Region:Middle East

Author(s):Shubham

Product Code:KRAA0916

Pages:86

Published On:August 2025

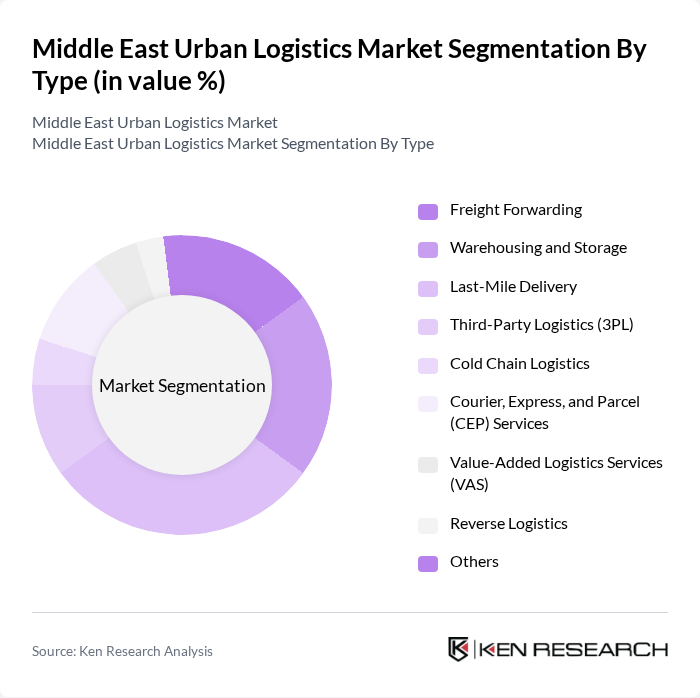

By Type:The urban logistics market is segmented into various types, including Freight Forwarding, Warehousing and Storage, Last-Mile Delivery, Third-Party Logistics (3PL), Cold Chain Logistics, Courier, Express, and Parcel (CEP) Services, Value-Added Logistics Services (VAS), Reverse Logistics, and Others. Among these, Last-Mile Delivery is currently the dominant segment, driven by the surge in e-commerce and heightened consumer demand for rapid and flexible delivery services. The increasing reliance on online shopping, growth of omnichannel retail, and rising expectations for same-day or next-day delivery have led to a significant rise in last-mile logistics solutions, making it a critical focus for logistics providers .

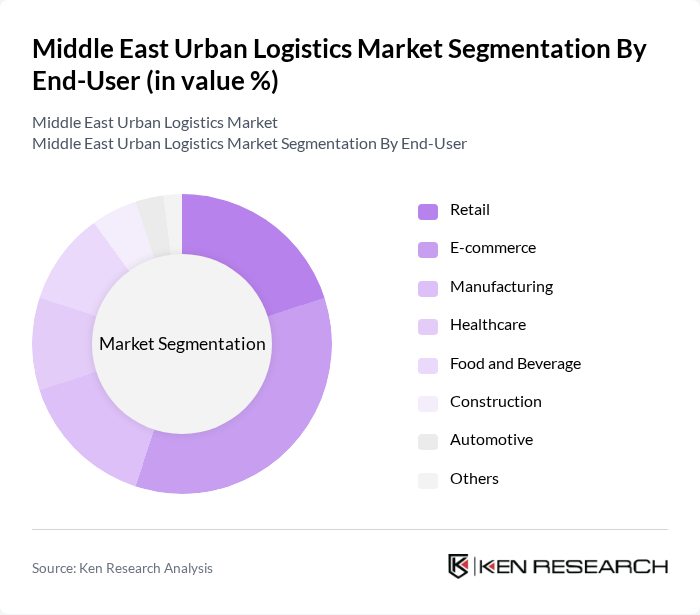

By End-User:The urban logistics market is also segmented by end-user industries, including Retail, E-commerce, Manufacturing, Healthcare, Food and Beverage, Construction, Automotive, and Others. The E-commerce segment is leading this market, propelled by the exponential growth of online shopping, digital payment adoption, and the proliferation of mobile commerce, all of which have necessitated efficient logistics solutions to meet consumer demands for rapid and reliable delivery. Retail also plays a significant role, as traditional brick-and-mortar stores increasingly adopt omnichannel and click-and-collect strategies to enhance customer experience and remain competitive .

The Middle East Urban Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, FedEx, UPS, Agility Logistics, DB Schenker, Kuehne + Nagel, CEVA Logistics, Al-Futtaim Logistics, Gulf Agency Company (GAC), Bahri, Emirates Logistics LLC, Mena Logistics, Fetchr, SMSA Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East urban logistics market appears promising, driven by technological advancements and a focus on sustainability. As cities continue to grow, the integration of smart logistics solutions and autonomous delivery vehicles is expected to enhance operational efficiency. Furthermore, the increasing emphasis on eco-friendly practices will likely lead to the adoption of green logistics initiatives, positioning the region as a leader in sustainable urban logistics solutions in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing and Storage Last-Mile Delivery Third-Party Logistics (3PL) Cold Chain Logistics Courier, Express, and Parcel (CEP) Services Value-Added Logistics Services (VAS) Reverse Logistics Others |

| By End-User | Retail E-commerce Manufacturing Healthcare Food and Beverage Construction Automotive Others |

| By Distribution Mode | Road Freight Rail Freight Air Freight Sea Freight Multimodal Transport Others |

| By Service Type | Dedicated Fleet Services Shared Fleet Services On-Demand Delivery Services Scheduled Delivery Services Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing Pay-Per-Use Pricing Others |

| By Technology Integration | IoT-Enabled Logistics AI and Machine Learning Applications Blockchain for Supply Chain Transparency Automated Warehousing Solutions Others |

| By Customer Segment | B2B B2C C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 100 | Operations Managers, Logistics Coordinators |

| Urban Freight Transportation | 80 | Fleet Managers, Supply Chain Analysts |

| Smart Logistics Technology Adoption | 60 | IT Managers, Technology Officers |

| Public-Private Partnerships in Urban Logistics | 50 | City Planners, Policy Makers |

| Environmental Impact of Urban Logistics | 40 | Sustainability Managers, Environmental Consultants |

The Middle East Urban Logistics Market is valued at approximately USD 250 billion, driven by factors such as e-commerce growth, urbanization, and infrastructure investments. This valuation is based on a comprehensive five-year historical analysis of the market.