Region:Middle East

Author(s):Shubham

Product Code:KRAD5522

Pages:86

Published On:December 2025

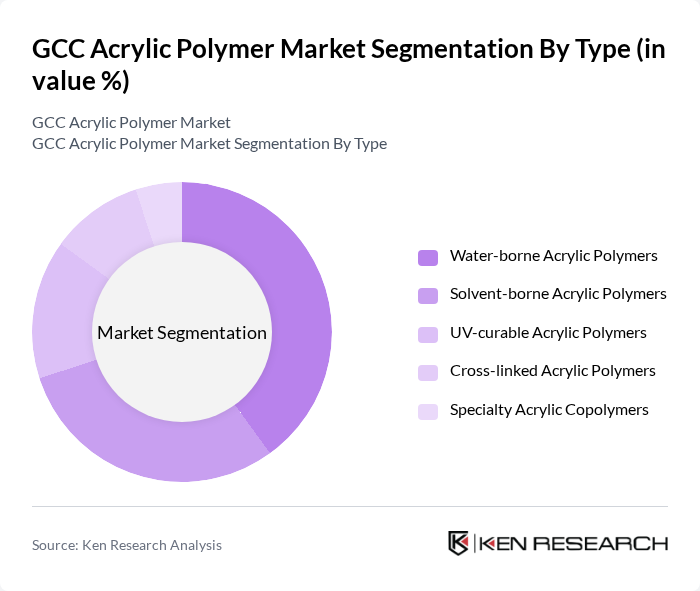

By Type:The acrylic polymer market can be segmented into various types, including water-borne acrylic polymers, solvent-borne acrylic polymers, UV-curable acrylic polymers, cross-linked acrylic polymers, and specialty acrylic copolymers. Among these, water-borne acrylic polymers are gaining significant traction due to their eco-friendly properties and compliance with stringent environmental regulations. The demand for solvent-borne acrylic polymers remains strong in applications requiring high durability and performance. The UV-curable segment is also witnessing growth, driven by advancements in curing technologies and increasing applications in coatings and adhesives.

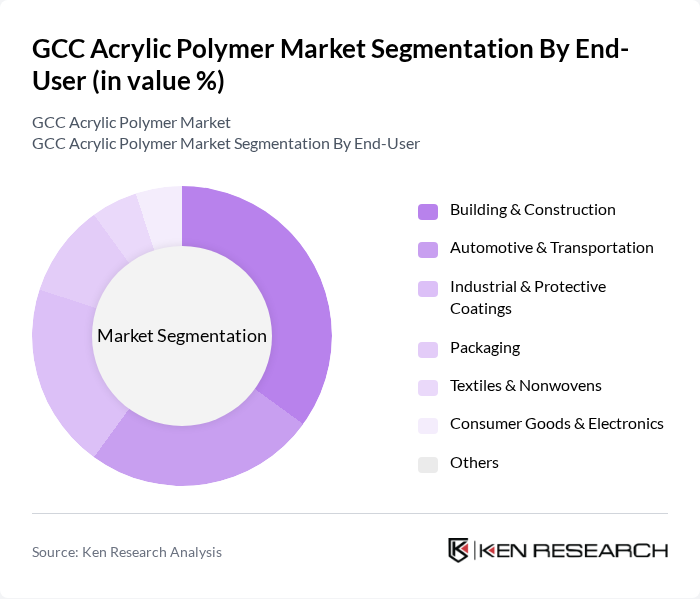

By End-User:The acrylic polymer market is segmented by end-user industries, including building & construction, automotive & transportation, industrial & protective coatings, packaging, textiles & nonwovens, consumer goods & electronics, and others. The building & construction sector is the largest consumer of acrylic polymers, driven by the increasing demand for high-performance coatings and adhesives. The automotive sector also contributes significantly, as manufacturers seek lightweight and durable materials for vehicle production. The packaging industry is rapidly adopting acrylic polymers for their excellent barrier properties and versatility.

The GCC Acrylic Polymer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Acrylic Polymer Company (SAPCo), Saudi Acrylic Acid Company (SAAC), Saudi Acrylic Monomer Company (SAMCo), Sadara Chemical Company, Petro Rabigh (Rabigh Refining & Petrochemical Company), Dow Chemical Company, BASF SE, Arkema S.A., Evonik Industries AG, Wacker Chemie AG, Clariant AG, LyondellBasell Industries N.V., Solvay S.A., Mitsubishi Chemical Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The GCC acrylic polymer market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As manufacturers adopt innovative production techniques, the efficiency and performance of acrylic polymers will improve, catering to diverse applications. Additionally, the increasing focus on eco-friendly products will likely lead to a surge in demand, particularly in construction and automotive sectors. Strategic partnerships and collaborations will further enhance market dynamics, fostering growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-borne Acrylic Polymers Solvent-borne Acrylic Polymers UV-curable Acrylic Polymers Cross-linked Acrylic Polymers Specialty Acrylic Copolymers |

| By End-User | Building & Construction Automotive & Transportation Industrial & Protective Coatings Packaging Textiles & Nonwovens Consumer Goods & Electronics Others |

| By Application | Paints & Coatings Adhesives & Sealants Construction Chemicals (Mortars, Grouts, Waterproofing) Plastics & Composites Modification Textiles, Leather & Nonwoven Binders Superabsorbent & Water Treatment Polymers Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Distribution Channel | Direct Sales to OEMs & Formulators Local Distributors & Traders International Chemical Distributors Online & E-commerce Platforms Others |

| By Product Form | Liquid Emulsions & Dispersions Solvent-based Solutions Powders & Beads Pellets & Granules Others |

| By Pricing Tier | Commodity-grade Acrylic Polymers Performance-grade Acrylic Polymers Specialty & Customized Grades |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 120 | Project Managers, Procurement Officers |

| Automotive Coatings Sector | 90 | Product Development Managers, Quality Assurance Heads |

| Adhesives and Sealants Market | 80 | Manufacturing Engineers, Supply Chain Managers |

| Textile and Fabric Coatings | 70 | Textile Engineers, R&D Specialists |

| Consumer Goods Packaging | 100 | Packaging Designers, Marketing Managers |

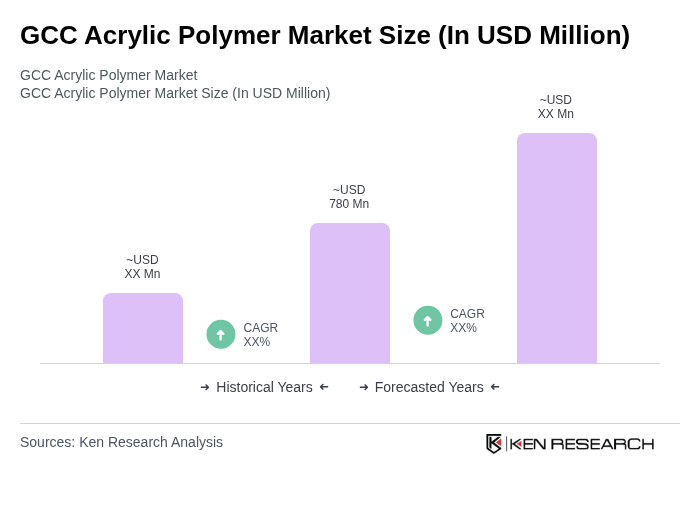

The GCC Acrylic Polymer Market is valued at approximately USD 780 million, driven by increasing demand for eco-friendly and high-performance materials across various industries, including construction, automotive, and consumer goods.