Region:Europe

Author(s):Geetanshi

Product Code:KRAA0183

Pages:96

Published On:August 2025

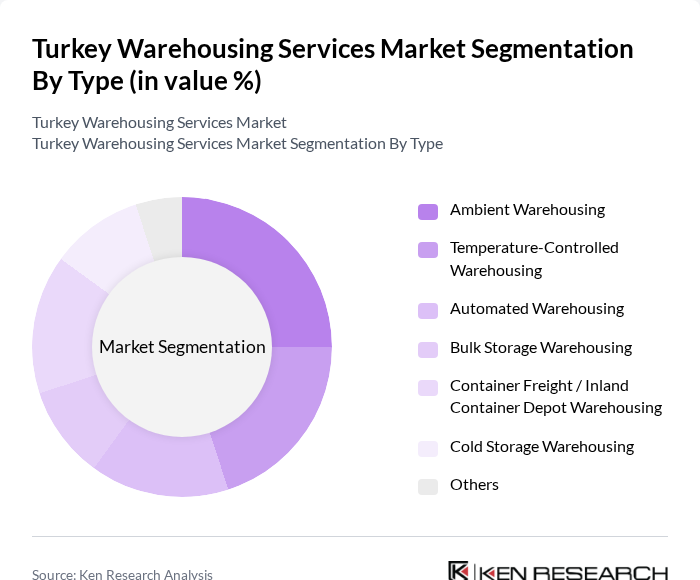

By Type:The Turkey Warehousing Services Market can be segmented into various types, including Ambient Warehousing, Temperature-Controlled Warehousing, Automated Warehousing, Bulk Storage Warehousing, Container Freight / Inland Container Depot Warehousing, Cold Storage Warehousing, and Others. Each of these sub-segments caters to specific storage needs and operational requirements .

The Ambient Warehousing segment is currently dominating the market due to its versatility and ability to accommodate a wide range of products. This type of warehousing is essential for various industries, including retail and manufacturing, where non-perishable goods are stored. The increasing demand for efficient storage solutions, coupled with the growth of e-commerce, has further propelled the need for ambient warehousing facilities. Additionally, the rise in consumer expectations for quick delivery times has led to a surge in demand for such services, making it a critical component of the logistics chain .

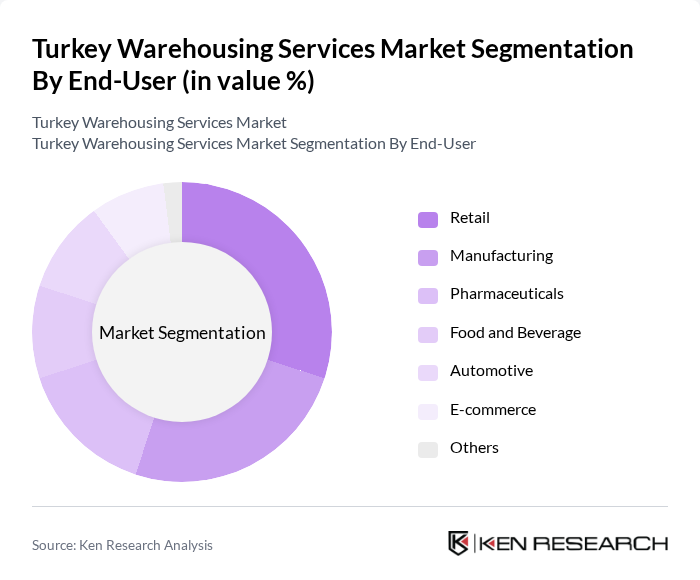

By End-User:The market can also be segmented by end-user industries, which include Retail, Manufacturing, Pharmaceuticals, Food and Beverage, Automotive, E-commerce, and Others. Each of these sectors has unique requirements that influence the type of warehousing services utilized .

The Retail segment is the leading end-user in the Turkey Warehousing Services Market, driven by the rapid growth of e-commerce and changing consumer shopping behaviors. Retailers are increasingly investing in warehousing solutions to enhance their supply chain efficiency and meet the rising demand for quick delivery. The need for effective inventory management and distribution strategies has made retail a significant contributor to the warehousing sector, as businesses strive to optimize their operations and improve customer satisfaction .

The Turkey Warehousing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netlog Logistics, Borusan Logistics, Ekol Logistics, Omsan Logistics, T?rsan Logistics, Sarp Intermodal, Mars Logistics, Horoz Logistics, Arkas Logistics, CEVA Logistics, DHL Supply Chain, Kuehne + Nagel, DB Schenker Arkas, Maersk Logistics, UPS Supply Chain Solutions, Yusen Logistics, Istanbul Express, D B Deniz Nakliyati Ticaret, Aras Logistics, PTT Cargo, TAV Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey warehousing services market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of smart warehousing solutions, including automation and AI, is expected to enhance operational efficiency and reduce costs. Additionally, the increasing focus on sustainability will likely lead to the adoption of green logistics practices, positioning companies to meet both regulatory demands and consumer expectations for environmentally responsible operations. This dynamic environment presents opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Ambient Warehousing Temperature-Controlled Warehousing Automated Warehousing Bulk Storage Warehousing Container Freight / Inland Container Depot Warehousing Cold Storage Warehousing Others |

| By End-User | Retail Manufacturing Pharmaceuticals Food and Beverage Automotive E-commerce Others |

| By Region | Marmara Aegean Central Anatolia Eastern Anatolia Mediterranean Black Sea Southeastern Anatolia Others |

| By Service Type | Storage Services Value-Added Services (Packaging, Labeling, Kitting) Transportation Services Inventory Management Services Cross-Docking Services Others |

| By Technology | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) Robotics RFID Technology IoT-Enabled Solutions Others |

| By Ownership | Private Warehousing Public Warehousing Contract Warehousing (3PL and Integrated Warehouses) Others |

| By Duration of Service | Short-Term Warehousing Long-Term Warehousing Seasonal Warehousing On-Demand Warehousing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 80 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Supply Chain Management | 60 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Strategies | 50 | eCommerce Operations Managers, Inventory Specialists |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Logistics Supervisors |

| Third-Party Logistics Providers | 45 | Business Development Managers, Client Relationship Managers |

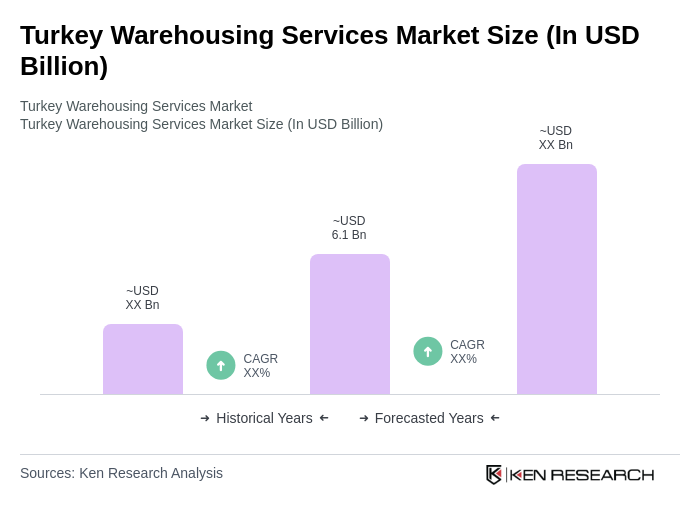

The Turkey Warehousing Services Market is valued at approximately USD 6.1 billion, reflecting significant growth driven by increasing demand for logistics and supply chain solutions, particularly in the e-commerce and retail sectors.