Region:Africa

Author(s):Shubham

Product Code:KRAA0975

Pages:89

Published On:August 2025

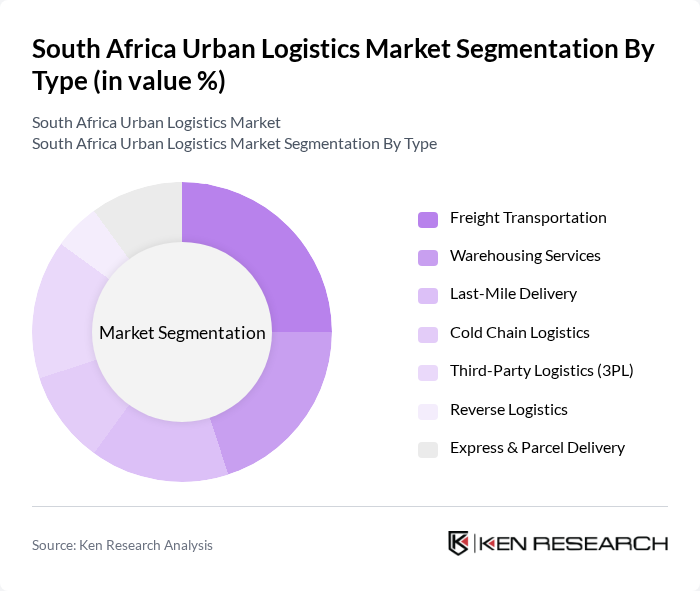

By Type:The South Africa Urban Logistics Market can be segmented into various types, including Freight Transportation, Warehousing Services, Last-Mile Delivery, Cold Chain Logistics, Third-Party Logistics (3PL), Reverse Logistics, and Express & Parcel Delivery. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different needs and operational requirements.

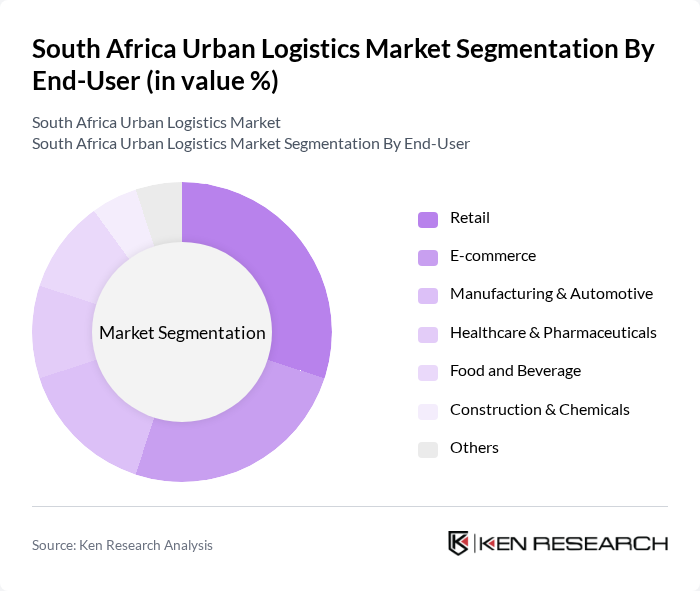

By End-User:The end-user segmentation of the South Africa Urban Logistics Market includes Retail, E-commerce, Manufacturing & Automotive, Healthcare & Pharmaceuticals, Food and Beverage, Construction & Chemicals, and Others. Each sector has unique logistics requirements, influencing the demand for specific logistics services.

The South Africa Urban Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imperial Logistics, Bidvest International Logistics, DHL Supply Chain South Africa, Transnet Freight Rail, Kuehne + Nagel South Africa, Barloworld Logistics, DSV South Africa, Grindrod Limited, Value Logistics, Onelogix, Cargo Carriers, Rhenus Logistics South Africa, Mainstream Logistics, UTi Worldwide (now part of DSV), and DB Schenker South Africa contribute to innovation, geographic expansion, and service delivery in this space.

The South African urban logistics market is poised for significant transformation driven by technological advancements and changing consumer behaviors. The integration of smart logistics solutions, such as AI and IoT, will enhance operational efficiency and reduce costs. Furthermore, the increasing emphasis on sustainability will push logistics providers to adopt greener practices. As urban areas continue to grow, the demand for innovative last-mile delivery solutions will also rise, creating new opportunities for businesses to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Warehousing Services Last-Mile Delivery Cold Chain Logistics Third-Party Logistics (3PL) Reverse Logistics Express & Parcel Delivery |

| By End-User | Retail E-commerce Manufacturing & Automotive Healthcare & Pharmaceuticals Food and Beverage Construction & Chemicals Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Others |

| By Service Type | Domestic Transportation Management International Transportation Management Value-Added Warehousing & Distribution On-Demand Logistics Scheduled Logistics Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Type | B2B B2C C2C Others |

| By Technology Integration | IoT-Enabled Logistics Blockchain in Supply Chain AI and Machine Learning Applications Automation & Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 100 | Operations Managers, Logistics Coordinators |

| Urban Freight Transport | 80 | Fleet Managers, Transport Planners |

| Warehouse Management in Urban Areas | 60 | Warehouse Supervisors, Inventory Managers |

| Technology Adoption in Logistics | 50 | IT Managers, Innovation Leads |

| Environmental Impact of Urban Logistics | 40 | Sustainability Officers, Policy Analysts |

The South Africa Urban Logistics Market is valued at approximately USD 14.5 billion, driven by rapid urbanization, e-commerce growth, and the need for efficient supply chain solutions in urban areas.