Region:Middle East

Author(s):Dev

Product Code:KRAC4173

Pages:85

Published On:October 2025

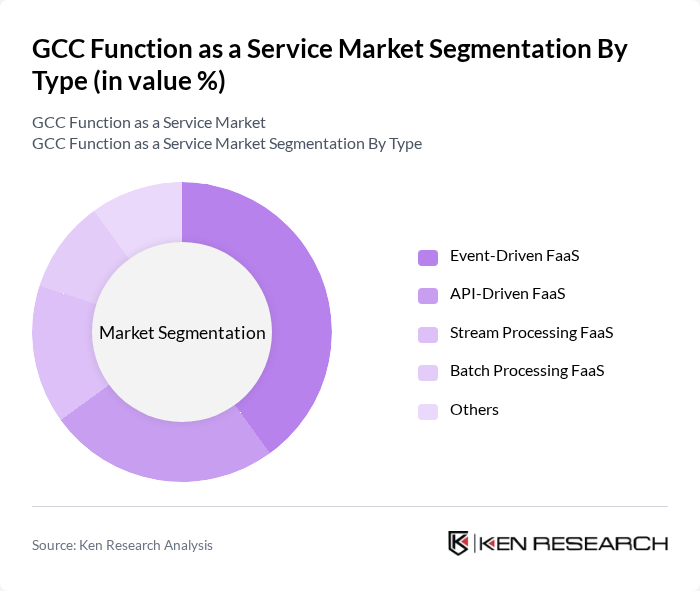

By Type:The market is segmented into various types, including Event-Driven FaaS, API-Driven FaaS, Stream Processing FaaS, Batch Processing FaaS, and Others. Among these, Event-Driven FaaS is currently the leading sub-segment, driven by its ability to respond to real-time events and automate workflows efficiently. This model is particularly favored by businesses looking to enhance their operational agility and reduce latency in application performance.

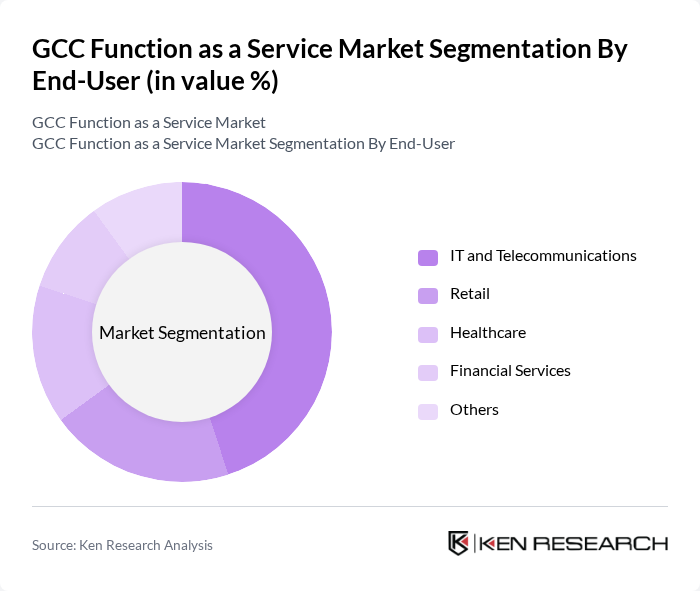

By End-User:The end-user segmentation includes IT and Telecommunications, Retail, Healthcare, Financial Services, and Others. The IT and Telecommunications sector dominates this market segment, as organizations in this field increasingly leverage FaaS to enhance their service delivery and operational efficiency. The growing demand for scalable and cost-effective solutions in this sector is driving the adoption of FaaS technologies.

The GCC Function as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc., Microsoft Corporation, Google Cloud Platform, IBM Corporation, Oracle Corporation, Alibaba Cloud, DigitalOcean, Inc., Red Hat, Inc., VMware, Inc., Salesforce.com, Inc., Rackspace Technology, Inc., Heroku, Inc., Cloudflare, Inc., Twilio Inc., Netlify, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The GCC Function as a Service market is poised for substantial growth as organizations increasingly embrace digital solutions. With the ongoing push for cloud adoption and the integration of advanced technologies like AI and IoT, FaaS is expected to play a pivotal role in enhancing operational efficiency. Additionally, government initiatives aimed at fostering innovation and digital transformation will further accelerate the adoption of FaaS, creating a robust ecosystem for technology-driven businesses in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Event-Driven FaaS API-Driven FaaS Stream Processing FaaS Batch Processing FaaS Others |

| By End-User | IT and Telecommunications Retail Healthcare Financial Services Others |

| By Application | Web Applications Mobile Applications Data Processing IoT Applications Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Industry Vertical | BFSI Manufacturing Education Government Others |

| By Service Model | Managed Services Professional Services Consulting Services Others |

| By Pricing Model | Pay-as-you-go Subscription-based Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise FaaS Adoption | 120 | IT Managers, Cloud Architects |

| SME Cloud Service Utilization | 100 | Business Owners, IT Consultants |

| Government Cloud Initiatives | 80 | Policy Makers, IT Directors |

| Industry-Specific FaaS Applications | 70 | Sector Specialists, Application Developers |

| Cloud Security and Compliance | 60 | Security Officers, Compliance Managers |

The GCC Function as a Service market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing adoption of cloud computing technologies among businesses in the region.