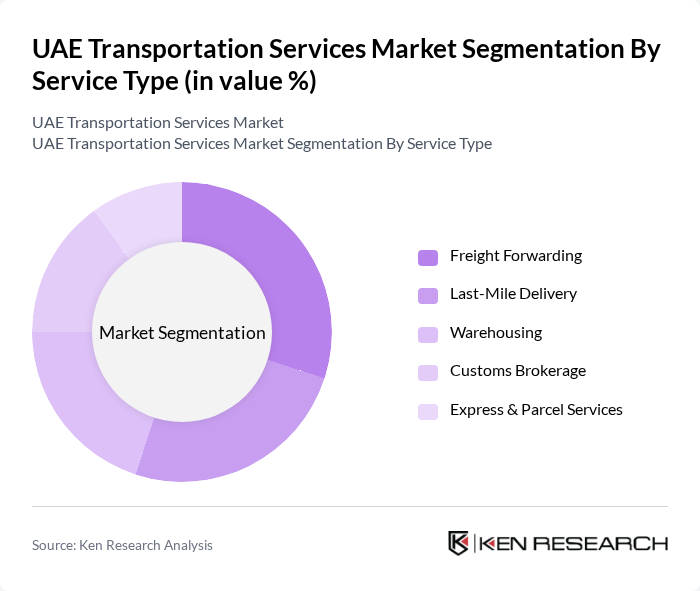

By Service Type:The market can also be segmented based on service types, including Freight Forwarding, Last-Mile Delivery, Warehousing, Customs Brokerage, and Express & Parcel Services. Each service type addresses specific logistical needs and contributes to the overall efficiency of transportation services. Freight Forwarding leads due to the UAE's role as a re-export hub and the high volume of international trade, while Last-Mile Delivery is rapidly growing with the expansion of e-commerce and digital retail channels .

Among the service types, Freight Forwarding leads the market due to the increasing volume of international trade and the need for efficient logistics solutions. The growth of e-commerce has also significantly contributed to the demand for Last-Mile Delivery services, as businesses seek to provide faster and more reliable delivery options to consumers. The integration of technology in logistics operations, such as real-time tracking and digital platforms, is further enhancing service efficiency and customer satisfaction .

The UAE Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Transport, Careem, Uber, Dubai Taxi Corporation, Aramex, Etihad Rail, DP World, Emirates Logistics, Agility Logistics, DHL Global Forwarding, FedEx Express, Al-Futtaim Logistics, Al Naboodah Group, Al Ain Transport, Transguard Group contribute to innovation, geographic expansion, and service delivery in this space.

The UAE transportation services market is poised for significant transformation, driven by technological advancements and a focus on sustainability. As urbanization continues, the demand for efficient public transport and smart mobility solutions will rise. The integration of digital payment systems and the adoption of electric vehicles will reshape the landscape, enhancing service efficiency and reducing environmental impact. Additionally, the growth of e-commerce will necessitate innovative logistics solutions, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Roadways Railways Airways Waterways |

| By Service Type | Freight Forwarding Last-Mile Delivery Warehousing Customs Brokerage Express & Parcel Services |

| By End-User | Individual Consumers Businesses Government Agencies Tourists |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) |

| By Vehicle Type | Buses Trucks Vans Motorcycles Cars |

| By Payment Method | Cash Credit/Debit Cards Mobile Payments Subscriptions |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Corporate Clients Government Contracts Retail Customers Event Organizers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Services | 60 | Transport Authority Officials, Public Transit Managers |

| Logistics and Freight Services | 55 | Logistics Managers, Freight Managers |

| Ride-Hailing Services | 45 | Operations Managers, Customer Experience Leads |

| Last-Mile Delivery Solutions | 40 | Delivery Managers, Supply Chain Analysts |

| Infrastructure Development Projects | 40 | Project Managers, Urban Planners |

The UAE Transportation Services Market is valued at approximately USD 54.5 billion, driven by rapid urbanization, increased tourism, and significant investments in infrastructure development. This growth reflects the UAE's strategic positioning as a global trade hub.