Region:Middle East

Author(s):Shubham

Product Code:KRAD3683

Pages:94

Published On:November 2025

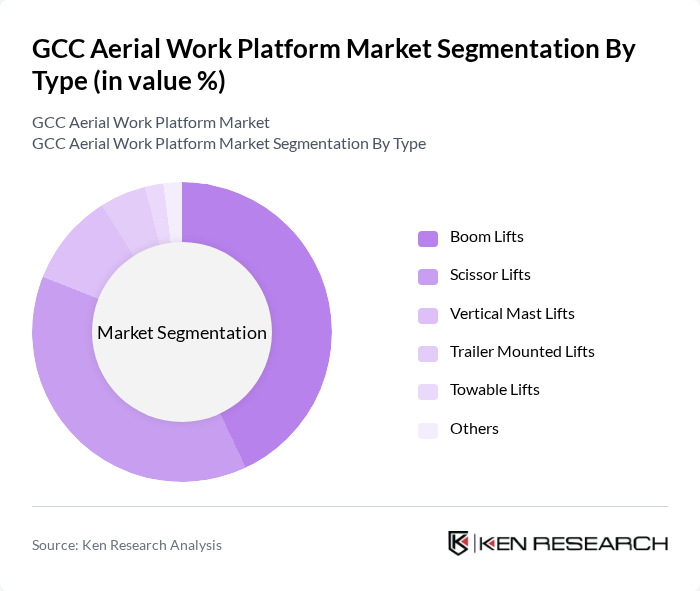

By Type:The market is segmented into various types of aerial work platforms, including Scissor Lifts, Boom Lifts, Vertical Mast Lifts, Trailer Mounted Lifts, Towable Lifts, and Others. Among these, Boom Lifts dominate the market due to their superior outreach capabilities and versatility in various applications. Boom Lifts are particularly favored for outdoor projects requiring extended reach and complex positioning, while Scissor Lifts remain essential for indoor tasks and confined spaces. The increasing demand for these platforms in construction and maintenance activities continues to drive their market share.

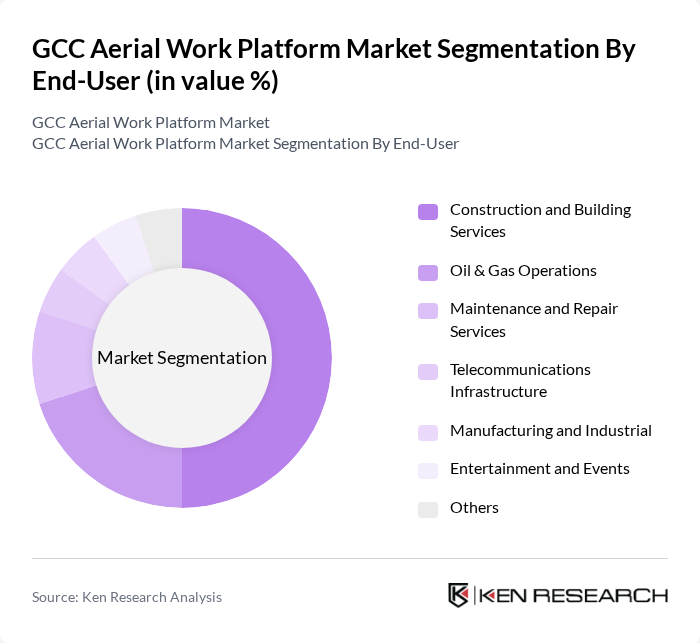

By End-User:The end-user segmentation includes Construction and Building Services, Oil & Gas Operations, Maintenance and Repair Services, Telecommunications Infrastructure, Manufacturing and Industrial, Entertainment and Events, and Others. The Construction and Building Services segment holds the largest share, driven by ongoing infrastructure projects and urban development initiatives across the GCC. The Oil & Gas sector also significantly contributes to the demand for aerial work platforms, particularly for maintenance and inspection tasks in challenging environments.

The GCC Aerial Work Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as JLG Industries (Oshkosh Corporation), Genie (Terex Corporation), Haulotte Group, Skyjack Inc., Manitou Group, Aichi Corporation, Snorkel International, Niftylift Limited, XCMG Construction Machinery Co., Ltd., Doosan Infracore, Alimak Group, Biljax LLC, MEC Aerial Work Platforms, Teupen SE, Grove Worldwide, Linamar Corporation, and regional GCC distributors and service providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC aerial work platform market appears promising, driven by ongoing investments in infrastructure and a growing emphasis on safety and efficiency. As the region continues to urbanize, the demand for advanced aerial work solutions will likely increase. Furthermore, the integration of smart technologies and automation in AWPs is expected to enhance operational capabilities, making them indispensable in construction and maintenance activities. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Scissor Lifts Boom Lifts Vertical Mast Lifts Trailer Mounted Lifts Towable Lifts Others |

| By End-User | Construction and Building Services Oil & Gas Operations Maintenance and Repair Services Telecommunications Infrastructure Manufacturing and Industrial Entertainment and Events Others |

| By Application | Building and Facade Maintenance Infrastructure Installation and Repair Warehouse and Logistics Operations Specialized Industrial Applications Others |

| By Power Source | Electric Diesel Hybrid LPG Others |

| By Platform Height | Up to 10 meters to 20 meters to 50 meters Above 50 meters |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Rental vs. Purchase | Rental Purchase Lease-to-Own |

| By Industry Vertical | Oil & Gas Refining and Upstream Operations Construction and Real Estate Development Telecommunications and Broadcasting Transportation and Logistics Utilities and Infrastructure Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Aerial Work Platforms | 45 | Project Managers, Site Supervisors |

| Industrial Maintenance Applications | 38 | Maintenance Managers, Safety Officers |

| Event Management Equipment Rentals | 32 | Event Coordinators, Equipment Rental Managers |

| Government Infrastructure Projects | 28 | Public Works Officials, Procurement Officers |

| Telecommunications Sector Installations | 25 | Network Engineers, Operations Managers |

The GCC Aerial Work Platform market is valued at approximately USD 1.87 billion, driven by significant investments in construction and infrastructure, as well as a focus on workplace safety regulations across the region.