Region:Europe

Author(s):Dev

Product Code:KRAA0432

Pages:85

Published On:August 2025

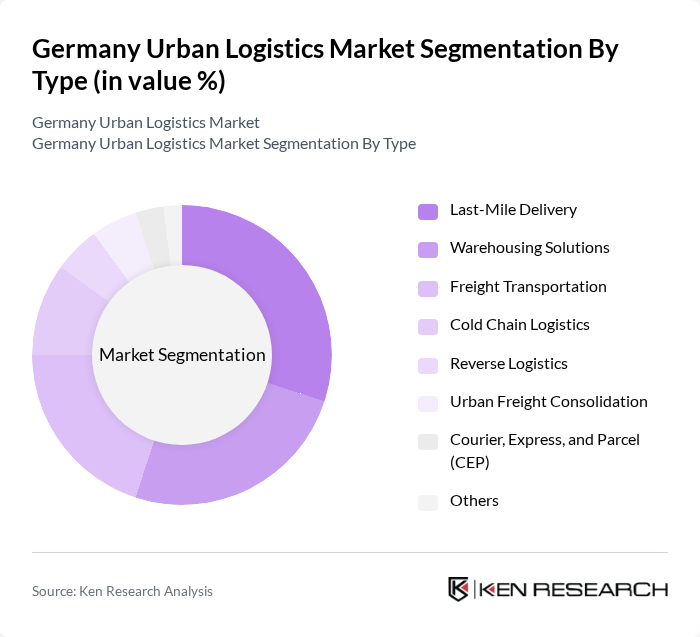

By Type:The urban logistics market is segmented into Last-Mile Delivery, Warehousing Solutions, Freight Transportation, Cold Chain Logistics, Reverse Logistics, Urban Freight Consolidation, Courier, Express, and Parcel (CEP), and Others. Last-Mile Delivery focuses on the final leg of delivery to consumers, Warehousing Solutions provide storage and inventory management, Freight Transportation covers the movement of goods across urban areas, Cold Chain Logistics ensures temperature-controlled delivery for sensitive goods, Reverse Logistics manages returns and recycling, Urban Freight Consolidation optimizes load efficiency, and CEP services handle time-sensitive shipments. Each segment addresses specific logistics challenges in urban environments .

By End-User:The end-user segmentation includes Retail, E-commerce, Food and Beverage, Pharmaceuticals, Consumer Electronics, Automotive, Manufacturing, Construction, and Others. Retail and E-commerce sectors are the largest consumers of urban logistics services, driven by the need for rapid and reliable delivery. Food and Beverage and Pharmaceuticals require specialized logistics solutions such as cold chain and time-sensitive delivery. Other sectors like Automotive, Manufacturing, and Construction rely on efficient freight and warehousing to support urban operations .

The Germany Urban Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (Deutsche Post AG), DB Schenker (Deutsche Bahn AG), Kuehne + Nagel International AG, Hermes Germany GmbH, DPD Deutschland GmbH, GLS Germany GmbH & Co. OHG, UPS Deutschland S.à r.l. & Co. OHG, FedEx Express Germany Services GmbH, XPO Logistics Europe, Rhenus Logistics (Rhenus SE & Co. KG), Trans-o-flex Express GmbH & Co. KGaA, Dachser Group SE & Co. KG, DSV Solutions GmbH (DSV Panalpina), GEODIS CL Germany GmbH, Hellmann Worldwide Logistics SE & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of urban logistics in Germany is poised for transformation, driven by technological innovations and sustainability initiatives. As cities continue to grow, logistics providers will increasingly adopt smart technologies, such as AI and IoT, to enhance operational efficiency. Additionally, the push for greener logistics solutions will lead to a rise in electric vehicles and sustainable delivery practices. Collaborations with local governments will also play a crucial role in addressing urban challenges, ensuring that logistics systems evolve to meet the demands of modern urban living.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Warehousing Solutions Freight Transportation Cold Chain Logistics Reverse Logistics Urban Freight Consolidation Courier, Express, and Parcel (CEP) Others |

| By End-User | Retail E-commerce Food and Beverage Pharmaceuticals Consumer Electronics Automotive Manufacturing Construction Others |

| By Delivery Model | B2B B2C C2C Subscription Services On-Demand Delivery Others |

| By Technology | Route Optimization Software Fleet Management Systems Warehouse Management Systems Delivery Tracking Solutions Autonomous Delivery Solutions IoT and Predictive Analytics Others |

| By Geographic Coverage | Major Cities (e.g., Berlin, Hamburg, Munich, Frankfurt, Cologne) Suburban Areas Rural Areas Cross-Border Deliveries Others |

| By Service Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Temperature-Controlled Delivery Others |

| By Payment Method | Prepaid Postpaid Subscription-Based Cash on Delivery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 100 | Operations Managers, Logistics Coordinators |

| Urban Warehousing Solutions | 70 | Warehouse Managers, Supply Chain Analysts |

| Public Transport Integration in Logistics | 50 | Urban Planners, Transport Policy Makers |

| Technology Adoption in Urban Logistics | 40 | IT Managers, Innovation Officers |

| Sustainability Practices in Logistics | 60 | Sustainability Managers, Compliance Officers |

The Germany Urban Logistics Market is valued at approximately USD 27 billion, reflecting significant growth driven by e-commerce expansion, urbanization, and the demand for efficient last-mile delivery solutions.