Region:Middle East

Author(s):Rebecca

Product Code:KRAD2928

Pages:92

Published On:November 2025

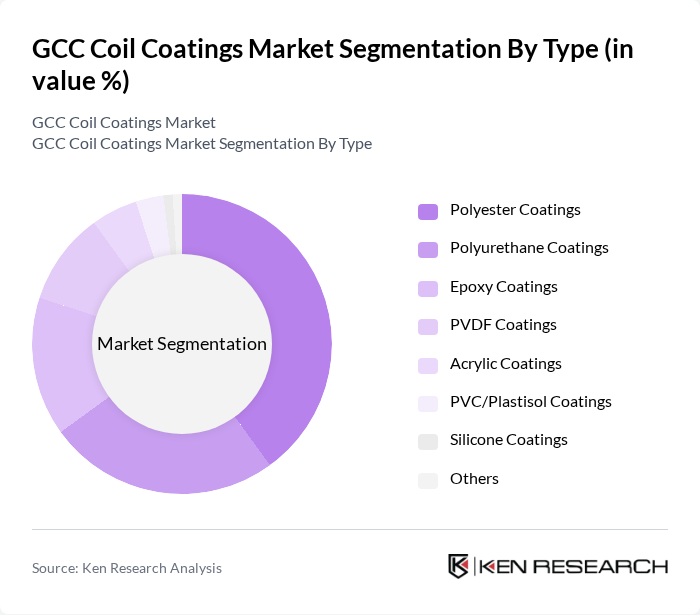

By Type:The market is segmented into various types of coil coatings, including Polyester Coatings, Polyurethane Coatings, Epoxy Coatings, PVDF Coatings, Acrylic Coatings, PVC/Plastisol Coatings, Silicone Coatings, and Others. Among these,Polyester Coatingsare leading due to their excellent durability, cost-effectiveness, and widespread use in architectural and industrial applications. The adoption of low-VOC and high-performance polyester formulations is increasing as manufacturers respond to regulatory and sustainability demands .

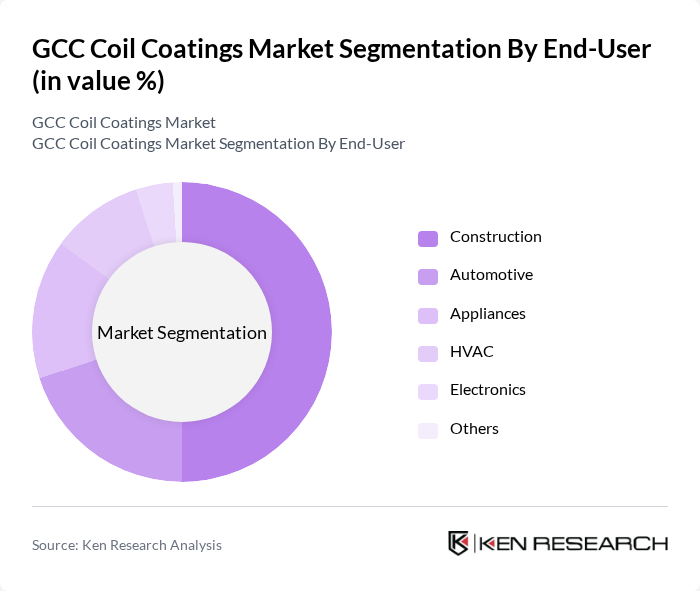

By End-User:The end-user segmentation includes Construction, Automotive, Appliances, HVAC, Electronics, and Others. TheConstructionsector is the dominant end-user, driven by rapid urbanization, infrastructure development, and the need for high-quality coil coatings that deliver durability and aesthetic appeal. The trend toward energy-efficient and sustainable building solutions further supports the sector's leadership in coil coating consumption .

The GCC Coil Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel, PPG Industries, The Sherwin-Williams Company, BASF SE, Nippon Paint Holdings Co., Ltd., Jotun Group, Henkel AG & Co. KGaA, Valspar (now part of Sherwin-Williams), Axalta Coating Systems, Kansai Paint Co., Ltd., Tikkurila Oyj, RPM International Inc., Hempel A/S, Sika AG, Covestro AG, National Paints Factories Co. Ltd. (UAE), Al-Jazeera Paints (Saudi Arabia), Berger Paints Emirates LLC, Caparol Arabia LLC, Sigma Paints Saudi Arabia Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The GCC coil coatings market is poised for significant transformation, driven by a strong emphasis on sustainability and technological innovation. As governments continue to prioritize energy efficiency and environmental protection, the demand for eco-friendly coatings is expected to rise. Additionally, advancements in application techniques will enhance product performance, making coil coatings more appealing to various industries. The market is likely to see increased collaboration between manufacturers and construction firms, fostering growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyester Coatings Polyurethane Coatings Epoxy Coatings PVDF Coatings Acrylic Coatings PVC/Plastisol Coatings Silicone Coatings Others |

| By End-User | Construction Automotive Appliances HVAC Electronics Others |

| By Application | Residential Buildings Commercial Buildings Industrial Facilities Infrastructure Projects Solar Panel Mounting Systems Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Coating Process | Roll Coating Spray Coating Dip Coating Others |

| By Performance Characteristics | Corrosion Resistance UV Resistance Chemical Resistance Color Stability Weatherability Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Coil Coatings | 100 | Project Managers, Procurement Officers |

| Automotive Coil Coating Applications | 70 | Manufacturing Engineers, Quality Control Managers |

| Appliance Industry Coatings | 50 | Product Development Managers, Supply Chain Analysts |

| Architectural Coating Solutions | 40 | Architects, Design Engineers |

| Industrial Coil Coating Processes | 60 | Operations Managers, Technical Directors |

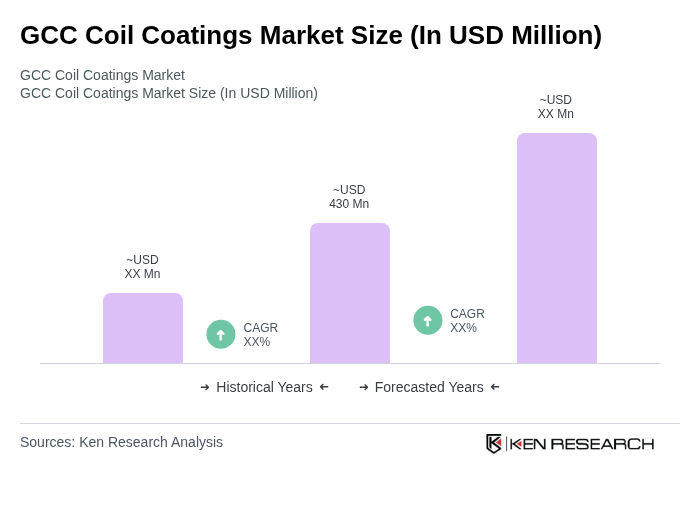

The GCC Coil Coatings Market is valued at approximately USD 430 million, driven by increasing demand for durable and aesthetically pleasing coatings in sectors like construction and automotive, alongside a surge in infrastructure projects in the region.