Region:Europe

Author(s):Geetanshi

Product Code:KRAA0240

Pages:95

Published On:August 2025

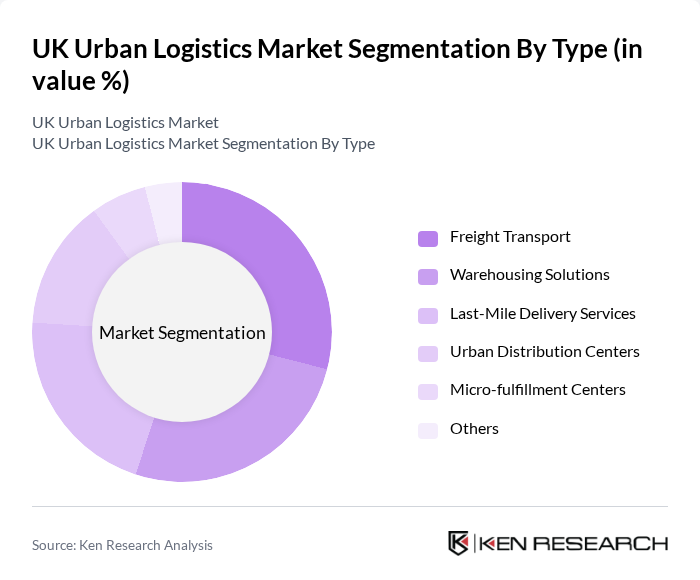

By Type:The market is segmented into various types, including Freight Transport, Warehousing Solutions, Last-Mile Delivery Services, Urban Distribution Centers, Micro-fulfillment Centers, and Others. Freight Transport encompasses the movement of goods within urban environments, while Warehousing Solutions refer to facilities for storage and inventory management. Last-Mile Delivery Services focus on the final leg of delivery to end consumers, and Urban Distribution Centers are strategically located hubs for efficient city-wide distribution. Micro-fulfillment Centers are smaller, automated facilities designed for rapid order processing and delivery in dense urban areas. The 'Others' category includes specialized logistics services such as temperature-controlled transport and reverse logistics .

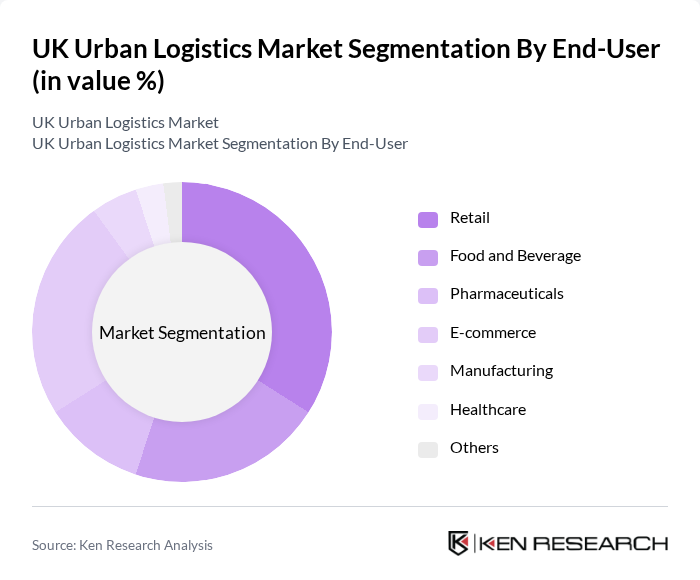

By End-User:The end-user segmentation includes Retail, Food and Beverage, Pharmaceuticals, E-commerce, Manufacturing, Healthcare, and Others. Retail and E-commerce sectors drive the majority of urban logistics demand due to high volumes of consumer deliveries and returns. Food and Beverage require specialized handling and timely delivery, while Pharmaceuticals and Healthcare need secure, temperature-controlled logistics. Manufacturing relies on just-in-time delivery of components, and the 'Others' category includes sectors such as technology and automotive .

The UK Urban Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, DPD Group, UPS, FedEx, Royal Mail, Yodel, Geodis, Kuehne + Nagel, DB Schenker, Palletways, Whistl, Tuffnells, GXO Logistics, ID Logistics, Tesco (Urban Logistics Division), Amazon Logistics UK, Evri (formerly Hermes UK) contribute to innovation, geographic expansion, and service delivery in this space .

The UK urban logistics market is poised for transformative growth, driven by technological advancements and increasing consumer expectations for rapid delivery. As cities evolve, logistics providers will need to embrace innovative solutions such as autonomous vehicles and drone deliveries. Furthermore, the integration of AI and big data analytics will enhance operational efficiency, enabling companies to optimize routes and reduce costs. The focus on sustainability will also shape future logistics strategies, aligning with government regulations and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transport Warehousing Solutions Last-Mile Delivery Services Urban Distribution Centers Micro-fulfillment Centers Others |

| By End-User | Retail Food and Beverage Pharmaceuticals E-commerce Manufacturing Healthcare Others |

| By Delivery Method | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Click & Collect Others |

| By Vehicle Type | Light Commercial Vehicles (LCVs) Heavy Goods Vehicles (HGVs) Electric Vans Cargo Bikes Autonomous Delivery Vehicles Others |

| By Technology Utilization | Route Optimization Software Fleet Management Systems Warehouse Management Systems Tracking and Visibility Solutions Automation & Robotics Others |

| By Geographic Coverage | Greater London North West England West Midlands Yorkshire and the Humber South East England Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Supply Chain Management Urban Consolidation Centres Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 60 | Operations Managers, Delivery Supervisors |

| Urban Warehousing Solutions | 40 | Warehouse Managers, Logistics Directors |

| Fleet Management in Urban Areas | 50 | Fleet Managers, Transport Planners |

| Impact of E-commerce on Urban Logistics | 45 | eCommerce Managers, Supply Chain Analysts |

| Regulatory Compliance in Urban Logistics | 40 | Compliance Officers, Policy Advisors |

The UK Urban Logistics Market is valued at approximately USD 13 billion, driven by the growth of e-commerce, urbanization, and the demand for efficient last-mile delivery solutions. This market is expected to continue expanding as consumer expectations for faster delivery times rise.