Region:Europe

Author(s):Geetanshi

Product Code:KRAA0281

Pages:94

Published On:August 2025

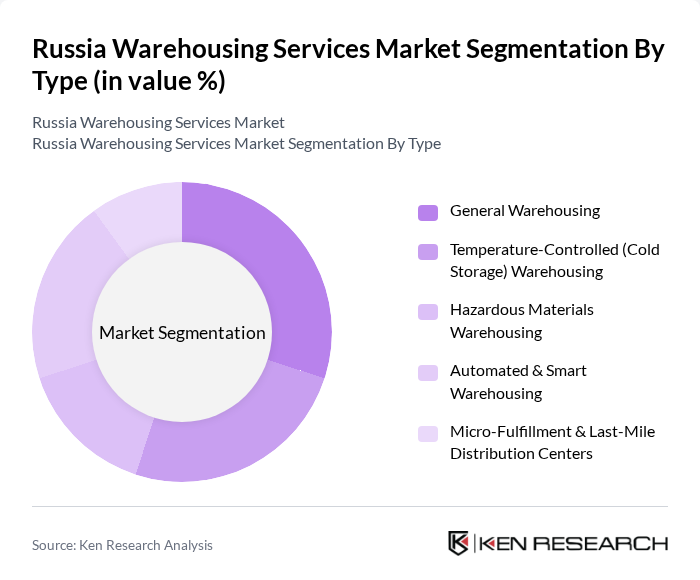

By Type:The warehousing services market can be segmented into General Warehousing, Temperature-Controlled (Cold Storage) Warehousing, Hazardous Materials Warehousing, Automated & Smart Warehousing, and Micro-Fulfillment & Last-Mile Distribution Centers. Each of these segments addresses specific logistics and storage requirements, reflecting the diverse needs of businesses across industries. General Warehousing remains the most prevalent due to its flexibility, while temperature-controlled and automated warehousing are expanding rapidly to support food, pharmaceutical, and e-commerce sectors .

The General Warehousing segment is currently dominating the market due to its versatility and ability to accommodate a wide range of products. This segment is favored by businesses seeking cost-effective storage solutions without specialized requirements. The increasing volume of goods being stored and distributed, particularly in urban areas, has led to a surge in demand for general warehousing services. The rise of e-commerce and omnichannel retail has further propelled this segment, as retailers seek to optimize supply chains and improve delivery times .

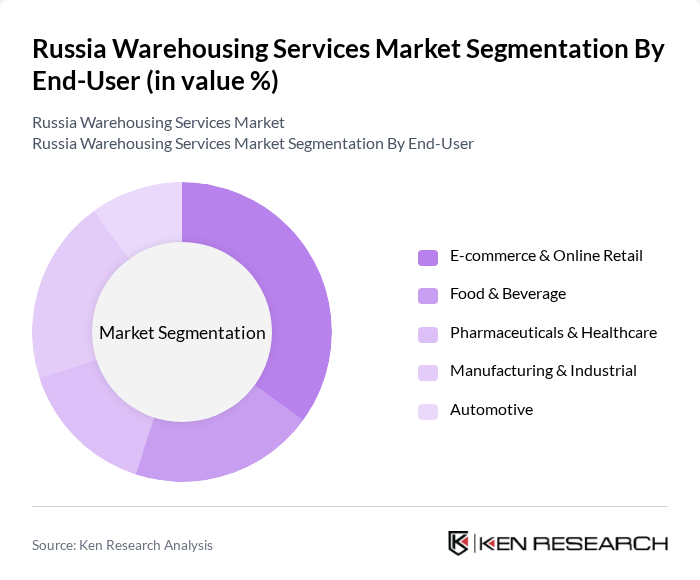

By End-User:The end-user segmentation includes E-commerce & Online Retail, Food & Beverage, Pharmaceuticals & Healthcare, Manufacturing & Industrial, Automotive, and Others. Each sector has unique warehousing needs, influencing the types of services and facilities required. E-commerce and online retail drive demand for flexible, high-throughput facilities, while food, beverage, and pharmaceuticals require temperature-controlled and compliant storage environments .

The E-commerce & Online Retail segment is leading the market, driven by the rapid growth of online shopping and the need for efficient logistics solutions. This sector requires flexible warehousing options to handle fluctuating inventory levels and fast order fulfillment. The increasing consumer preference for online shopping has prompted retailers to invest in advanced warehousing technologies, automation, and last-mile delivery solutions, further solidifying the dominance of this segment in the warehousing services market .

The Russia Warehousing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as X5 Logistics (X5 Retail Group), Magnit Logistics, DPD Russia, Kuehne + Nagel Russia, DB Schenker Russia, RUSCON, CDEK, Russian Post (Pochta Rossii), SberLogistics, TTK (TransContainer), FM Logistic Russia, Ozon Logistics, AliExpress Russia, Itella Russia, and Globaltrans contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia warehousing services market appears promising, driven by technological advancements and evolving consumer preferences. As e-commerce continues to expand, companies are likely to invest in automation and AI-driven solutions to enhance operational efficiency. Additionally, the focus on sustainable practices will shape logistics strategies, with businesses seeking eco-friendly warehousing options. These trends will create a dynamic environment, fostering innovation and competitiveness in the warehousing sector in future.

| Segment | Sub-Segments |

|---|---|

| By Type | General Warehousing Temperature-Controlled (Cold Storage) Warehousing Hazardous Materials Warehousing Automated & Smart Warehousing Micro-Fulfillment & Last-Mile Distribution Centers |

| By End-User | E-commerce & Online Retail Food & Beverage Pharmaceuticals & Healthcare Manufacturing & Industrial Automotive Others |

| By Region | Central Russia (including Moscow region) Northwestern Russia (including St. Petersburg) Southern Russia Volga Region Siberia & Far East |

| By Service Type | Storage Services Value-Added Services (Packaging, Labeling, Kitting) Cross-Docking & Transshipment Inventory Management Services Transportation & Distribution Services Others |

| By Technology | Warehouse Management Systems (WMS) Robotics & Automation Internet of Things (IoT) & Sensors Artificial Intelligence & Analytics Blockchain Technology Others |

| By Investment Source | Domestic Private Investments Government Funding & Subsidies Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Tax Incentives Subsidies for Infrastructure Development Grants for Technology Adoption Regulatory Support for Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 70 | Warehouse Managers, Logistics Directors |

| Manufacturing Supply Chain Management | 60 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 50 | eCommerce Managers, Distribution Supervisors |

| Cold Storage Facilities | 40 | Facility Managers, Quality Control Officers |

| Third-Party Logistics Providers | 45 | Business Development Managers, Client Relationship Managers |

The Russia Warehousing Services Market is valued at approximately USD 20 billion, driven by the growing demand for logistics and supply chain solutions, particularly in the e-commerce and retail sectors.