Region:Europe

Author(s):Shubham

Product Code:KRAA0828

Pages:80

Published On:August 2025

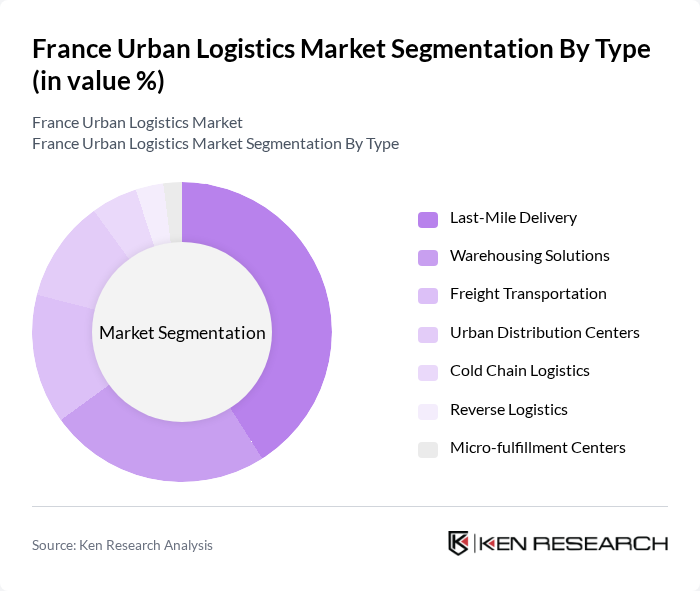

By Type:The urban logistics market is segmented into Last-Mile Delivery, Warehousing Solutions, Freight Transportation, Urban Distribution Centers, Cold Chain Logistics, Reverse Logistics, and Micro-fulfillment Centers. Last-Mile Delivery remains the most significant segment, driven by the surge in e-commerce and consumer demand for rapid, flexible delivery services. The adoption of automation, real-time tracking, and electric vehicles is enhancing the efficiency and sustainability of last-mile operations. Warehousing Solutions are evolving with the integration of smart technologies and urban micro-fulfillment centers, supporting faster order processing and inventory management. Freight Transportation and Urban Distribution Centers play a pivotal role in optimizing intra-city and inter-city flows, while Cold Chain Logistics is gaining importance for food and pharmaceutical deliveries. Reverse Logistics and Micro-fulfillment Centers are emerging segments, reflecting the growing need for returns management and hyperlocal fulfillment .

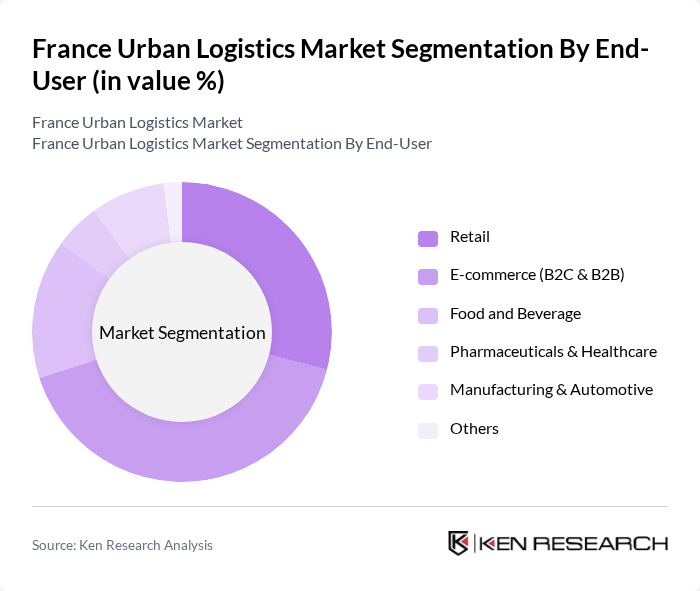

By End-User:The urban logistics market serves a diverse range of end-users, including Retail, E-commerce (B2C & B2B), Food and Beverage, Pharmaceuticals & Healthcare, Manufacturing & Automotive, and Others. The E-commerce segment leads, driven by the exponential growth of online shopping and demand for rapid, flexible delivery services. Retailers are increasingly leveraging urban logistics solutions to enhance last-mile efficiency, reduce delivery times, and improve customer satisfaction. Food and Beverage, as well as Pharmaceuticals & Healthcare, are expanding their reliance on cold chain and time-sensitive logistics, while Manufacturing & Automotive utilize urban logistics for just-in-time inventory and component delivery .

The France Urban Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geodis, DHL Supply Chain, XPO Logistics, Kuehne + Nagel, DB Schenker, DPDgroup (La Poste Group), Chronopost (La Poste Group), La Poste, FM Logistic, Stef, Rhenus Logistics, Norbert Dentressangle (XPO Logistics France), Transports Dufour, Groupe Charles André (GCA), and UrbanHub (urban micro-fulfillment specialist) contribute to innovation, geographic expansion, and service delivery in this space .

The future of urban logistics in France is poised for transformation, driven by technological advancements and sustainability initiatives. As cities continue to grow, logistics providers will increasingly adopt autonomous delivery vehicles and drones, enhancing efficiency and reducing costs. Furthermore, the integration of real-time tracking technologies will improve transparency and customer satisfaction. These trends indicate a shift towards more sustainable and efficient urban logistics solutions, aligning with government regulations and consumer expectations for faster, greener deliveries.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Warehousing Solutions Freight Transportation Urban Distribution Centers Cold Chain Logistics Reverse Logistics Micro-fulfillment Centers |

| By End-User | Retail E-commerce (B2C & B2B) Food and Beverage Pharmaceuticals & Healthcare Manufacturing & Automotive Others |

| By Delivery Mode | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery On-Demand Delivery |

| By Vehicle Type | Light Commercial Vehicles (LCVs) Heavy Goods Vehicles (HGVs) Electric Vans & Trucks Cargo Bikes & E-bikes Others (including drones, autonomous vehicles) |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Integrated Logistics Services Urban Consolidation Services |

| By Technology Adoption | IoT and Telematics Solutions AI and Machine Learning Applications Blockchain for Supply Chain Automation and Robotics Route Optimization Software |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Dynamic Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 100 | Operations Managers, Delivery Coordinators |

| Urban Warehousing Solutions | 70 | Warehouse Managers, Logistics Directors |

| Public Transport Integration for Freight | 50 | Urban Planners, Transport Policy Makers |

| Green Logistics Initiatives | 60 | Sustainability Managers, Environmental Consultants |

| Technology Adoption in Urban Logistics | 80 | IT Managers, Innovation Officers |

The France Urban Logistics Market is valued at approximately USD 16 billion, reflecting significant growth driven by last-mile delivery and urban distribution activities, particularly due to the rise of e-commerce and increasing urbanization.